Does A Refund Count As A Payment

You will still need to make the minimum. You can request your refund to be direct deposited into a maximum of three checking or savings accounts or have a paper check mailed to your home.

10 Clever Ways To Win With Your Tax Refund Tax Refund Debt Debt Free

10 Clever Ways To Win With Your Tax Refund Tax Refund Debt Debt Free

The Tax Cuts and Jobs Act TCJA put a cap on how much you can claim for state and local taxes.

Does a refund count as a payment. You will still need to make the minimum payment due in order to avoid missing a. The stimulus payment is a unique fully refundable tax credit. No - If its the state refund and you took the standard deduction last year did not itemize.

Do Credit Card Refunds Count as a Payment. You are absolutely correct to enter the payments in the Estimated Tax payment section. So in case refunds are considered a payment then people will buy products that are more than their balance every month and then return them a few days later.

TurboTax adds Even when your refund is taxable it may not be the entire amount. Even if you dont owe a penny of tax. In essence theyre payments from the government delivered through the Internal Revenue Service.

The IRS makes tax refund payments in three ways and allows you to choose the payment method on your tax return. According to Devereux a credit card refund to your account is considered an account credit not a payment. This refund is always paid to you in a later year or two depending on how late you filed your State Return.

COVID Tax Tip 2020-111 August 31 2020 In mid-August interest payments were sent to nearly 14 million individual taxpayers. Because your refund isnt applied toward your regular monthly payment continue making your installment agreement payments as scheduled. The year in which you receive this refund IRS is claiming that you had already reduced your IRS taxable income by part of the refund amount.

But even if you do have to include your state tax refund as income its not as terrifying as it sounds. No one of the conditions of your installment agreement is that the IRS will automatically apply any refund or overpayment due to you against taxes you owe. If your refund exceeds your total balance due on all outstanding tax liabilities including accruals youll receive a refund of the excess unless you owe certain other past-due amounts such.

Note that if you want to put the money back in the account you will need to contact the HSA administrator and tell them in advance that this is a return of a previous withdrawal. So they basically want you to now report it as taxable income when received. Even if they file a tax return when they dont have to like to get a tax refund their income wont be counted.

I then proceeded but why would the credit card companies care about this dont they take a cut that is worth anywhere between 2 or 3 of the whole transaction amount not to mention of course transaction fees. Does the federal stimulus count as income when applying for health insurance through the Obamacare marketplace. The Marketplace will count their income only if theyre required to file a federal tax return.

Learn about filing requirements for dependents from the IRS. While stimulus checks dont count as taxable income unemployment benefit money does count when the IRS tallies up a persons income-tax bill according to April Walker lead manager for tax. If you were to return a purchase near or after the end of your billing cycle the refund for the transaction might not show on your account before your next credit card payment is due.

While youre waiting on your refunds and missing money know that this tax season could determine if youll be eligible for a third stimulus check of up to 1400 per person or a smaller payment. Estimated tax payments are considered credits towards your taxes owed and are not considered an expense. Why does my stimulus payment reduce my refundincrease my amount owed.

These interest payments averaged about 18. As long as your total qualified expenses for the year are equal or more than your qualified withdrawals plus the amount of the refund then the refund doesnt matter. I recently became unemployed.

The IRS issued most of the payments separately from tax refunds. People who got these payments filed their 2019 federal income tax returns by the July 15 deadline and were owed refunds. Even if you had purchased the laptop the previous month and was charged to your current bill and you returned it yesterday it will still possibly not be considered a payment since.

Your refund is only taxable if you took a deduction for state and local income taxes. The stimulus payment is not added to your taxable income on your return. Yes - If its the state refund and you itemized deductions last year.

According to Devereux a credit card refund to your account is considered an account credit not a payment. Generally when a refund is processed for a returned item within the same credit card billing cycle you wont be held responsible to make a payment on that specific charge. You have that choiceyou can deduct either income taxes or sales taxes but not both.

That limit is still 10000 as of 2020. No - If its the federal refund you do not report that as income. Based on your entries for the stimulus payment amounts filing status and dependents the program will automatically calculate the amount of credit due to you and enter the amount on line 30.

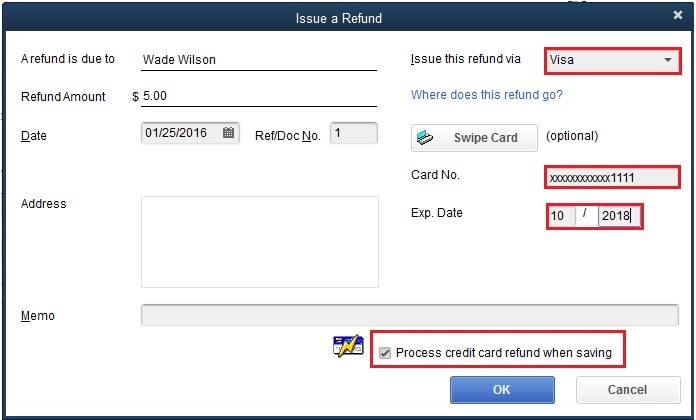

Void Or Refund Customer Payments In Quickbooks Des

Void Or Refund Customer Payments In Quickbooks Des

Printable Lease Agreement Template Beautiful Printable Rental Agreement 13 Free Word Pdf Documents Rental Agreement Templates Lease Agreement Car Lease

Printable Lease Agreement Template Beautiful Printable Rental Agreement 13 Free Word Pdf Documents Rental Agreement Templates Lease Agreement Car Lease

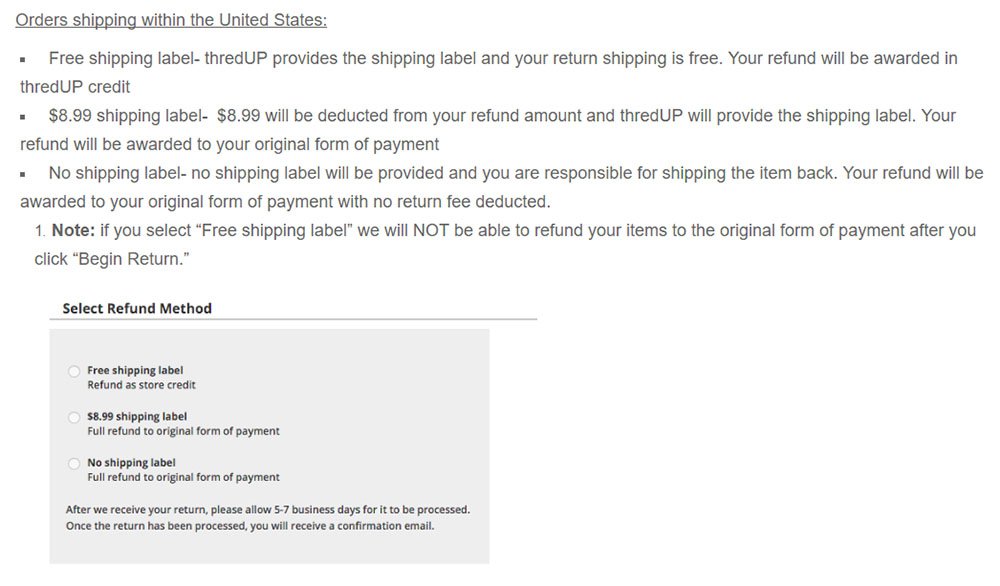

Return And Refund Laws In The U S Termsfeed

Return And Refund Laws In The U S Termsfeed

Pin By William Chamberlain On Infographics Tax Refund Credit Card Infographic Tax Day

Pin By William Chamberlain On Infographics Tax Refund Credit Card Infographic Tax Day

Read This If You Faced A Transaction Failure While Processing Our Service Fee Payment Failure Credit Card Transactions Payment

Read This If You Faced A Transaction Failure While Processing Our Service Fee Payment Failure Credit Card Transactions Payment

9 Lessons That Will Teach You All You Need To Know About American Express Serve American Express Serve Https Card In 2020 Expressions Teaching Rewards Credit Cards

9 Lessons That Will Teach You All You Need To Know About American Express Serve American Express Serve Https Card In 2020 Expressions Teaching Rewards Credit Cards

Refund Request Form Template Mactemplates Com Words To Use Refund Templates

Refund Request Form Template Mactemplates Com Words To Use Refund Templates

Your Birth Order How Will You Spend Your Tax Refund Tax Refund Income Tax Return Income Tax

Your Birth Order How Will You Spend Your Tax Refund Tax Refund Income Tax Return Income Tax

Should You Pay Off Debt With Your Tax Refund In 2020 Debt Payoff Tax Refund Debt Advice

Should You Pay Off Debt With Your Tax Refund In 2020 Debt Payoff Tax Refund Debt Advice

Smotrite Eto Foto Ot Analogsigns Na Instagram Otmetki Nravitsya 39 Instagram Posts Area Restaurants Signs

Smotrite Eto Foto Ot Analogsigns Na Instagram Otmetki Nravitsya 39 Instagram Posts Area Restaurants Signs

Why I Love Paying Taxes And You Should Too Radical Fire Paying Taxes Tax Refund Personal Finance

Why I Love Paying Taxes And You Should Too Radical Fire Paying Taxes Tax Refund Personal Finance

Class Reunion Planning 101 Class Reunion Planning High School Class Reunion Class Reunion

Class Reunion Planning 101 Class Reunion Planning High School Class Reunion Class Reunion

Personalized Irs Letters Nudge Uninsured To Get Coverage Tax Refund Financial Help Filing Taxes

Personalized Irs Letters Nudge Uninsured To Get Coverage Tax Refund Financial Help Filing Taxes

My 1st Payment Proof From Likesplanet Http Likesplanet Com Promote Php Ref Thewoodywoodpecker17 Book Worth Reading How To Stay Healthy Earn Money Online

My 1st Payment Proof From Likesplanet Http Likesplanet Com Promote Php Ref Thewoodywoodpecker17 Book Worth Reading How To Stay Healthy Earn Money Online

Caffeine 100mg L Theanine 200mg 90 Count Taken For Better Focus Energy Mood Wakefulness Nootropic Stack V Capsul Theanine Expensive Coffee Capsule

Caffeine 100mg L Theanine 200mg 90 Count Taken For Better Focus Energy Mood Wakefulness Nootropic Stack V Capsul Theanine Expensive Coffee Capsule

2020 To 2021 Irs Tax Refund Processing Schedule And Direct Deposit Cycle Chart When Will I Get My Refund Aving To Invest

2020 To 2021 Irs Tax Refund Processing Schedule And Direct Deposit Cycle Chart When Will I Get My Refund Aving To Invest

10 Smart Ways To Spend Your Tax Refund This Year Tax Refund Tax Money Money Saving Tips

10 Smart Ways To Spend Your Tax Refund This Year Tax Refund Tax Money Money Saving Tips

Pin By Look Gan On Form New Today Metric Whats New

Pin By Look Gan On Form New Today Metric Whats New

Poster 5 Reasons Why You Should Not Take Out Student Loansthis Is A Poster About General Student Loan Debt Facts And M Student Loans Student Loan Debt Student

Poster 5 Reasons Why You Should Not Take Out Student Loansthis Is A Poster About General Student Loan Debt Facts And M Student Loans Student Loan Debt Student

Post a Comment for "Does A Refund Count As A Payment"