Loan Amount Calculation Worksheet Ppp

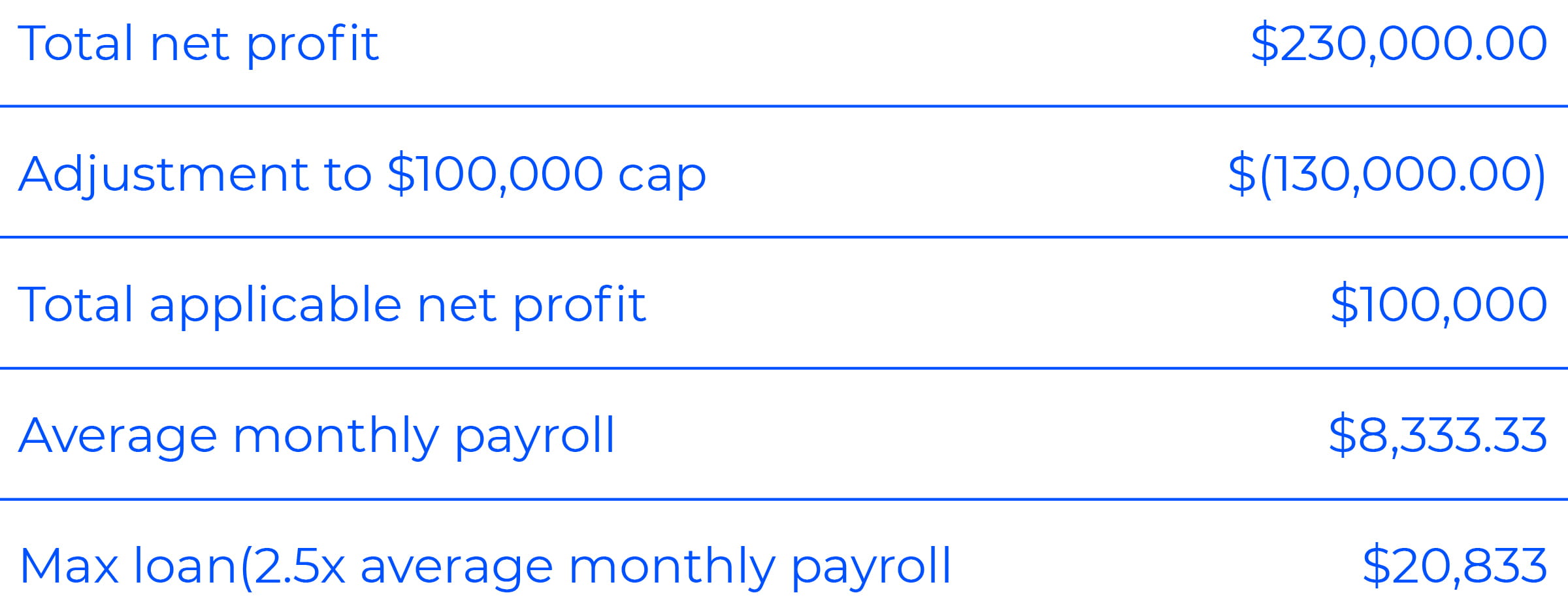

The PPP sets a cap on salaries of 100000if you or any of your employees make more than that you can only write 100000 on your application. Maximum Loan Calculation Worksheet Revised.

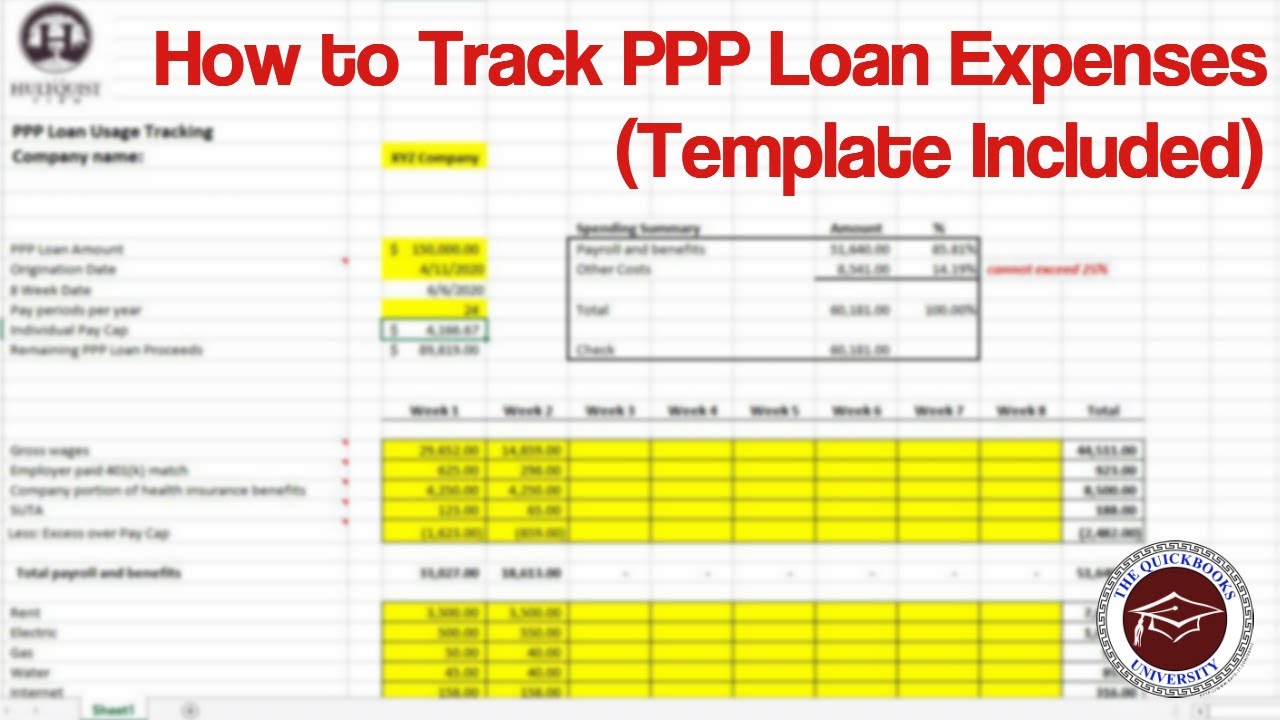

How To Track Ppp Loan Expenses Template Included Youtube

How To Track Ppp Loan Expenses Template Included Youtube

The Small Business Administration SBA in consultation with the Department of the Treasury.

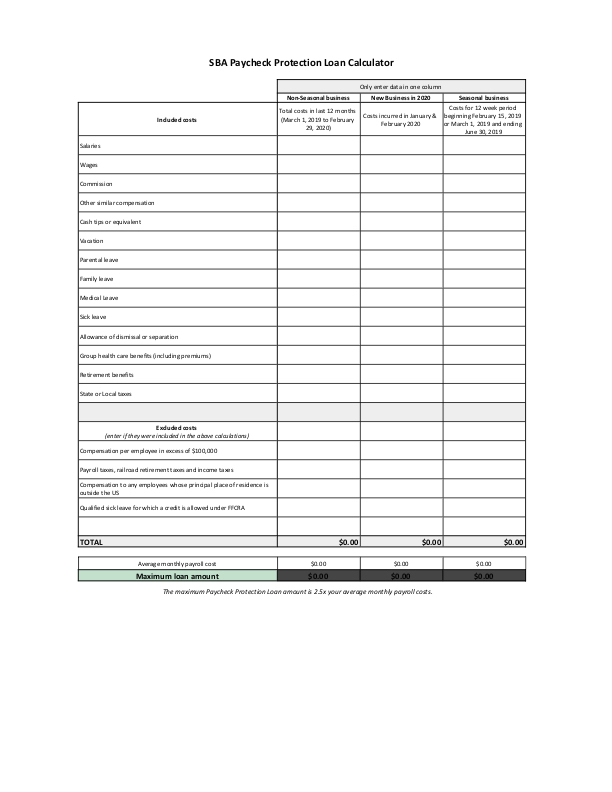

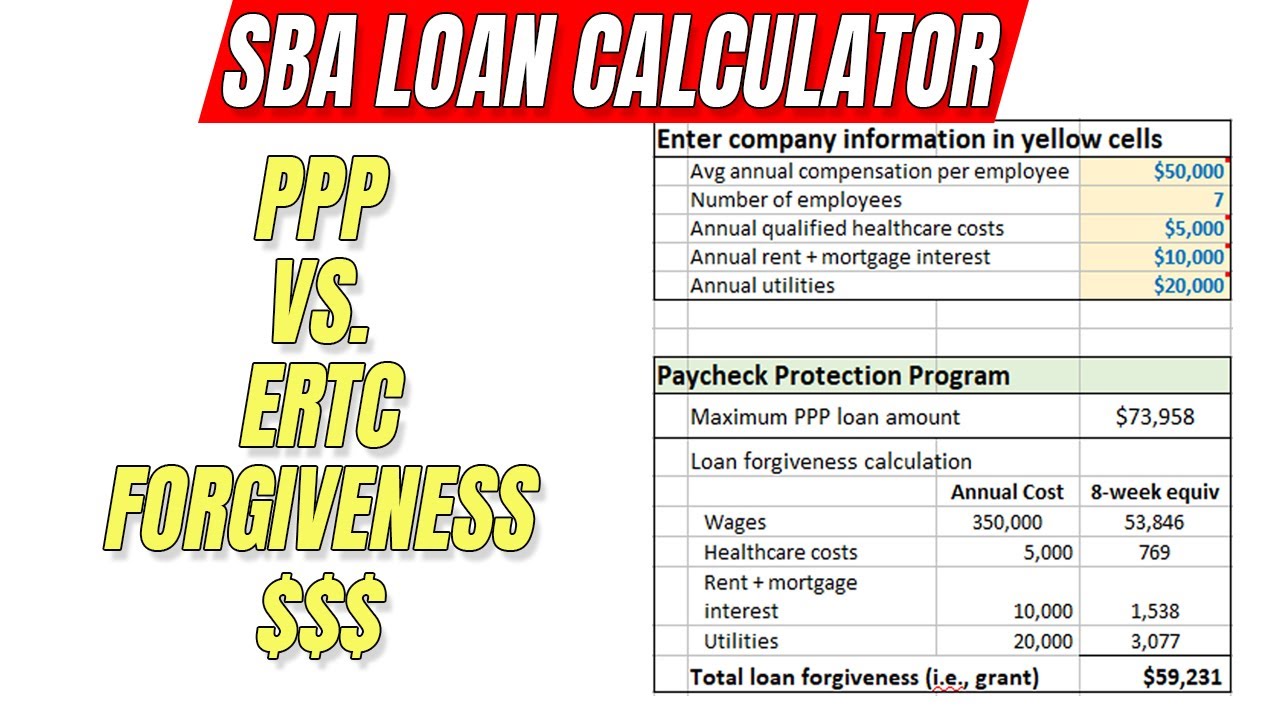

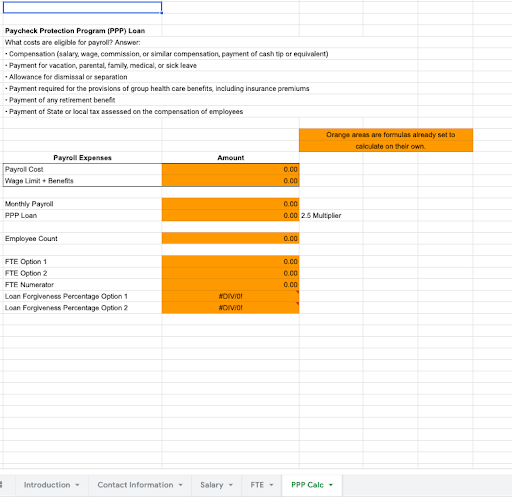

Loan amount calculation worksheet ppp. The loan calculation itself requires you to use your annual salary and the annual salary of any W2 employees whose primary residence is the United States. Please read the instructions in the worksheet which indicate how to use the resources as intended. When it comes to PPP forgiveness calculation you need the PPP Schedule A Worksheet PPP Schedule A and PPP Loan Forgiveness Calculation Form in that order.

Some employees make more than 100000. The worksheet will divide that figure by 12 to arrive at your average monthly payroll. Maximum loan amount is 25000.

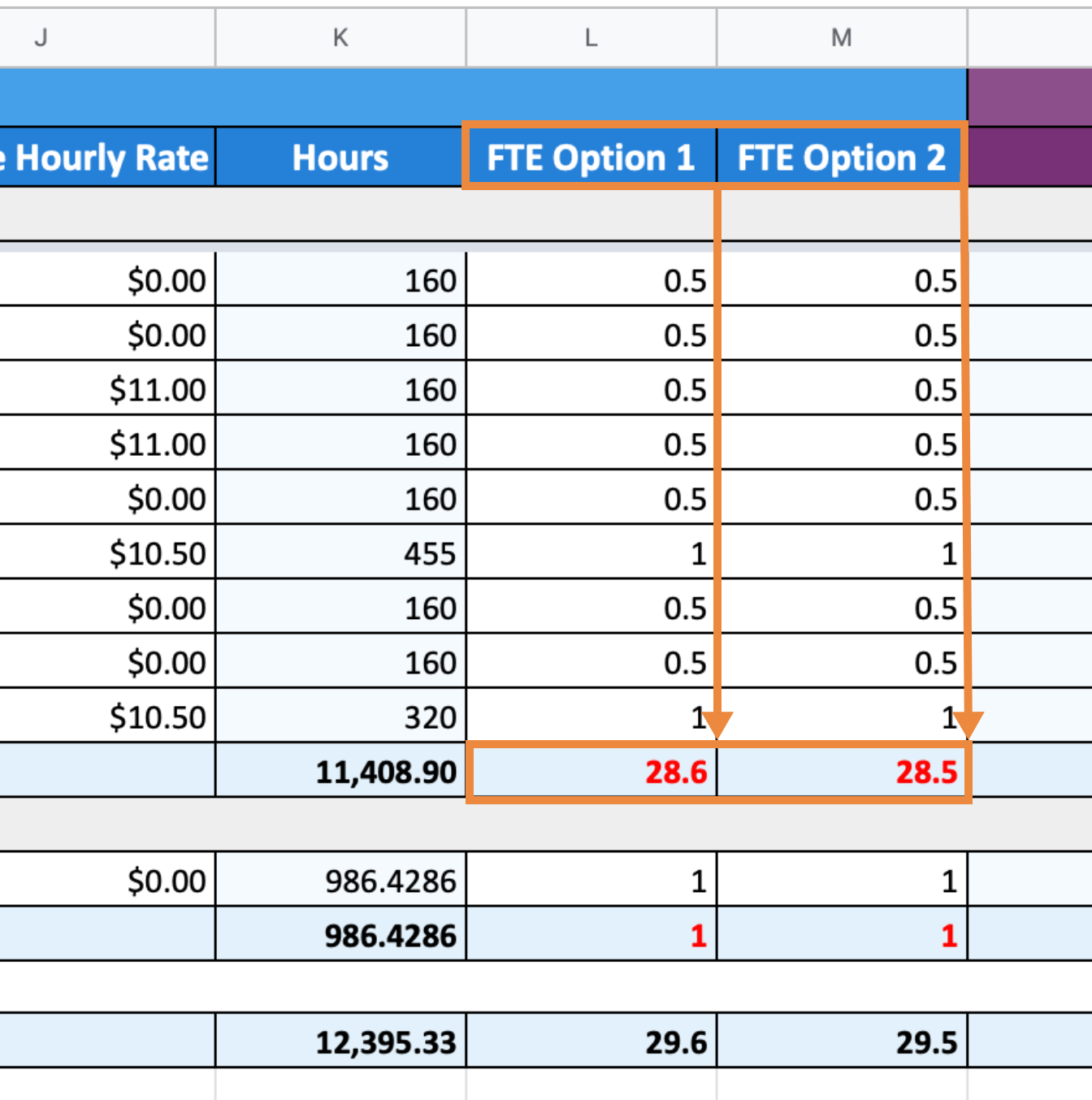

Enter Average FTE Box 2 from PPP Schedule A Worksheet Table 1. The amount of loan forgiveness the Borrower applies for may be subject to reductions as explained in PPP Schedule A. How to Calculate Revenue Reduction and Maximum Loan Amounts Including What Documentation to Provide.

Average Monthly Payroll - The total allowed payroll expenses for the Base Period divided by the number of months in the Base Period 2. Second Draw Paycheck Protection Program PPP Loans. Maximum loan amount is 250000.

If this amount is zero or less you are not eligible for a PPP loan. The applied-for PPP loan amount and a 2019 or 2020 whichever you used to calculate your loan amount IRS Form 1099-MISC detailing nonemployee compensation received box 7 invoice bank statement or book of record that establishes you are self-employed. All of these are in the Loan Forgiveness Application form packet.

Times 25x Enter total costs for each category for. February 25 2021 The purpose of this worksheet is to accurately determine the following two figures that you will input on your SBA Application. 15 2019 to calculate its maximum PPP loan amount must use the same 12-week period as the reference period for calculation of any reduction in the amount of loan forgiveness.

If this amount is over 100000 reduce it to 100000. For a Second Draw PPP Loan amount of 150000 or less the borrower must. In short its a lot to take in.

After entering the information scroll to the bottom of the rows to verify the total allowable payroll amount. SBA PPP Calculator All of the following relate to calendar year 2019 Assuming they were in business during 2019 Start with 2019 from W-3 Box 5 Gross Wages _____ This amount should be verified with a copy of the W-3 Subtract amounts for those compensated in excess of 100000 _____. Download the PPP Loan Calculator Non-seasonal In business.

Simply enter the amounts in the YELLOW CELLS for each column. Loan Amount Calculation Worksheet. Second Draw Paycheck Protection Program PPP Loans.

How to Calculate Revenue Reduction and Maximum Loan Amounts Including What Documentation to Provide. A seasonal employer that elects to use a 12-week period between May 1 2019 and Sept. PPP Schedule A PPP Schedule A Worksheet Table 1 Totals Amounts Line 1.

The loan forgiveness calculators use available guidance from the Small Business Administration SBA and Treasury along with interpretations of that guidance see notes throughout to estimate the amount of a PPP loan that may be eligible for. Enter Cash Compensation Box 1 from PPP Schedule A Worksheet Table 1. Reference documents such as your IRS Quarterly 940 941 or 944 payroll tax reports or form 5500 to complete the following worksheet.

In this 11-minute webinar Pursuits Chris Levy will explain how you can calculate your PPP loan amount as a Schedule C with employees. Borrowers must use all three forms to calculate their loan forgiveness amount. If using 2020 to calculate your loan amount this is required.

Find your 2019 IRS Form 1040 Schedule C line 31 net profit amount if you have not yet filed a 2019 return fill it out and compute the value. Average monthly qualifying payroll. When making a PPP loan calculation the worksheet is straightforward.

Multiply by 25 250000. Either 2019 or 2020. How to calculate First Draw Paycheck Protection Program loan amounts and what documentation to provide - by business type.

Subtract compensation amounts in excess of an annual salary of. PSC PPP Form 103. New entities applying for first-draw loans who do not use calendar year 2019 2020 or the precise 1-year period before the date on which the loan is made may calculate total annual payroll by taking the payroll costs incurred from January 1 2020 to February 29 2020 dividing that number by 60 and then multiplying that number by 364 to.

Ppp Loan Calculation How To Use The Payroll Worksheet Camino Financial

Ppp Loan Calculation How To Use The Payroll Worksheet Camino Financial

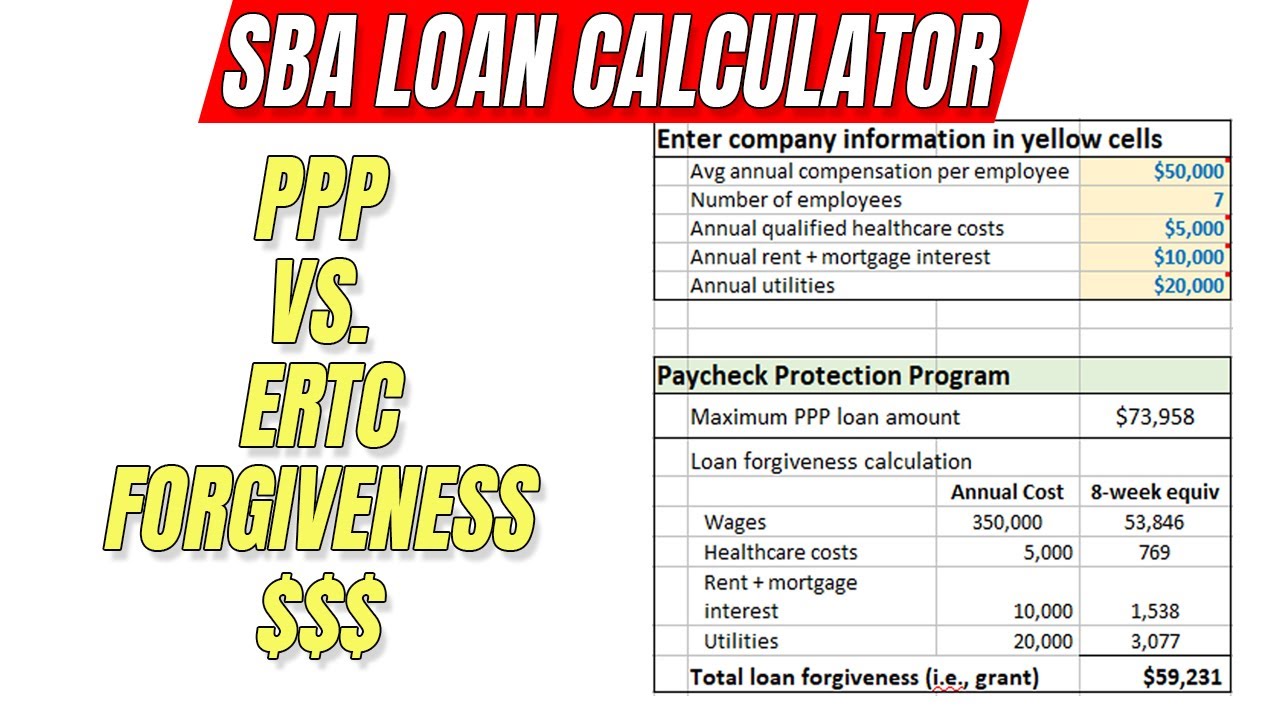

Sba Paycheck Protection Loans Loan Forgiveness Calculator Levelset

Sba Paycheck Protection Loans Loan Forgiveness Calculator Levelset

The Squire Sba Payroll Protection Program Ppp Calculator Tool Tutorial V 2 Youtube

The Squire Sba Payroll Protection Program Ppp Calculator Tool Tutorial V 2 Youtube

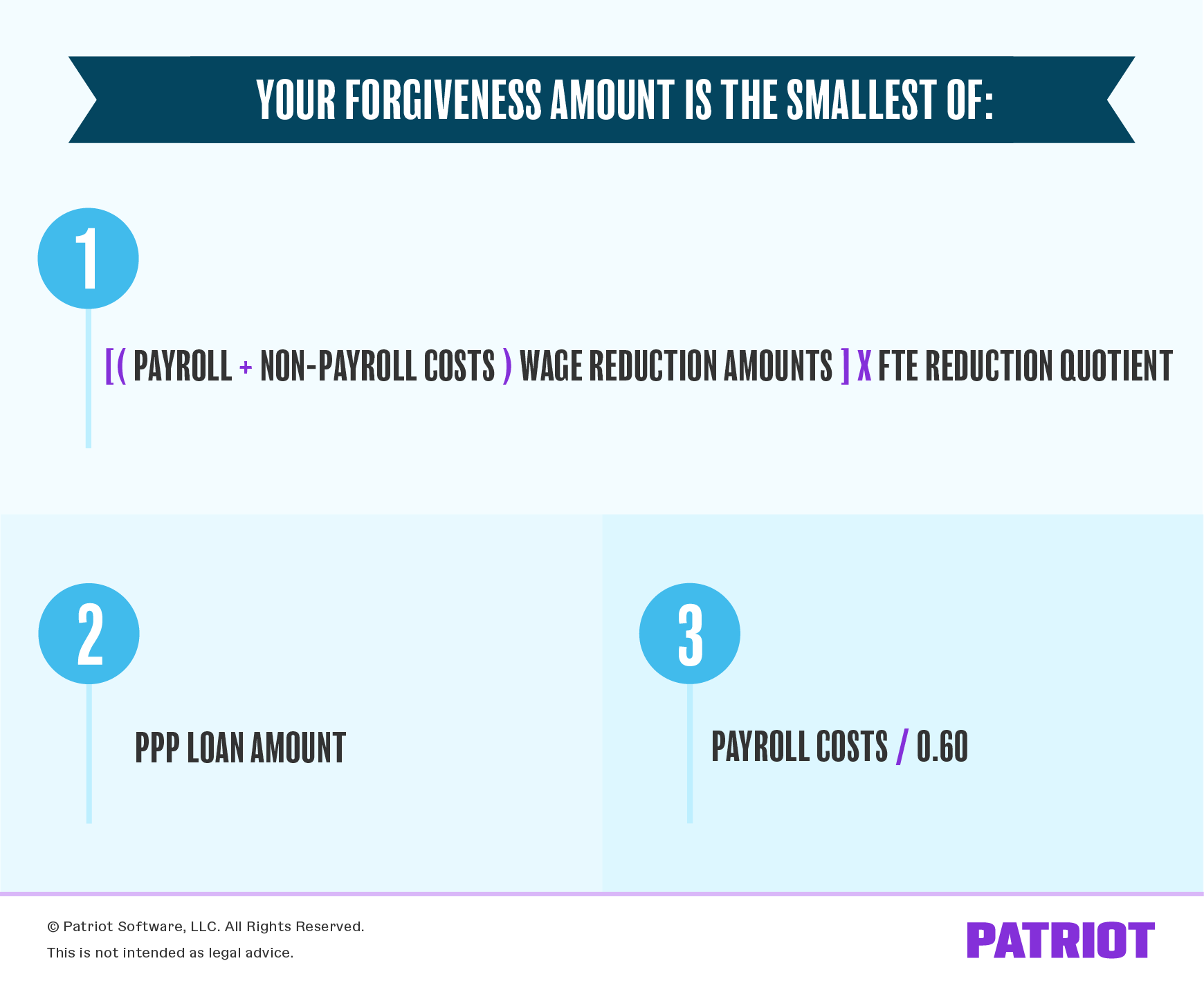

Ppp Forgiveness Calculation How To Calculate Loan Forgiveness

Ppp Forgiveness Calculation How To Calculate Loan Forgiveness

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

Ppp Loan Amount For Self Employed What Is Average Monthly Payroll 1099 Smllc Uber Sole Prop Youtube

Ppp Loan Amount For Self Employed What Is Average Monthly Payroll 1099 Smllc Uber Sole Prop Youtube

Introducing The Excel Spreadsheet For Ppp Loan Forgiveness Youtube

Introducing The Excel Spreadsheet For Ppp Loan Forgiveness Youtube

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

Ppp Loan Faqs For Employers Stratus Hr

Ppp Loan Faqs For Employers Stratus Hr

Ppp Loan Forgiveness Application Guide Updated Gusto

Ppp Loan Forgiveness Application Guide Updated Gusto

Ppp Loan Forgiveness How To Calculate Wage Reduction Template Included Youtube

Ppp Loan Forgiveness How To Calculate Wage Reduction Template Included Youtube

Real Estate Brokers How To Calculate Your Ppp Loan Amount Wipfli

Real Estate Brokers How To Calculate Your Ppp Loan Amount Wipfli

How To Fill Out The Schedule A Worksheet Using Onpay S Ppp Loan Forgiveness Report Help Center

How To Fill Out The Schedule A Worksheet Using Onpay S Ppp Loan Forgiveness Report Help Center

Forgivable Loan Calculator Paycheck Protection Program Ppp Stimulus Grant Youtube

Forgivable Loan Calculator Paycheck Protection Program Ppp Stimulus Grant Youtube

Ppp Loan Forgiveness Full Time Equivalent Employee Fte Calculation Template Included Youtube

Ppp Loan Forgiveness Full Time Equivalent Employee Fte Calculation Template Included Youtube

.png?width=425&name=PPP%20Forgiveness%20Spreadsheet%20(2).png) Ppp Loan Forgiveness Spreadsheet Vanderbloemen

Ppp Loan Forgiveness Spreadsheet Vanderbloemen

Clarity On Federal Taxes For Cares Act Paycheck Protection Program

Clarity On Federal Taxes For Cares Act Paycheck Protection Program

An Advisor S Guide To The Paycheck Protection Program

An Advisor S Guide To The Paycheck Protection Program

How To Calculate Your Payroll Costs For The Ppp Loan

How To Calculate Your Payroll Costs For The Ppp Loan

Post a Comment for "Loan Amount Calculation Worksheet Ppp"