Irs Installment Agreement Extension

That secures the IRSs interest against other creditors. Here are our options to get your agreement reinstated in the next 30 days.

Can I Apply For Naturalization If I Owe Back Taxes Maybe

Can I Apply For Naturalization If I Owe Back Taxes Maybe

To help people facing the challenges of COVID-19 issues the IRS through the People First Initiative will temporarily adjust and suspend key compliance programs.

Irs installment agreement extension. For taxpayers under an existing Installment Agreement payments due between April 1 and July 15 2020 are suspended. The deadline for mailing the form to the IRS is April 18. In an Information Release the IRS has announced that beginning April 1 it will provide relief to taxpayers that ranges from easing payment guidelines for installment agreements and Offers in Compromise to postponing certain compliance actions.

In other words the IRS is giving us an opportunity to fix the installment agreement and get it reinstated before they actually terminate it. However there is one catch. Furthermore the IRS will not default any Installment Agreements during this period.

To request a payment plan use the OPA application complete Form 9465 Installment Agreement Request and mail it to us or call the appropriate telephone number listed below. See IRSgov for further information. On the other hand if youre requesting a business tax extension your filing deadline will be extended either 5 or 6 months depending on the type of business entity.

The IRS will let you pay off your federal tax debt in monthly payments through an installment agreement. Specifically IRS will generally issue a Notice of Federal Tax Lien if an individual taxpayer owes between 25k-50k and sets up an IA that is not via payroll deduction or direct debit. This way you wont have to file a separate extension form and you will receive a confirmation number for your records.

The best feature of this new payment plan is that it is very easy to set up with the IRS. IRS suspends certain compliance programs eases payment guidelines. Free File is accessible for tax return preparation and e-filing through Oct.

There is no fee for setting up a 120-day IRS payment extension. If you owe less than 100000 its pretty easy to get an installment agreement. Individual Income Tax Return.

You can also get an extension by paying all or part of your estimated income tax due and indicate that the payment is for an extension using Direct Pay the Electronic Federal Tax Payment System EFTPS or a credit or debit card. You may have had to negotiate with a local IRS Revenue Officer or over the phone with the IRS automated collection service. Getting a personal tax extension means you will have an additional 6 months to file your income tax return.

The new non-streamlined installment agreement or NSIA does require the IRS to file a Notice of Federal Tax Lien with the IRS. If you havent filed yet step through the File section of TurboTax until you reach the screen How do you want to pay your federal taxes. PO Box 219236 Stop 5050.

You have filed all required returns and owe 25000 or less in combined tax penalties and interest. The IRS generally has 10 years to collect tax debts called the collection statute expiration date. Applicants should submit the form to the IRS within 30 days from the date of their installment agreement acceptance letter to request the IRS to reconsider their status.

New Installment Agreements The IRS reminds people unable to fully pay their federal taxes that they can resolve outstanding liabilities by entering into a monthly payment agreement with the IRS. As long as you owe less than 100k in combined tax interest and penalties you can apply for this online. If you are filing your tax return and you dont have the full payment you can even request a payment plan at the same time as you file your return.

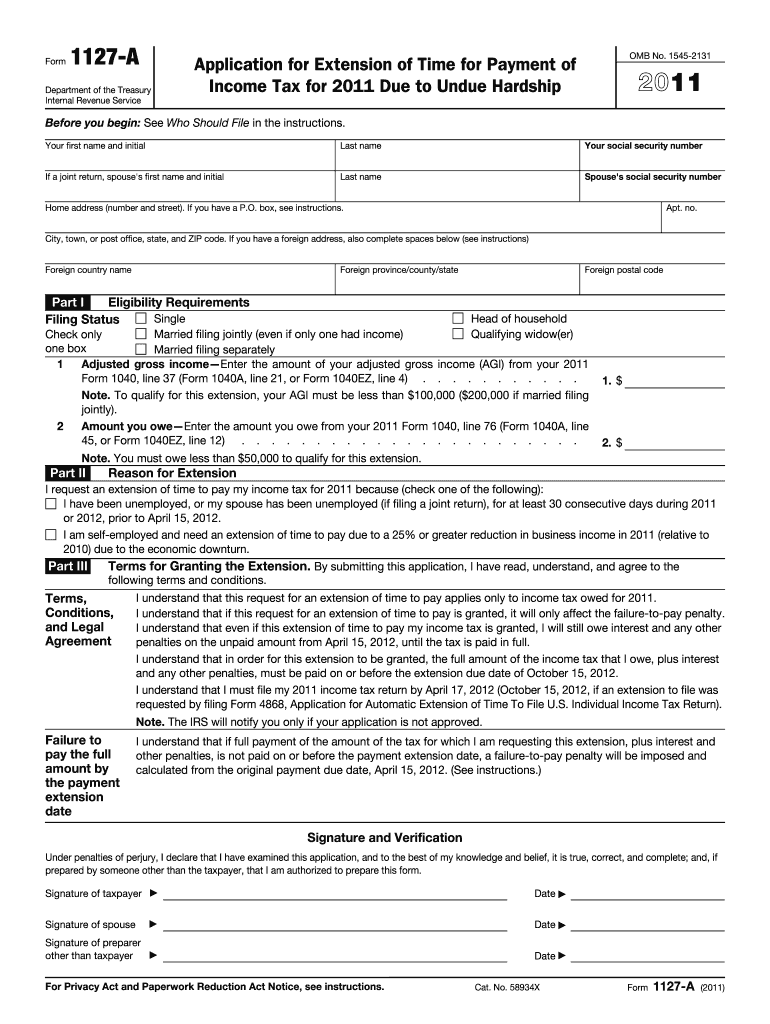

Now qualified taxpayers with installment agreements paid by direct debit may now be able to. The IRS has an official 120-day payment agreement. Fill out a request for an extension using Form 4868 Application for Automatic Extension of Time to File US.

Use the Online Payment Agreement applicationits the same application you use to apply for an installment plan. This form can be downloaded from IRSgovforms and should be mailed to the IRS along with a tax return IRS bill or notice. Select the installment payment plan option Continue and follow the onscreen instructions.

Yes the IRS can issue a tax lien while an Installment Agreement is in place. Alternatively taxpayers can request a payment agreement by filing Form 9465 Installment Agreement Request. Once you have an existing installment agreement you typically have to talk to the IRS to make changes.

The IRS is only putting us on notice that they are about to terminate your installment agreement in 30 days. Taxpayers who are currently unable to comply with the terms of an Installment Payment Agreement including a Direct Debit Installment Agreement may suspend payments during this period if they prefer. If youre not able to pay your balance in full immediately or within 180 days you may qualify for a monthly payment plan including an installment agreement.

It is only available through IRSgov. If you are a sole proprietor or independent contractor apply for a payment plan as an individual. Kansas City MO 64121-9236.

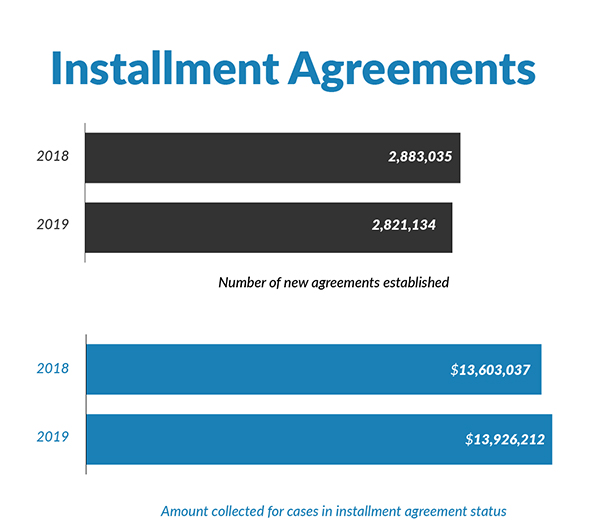

Get an extension when you make a payment. An installment agreement is one of the most common payment arrangements for people who owe back taxes to the IRS. A payment plan allows you to make a series of monthly payments over time.

If you owe tax for more than one tax year you have to bundle all the taxes you owe into one installment agreement. Long-term payment plan installment agreement. This means your filing deadline moves from April 15 to October 15.

Although not an official IRS pronouncement as of 8292020 the IRS now allows tax debtors who owe between 50000 and 250000 to pay on easier terms. Midnight April 18 is the deadline for receipt of an e-filed extension request. Maybe you had minimal negotiations made possible by qualifying for a streamlined installment agreement which the IRS will automatically grant if you owe under 50000 and can repay it in 72 months.

By law interest will continue to accrue on any unpaid balances.

Irs Payment Options How To Make Your Payments

Irs Payment Options How To Make Your Payments

Irs 84 Month Installment Agreement Wilson Rogers Company

Irs 84 Month Installment Agreement Wilson Rogers Company

Paying Back Taxes How To Pay Back Taxes To The Irs

Paying Back Taxes How To Pay Back Taxes To The Irs

Irs Installment Agreement Services

Irs Installment Agreement Services

Irs Installment Agreement Greensboro Nc Mm Financial Consulting Inc Internal Revenue Service Greensboro Irs

Irs Installment Agreement Greensboro Nc Mm Financial Consulting Inc Internal Revenue Service Greensboro Irs

Https Www Irs Gov Pub Irs Prior F9465 1993 Pdf

How To Complete An Irs Form 433 D Installment Agreement

How To Complete An Irs Form 433 D Installment Agreement

Filing For An Extension Irs Source Doc From 4 8 2013

Filing For An Extension Irs Source Doc From 4 8 2013

Https Www Irs Gov Pub Notices Cp523 English Pdf

Irs Letter 2272c Installment Agreement Request H R Block

Irs Letter 2272c Installment Agreement Request H R Block

How To Setup An Irs Payment Plan Or Installment Agreement

How To Setup An Irs Payment Plan Or Installment Agreement

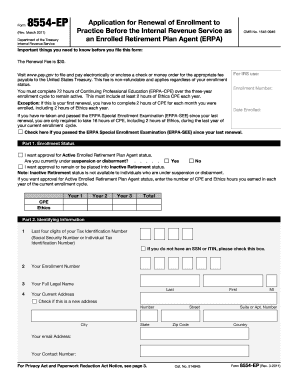

Irs Payment Plan Form Fill Out And Sign Printable Pdf Template Signnow

Irs Payment Plan Form Fill Out And Sign Printable Pdf Template Signnow

Irs Streamlined Installment Agreement Requirements How To Request

Irs Streamlined Installment Agreement Requirements How To Request

19 Printable Irs Payment Plan Calculator Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

19 Printable Irs Payment Plan Calculator Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Irs Form 9465 Installment Agreement Request Instructions

Irs Form 9465 Installment Agreement Request Instructions

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Financial

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Financial

Irs Installment Agreement Payment Plan Tax Payment Options

Irs Installment Agreement Payment Plan Tax Payment Options

Irs Notice 2272c Understanding Irs Notice 2272c Denied Installment Agreement Immediate Response Required

Irs Notice 2272c Understanding Irs Notice 2272c Denied Installment Agreement Immediate Response Required

Post a Comment for "Irs Installment Agreement Extension"