Do Guaranteed Payments Qualify For Ppp

An SBA-backed loan that helps businesses keep their workforce employed during the Coronavirus COVID-19 crisis. 27 at 3 pm.

For example it was originally unclear whether a partners earnings from self-employment whether distributed as net earnings or paid as a guaranteed payment qualified as payroll for the partnership.

Do guaranteed payments qualify for ppp. Subsequent governmental guidance clarified that self-employment earnings are payroll of the partnership for PPP purposes. Guaranteed payments for partners are not specifically included in the definition of payroll costs for PPP however I have heard many banks are telling their customers to include it in their wage number if they had employees. To be certain the Second Rule leaves a number of questions unanswered.

As a result the SBA appears to have opened up the definition of payroll costs to partners K-1 distributions and presumably guaranteed payments. With respect to fringes distributive shares and guaranteed payments it is unlikely that such payments would be within the scope of payroll costs. In this article well guide your partnership through the process of calculating how much you can request for your PPP loan.

Moreover whether PPP lenders will accept applications on that basis remains to be seen. On March 27 the president signed into law the CARES Act to provide relief to taxpayers and businesses facing hardship due to COVID-19. The SBA released initial guidance for the reauthorized PPP on January 5 2021.

If you dont have employees there is another way to get there. Frequently Asked Questions for Lenders and Borrowers participating in the Paycheck Protection Program PPP. However the partner receiving the guaranteed payments may be able to file for a PPP loan in hisher capacity as a self-employed person.

The AICPA will provide analysis of the interim final rule during a PPP Town Hall on Thursday Aug. Get your PPP loan or second draw PPP loan through Womply. Interim Final Rule 2021-0001 details the terms of the PPP as amended.

The PPP in brief. The Paycheck Protection Program PPP is designed to support American small businesses with eight weeks of cash support during the COVID-19 pandemic. Womply has helped.

General partners and some LLC members depending on structure receive self-employment in the form of guaranteed payments and distributive income share. This does not apply to S corporation shareholders Those amounts should be eligible for inclusion in the average monthly payroll used to size the PPP loan. If you are a partner in a multi-member LLC or partnership heres what you need to know about the PPP and what youll need to apply.

Independent contractors have the ability to apply for a PPP loan on their own so they do not count for purposes of a borrowers PPP loan forgiveness. One of the more debated topics in the newly established Paycheck Protection Program PPP is the treatment of partner compensation whether in the form of guaranteed payments or distributions. Because those regulations treat the recipient of a guaranteed payment for services but not distributive share as being self-employed in a trade or business it is possible that such a recipient may themselves be eligible to apply for a PPP loan.

Per the ruling PPP loans are intended to help businesses cover nonpayroll costs owed to third parties not payments to a businesss owner that occur because of how the business is structured. You should let your contractors and other 1099 workers know that they can and should apply directly with Womply for their own PPP loans. Specifically the question is whether guaranteed payments or distributions are treated as payroll costs as defined by the CARES Act.

Remember that at least 75 percent of the PPP loan proceeds shall be used for payroll costs. SBA Rationale for PPP Partnership Aggregation Instead the most recent SBA guidance has taken an aggregate approach for partners and partnerships. Several types of businesses qualify for this program including partnerships.

This legislation includes the Paycheck Protection Program PPP which provides cash-flow assistance through federally guaranteed loans to employers who maintain their payroll during the coronavirus pandemic. Generally speaking income that is classified as self-employment income for a member or partner includes guaranteed payments as well as that members or partners distributable share of income arising from the trade or business of the LLC or partnership. Check here for the full details on who can apply for a PPP loan.

Its free to apply and it could mean thousands of dollars in forgivable income for them. The Interim Final Rule posted by SBA on April 2 2020 indicated that individuals who operate under a sole proprietorship or as an independent contractor or eligible self-employed individual and were in operation on February 15 2020 would qualify for PPP loans. SBA guidance states that the total program allocation for guaranteed loans through the PPP is 806450000000 in 2020 and 2021.

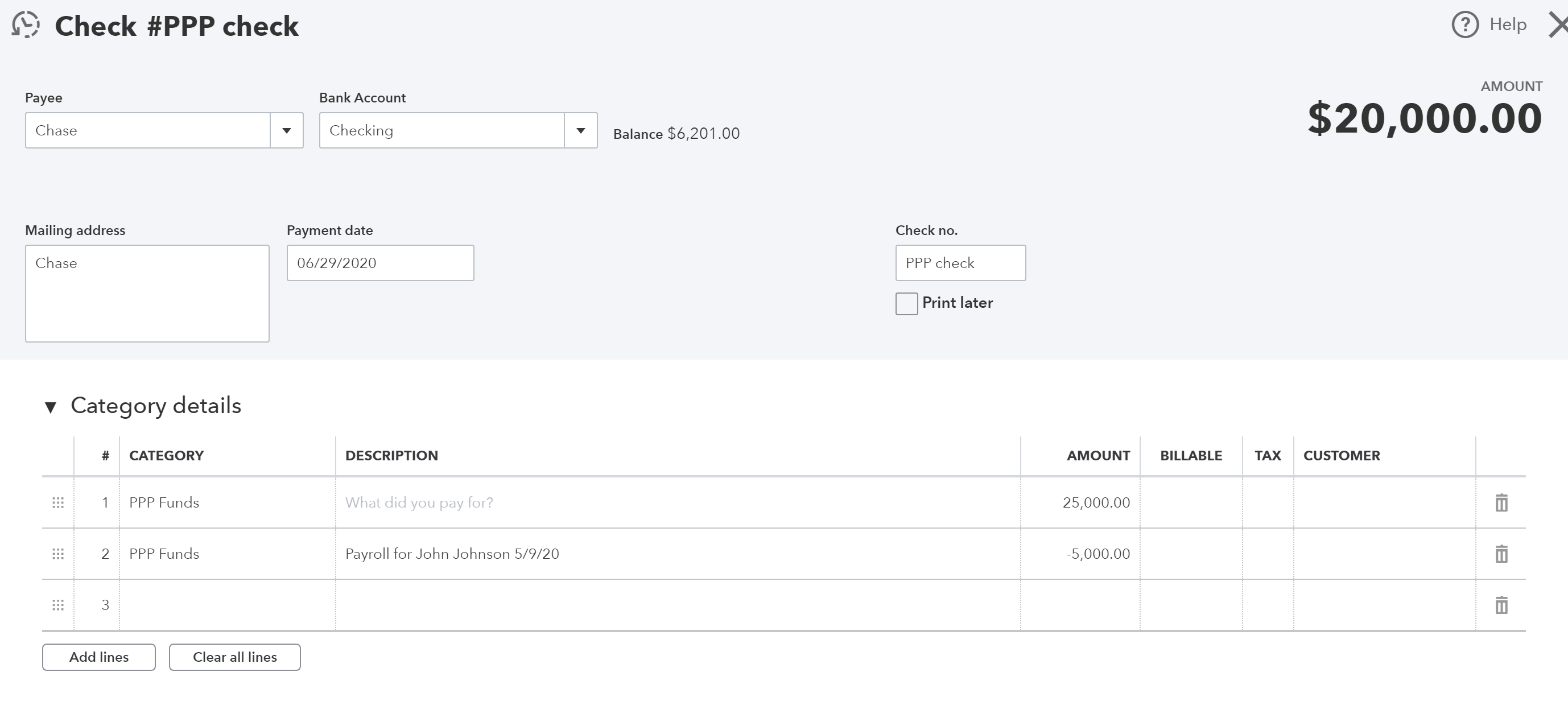

Ppp Loan Forgiveness And Recording Ppp Loan Funds Tax Queen

Ppp Loan Forgiveness And Recording Ppp Loan Funds Tax Queen

Ppp Loans For Partnerships What You Need To Know Bench Accounting

Ppp Loans For Partnerships What You Need To Know Bench Accounting

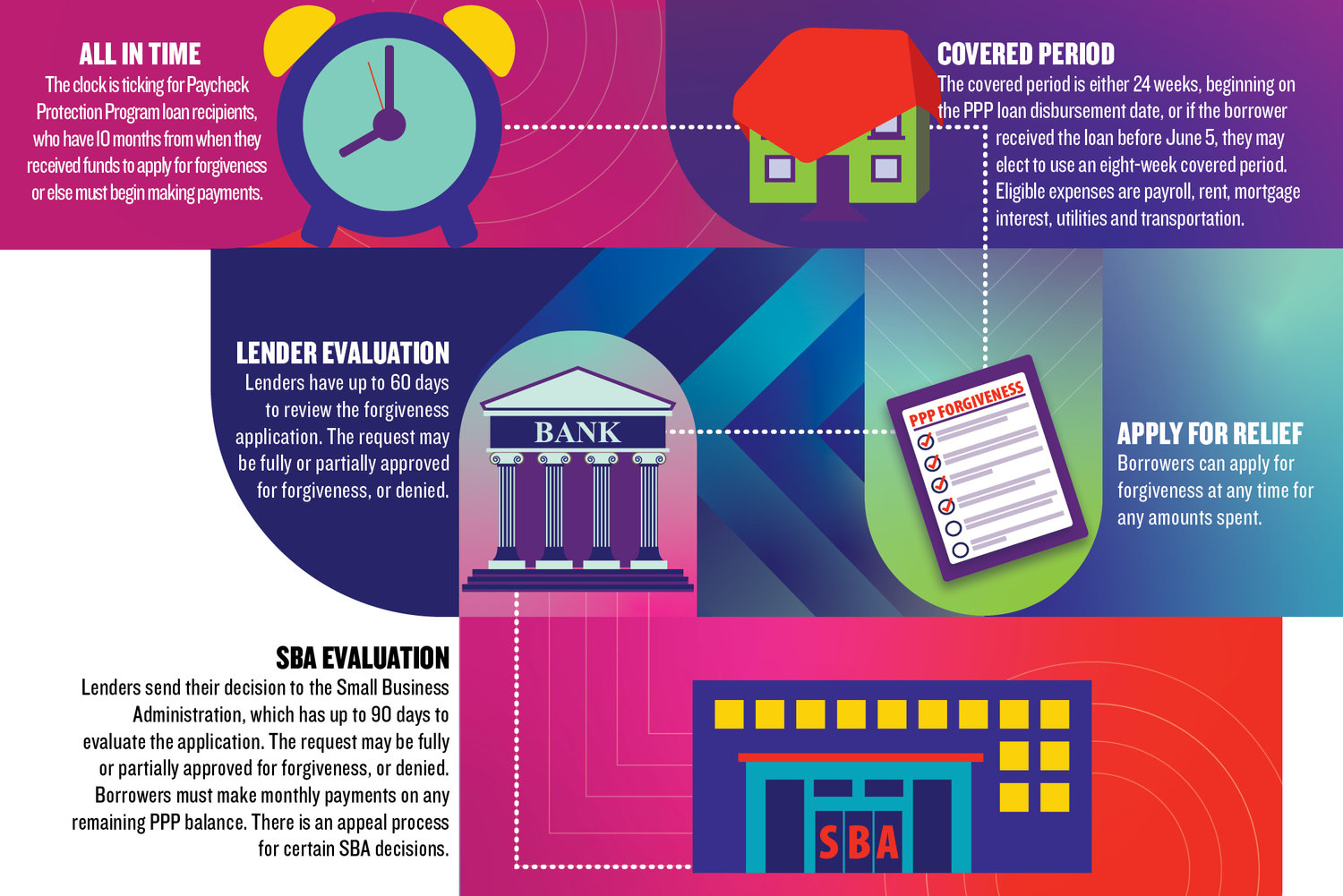

Asking For Forgiveness Banks Note Application Uptick As Sba Begins Forgiving Ppp Loans Springfield Business Journal

Asking For Forgiveness Banks Note Application Uptick As Sba Begins Forgiving Ppp Loans Springfield Business Journal

Https Www Bkd Com Sites Default Files 2020 08 Important New Details On Ppp Loan Forgiveness Pdf

Understanding The Updated Ppp Loan Criteria Trilogy

Understanding The Updated Ppp Loan Criteria Trilogy

Partners Self Employment Income Now Qualifies As Payroll Costs For Ppp Loans Wilkinguttenplan

Partners Self Employment Income Now Qualifies As Payroll Costs For Ppp Loans Wilkinguttenplan

Ppp Forgiveness Apply Now Or Wait

Ppp Forgiveness Apply Now Or Wait

5 Minute Ppp Loan Application For 22 997 At 1 With Kabbage Sba Paycheck Protection Program Youtube

5 Minute Ppp Loan Application For 22 997 At 1 With Kabbage Sba Paycheck Protection Program Youtube

Do Owner Draws Count As Salary For The Paycheck Protection Program Bench Accounting

Do Owner Draws Count As Salary For The Paycheck Protection Program Bench Accounting

Covid 19 Business Planning Williams Keepers Llc

Pin On Coronovirus Business Tips

Pin On Coronovirus Business Tips

Ppp Eidl Eligibility For Foreign Owned U S Businesses

Ppp Eidl Eligibility For Foreign Owned U S Businesses

Sba Guidance Appears To Answer The Ppp Partnership Question Graydon Law

Sba Guidance Appears To Answer The Ppp Partnership Question Graydon Law

Paycheck Protection Program Ppp Frequently Asked Questions Christian Small

Paycheck Protection Program Ppp Frequently Asked Questions Christian Small

Paycheck Protection Program Round 2 Knowns Unknowns Rkl Llp

Paycheck Protection Program Round 2 Knowns Unknowns Rkl Llp

Post a Comment for "Do Guaranteed Payments Qualify For Ppp"