Online Payment Of Tds Hdfc Bank

Its a secured quick and a convenient way to pay your taxes online via a simple process. But remember to write your PAN in the challan.

How To Pay Hdfc Credit Card Bill Payment This Site Elaborate How To Make Hdfc Card Payment Online As Well As Offline Using Net Banki Credit Card Payment Bills

How To Pay Hdfc Credit Card Bill Payment This Site Elaborate How To Make Hdfc Card Payment Online As Well As Offline Using Net Banki Credit Card Payment Bills

For any premium payment due in the next financial year the same can be paid three months prior to the premium due date.

Online payment of tds hdfc bank. HDFC Bank facilitates Custom Duty Payments through an Authorised Bank. I agree to abide by the Banks Terms and Conditions and rules in force and the changes thereto in Terms and Conditions from time to time relating to my account as communicated and made available on the Banks website. TIN Facilitation Centers cum PAN centers.

Buy flight tickets book hotel rooms recharge mobiles send money to friends and family and manage multiple modes of payments through a variety of payment apps and products. Bank will give CounterfoilReceipt Back Stamped. Follow these simple steps for online tds certificate download via netbanking at HDFC Bank.

Confirm payment at Bank. Submit Printout of Challan 281 CashCheque. To avail of this facility the taxpayer is required to have a net-banking account with any of the Authorized Banks.

The following are the TDS payment due dates for the same. Yes you can do TDS online payment quarterly. HDFC Bank is one of the designated banks that can accept online income tax payments.

The deductor is required to remit the TDS amount to the government within a stipulated deadline. On mobile phones and the web. Challan NoITNS 281- Payment of TDSTCS by Company or Non Company.

To Practically learn how to make TDS computation and pay challan attend CA Maninder Singh Practical Training Classes. As per the HDFC Bank website tax certificates will be available only if PAN is updated and there is tax deduction in the financial quarter. Search for Authorised Bank branch for Payment of Direct Tax near your location.

Pay Taxes Online - e-Payment facilitates payment of direct taxes online by taxpayers. Heres how you can download your TDS certificate from traces. Offer valid from 1st November 2019 to 31st March 2020.

Welcome to HDFC Bank NSDL Payment Gateway. Please update your PANForm 60 if PAN is unavailable for your policy with us. An advance premium can be paid within the same financial year for any premium due in that financial year.

Debit Card TC 5 Cashback for online payment through HDFC Bank debit cards on select HDFC Bank SmartHub Education institutes. The last date to file income tax return ITR for the financial year 2019-20 is December 31 2020 extended from earlier date November 30 2020. The Tax Deducted at Source or TDS is the tax amount which is deducted by the responsible deductor and paid on behalf of the assessee to the tax department.

Ministry of Finance has made TDS Payments mandatory via the Electronic Mode from 1 st April 2008. Customer will be eligible to earn maximum Cashback points equivalent to Rs500- per month per customer for the said promotional Cashback offer. You will be securely redirected to the bank payment interface of your chosen net banking option.

After that we will get a window where list of all recent payments of TDS and Income tax from this HDFC Bank account will appear with the heading Regenerate Direct Tax Challans. If you dont have an account in one of the designated banks you can use an account that belongs to your spouse or friend to make an online tax payment. Click to pay tax online.

Take your pick from a range of innovative payment and collections solutionsavailable for consumers and merchants. Retail Users Pay using NetBanking Click Here Corporate Users Pay using ENET Click HereClick Here. However as a taxpayer you will have to take permission from the Assessing Officer with consent from the Joint Commissioner.

Challan NoITNS 282- Payment of Securities transaction tax Estate duty Wealth-tax Gift-tax Interest-tax Expenditureother. Enter your HDFC Bank Credit Card number and Payment amount. ENet acts as a secured user friendly single point of access for various payments like Vendor Payments Employee Payments Collections and Taxes.

Challan NoITNS 280- Payment of Advance tax Self-Assessment tax Tax on Regular Assessment Surtax Tax on Distributed Profits of Domestic Company and Tax on Distributed income to unit holders. Corporates having account with HDFC Bank can pay their Custom Duty using HDFC Bank Corporate and Retail Netbanking. NEFT Available 24 7.

After apply for the TAN you have to required to charge the taxes but there is problementrepreneurs are confused about to making Online Tds payment in indiaSo in todays article will discuss how you can make online Tds payment in India. In Request Tab there would be an option called Regenerate Direct Tax challansClick on that. Middle navigation MENU NavBarAdvancedControlleruserNamesplit 0.

This TDS payment can be made online. Direct Indirect Tax Payments. 7 th July for the quarter that concludes on June 30th.

HDFC Bank is the leading bank in collection of various tax payments CBDT CBEC via electronic mode. PAY Cards Bill Pay. Tax payer can select a state and location to get the list of Authorised Bank branches for the payment of Direct tax in the location near to them.

Take Printout 1 Copy Go To Bank. TDS is playing very important role for the small business. Procedure after paying challan in TDS.

Select your net banker from drop-down and click on PAY.

Hdfc Rtgs Charges Paisabazaar Com

Hdfc Rtgs Charges Paisabazaar Com

Know Procedure To Filling Form 16 Online Tax Forms Income Tax Income

Know Procedure To Filling Form 16 Online Tax Forms Income Tax Income

Online Payment Of Employees Provident Fund Now Pay Your Monthly Epf Payment Through Your Banks Like Sbi Icici Hdfc Etc No Ne Online Payment Payment Online

Online Payment Of Employees Provident Fund Now Pay Your Monthly Epf Payment Through Your Banks Like Sbi Icici Hdfc Etc No Ne Online Payment Payment Online

Https V1 Hdfcbank Com Assets Pdf Retail Process Pdf

How To E Verify Itr Using Hdfc Bank Net Banking Tax2win

How To E Verify Itr Using Hdfc Bank Net Banking Tax2win

Hdfc Loan Hdfc Loan Calculator Hdfc Bank Loans Status Loan Calculator Bank Loan Loan

Hdfc Loan Hdfc Loan Calculator Hdfc Bank Loans Status Loan Calculator Bank Loan Loan

Income Tax Payment Online Now Pay Your Taxes Using Hdfc Bank Debit Card And Get Rs 100 Cashback Zee Business

Income Tax Payment Online Now Pay Your Taxes Using Hdfc Bank Debit Card And Get Rs 100 Cashback Zee Business

Hdfc Net Banking Hdfc Bank Internet Banking Online

Hdfc Net Banking Hdfc Bank Internet Banking Online

How To Pay Tds Online Tds Challan Payment 281 Using Hdfc Payincometaxonline Onlinetdspayment Youtube

How To Pay Tds Online Tds Challan Payment 281 Using Hdfc Payincometaxonline Onlinetdspayment Youtube

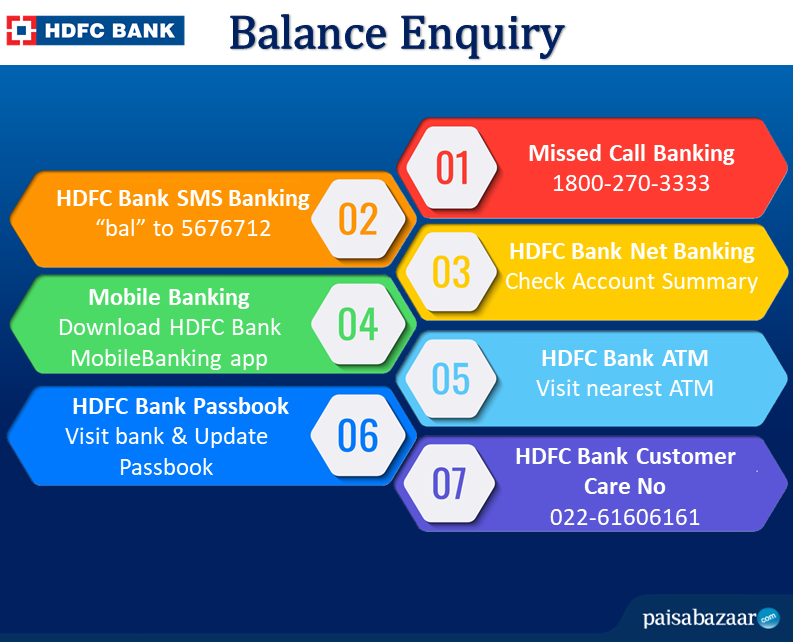

Hdfc Balance Check By Number Missed Call Sms Netbanking Atm

Hdfc Balance Check By Number Missed Call Sms Netbanking Atm

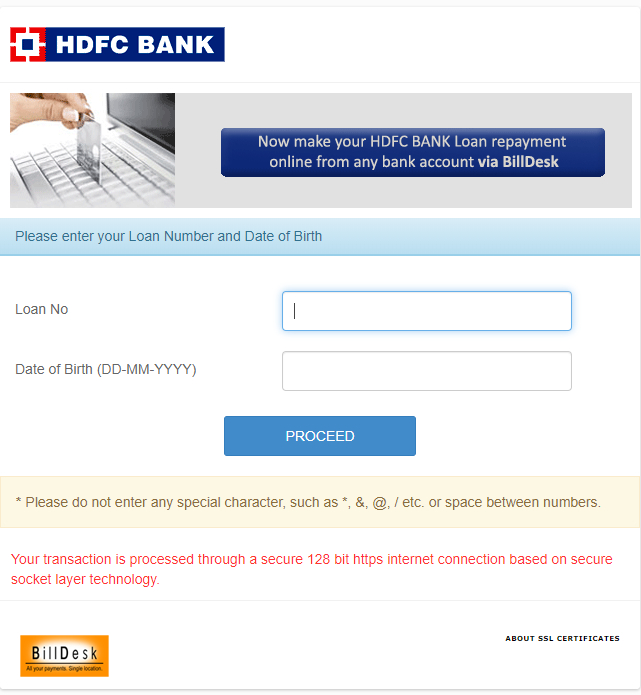

Hdfc Personal Loan Payment How To Pay Online

Hdfc Personal Loan Payment How To Pay Online

How To Open Hdfc Bank Account Online Hdfc Insta Account Online Youtube

How To Open Hdfc Bank Account Online Hdfc Insta Account Online Youtube

How To E Verify Itr Using Hdfc Net Banking Youtube

How To E Verify Itr Using Hdfc Net Banking Youtube

Amazon Hdfc Bank Offer 1 30 Nov Extra 10 Cashback Cashback Debit Card Festival Lights

Amazon Hdfc Bank Offer 1 30 Nov Extra 10 Cashback Cashback Debit Card Festival Lights

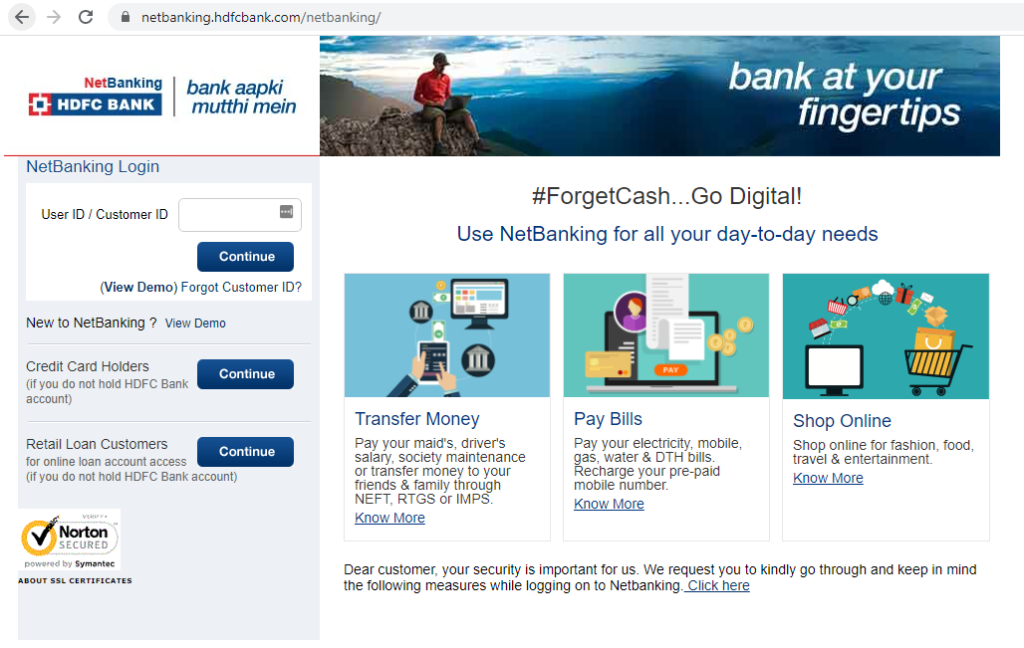

Hdfc Bank Netbanking Register Login Download Bank Statement Tax Payment E Verify Itr Learn By Quicko

Hdfc Bank Netbanking Register Login Download Bank Statement Tax Payment E Verify Itr Learn By Quicko

Fd Calculator For Hdfc Bank Deposit Interest Calculator Saving Bank Account

Fd Calculator For Hdfc Bank Deposit Interest Calculator Saving Bank Account

Income Tax Payment Know How To Pay Income Tax Online Hdfc Bank

Income Tax Payment Know How To Pay Income Tax Online Hdfc Bank

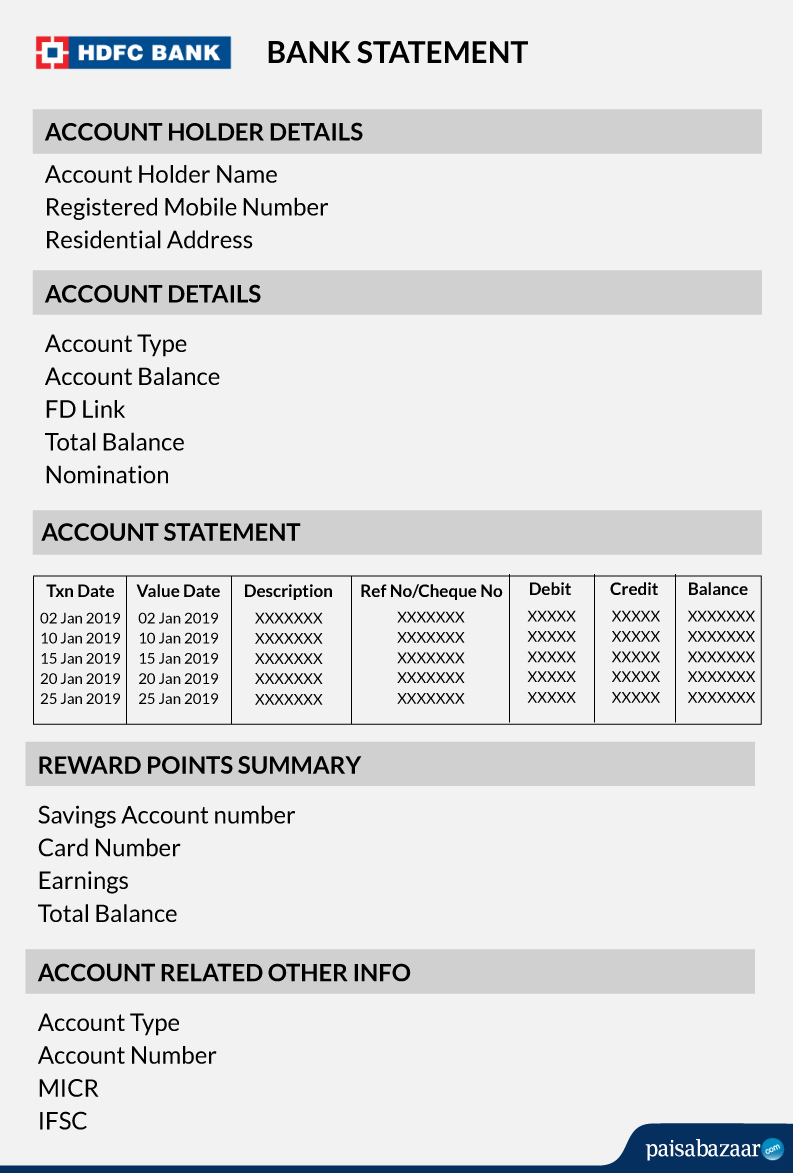

Hdfc Bank Statement Format View Download Benefits Paisabazaar

Hdfc Bank Statement Format View Download Benefits Paisabazaar

Hdfc Netbanking Registration Online How To Register Hdfc Internet Ban Online Registration Banking

Hdfc Netbanking Registration Online How To Register Hdfc Internet Ban Online Registration Banking

Post a Comment for "Online Payment Of Tds Hdfc Bank"