Upfront Payment Of Accrued Interest

First take your interest rate and convert it into a decimal. T-8 Accrued interest on valuation datereceive leg.

Bond Premium With Straight Line Amortization Accountingcoach

Bond Premium With Straight Line Amortization Accountingcoach

You would pay 3513180 in monthly payments.

Upfront payment of accrued interest. T-6 On valuation of interest rate swap on valuation date. The coupon table of a free-style bond. The receivable is consequently.

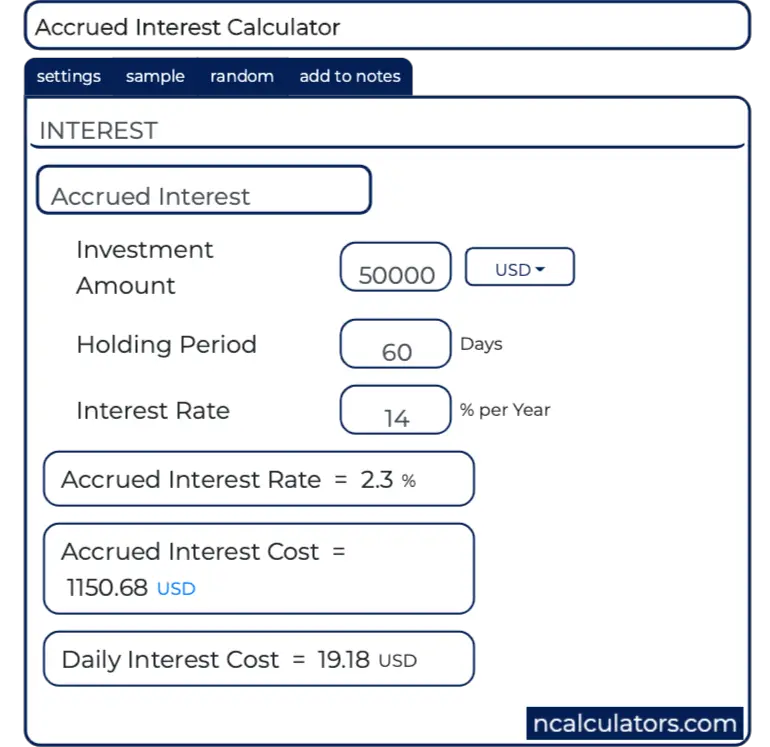

Interest is considered accrued when it is added to the balance on the account which accrues on loans such as a mortgage on savings accounts student loans and on other investments. Buyer pays clean price 2 36mm notional 720k Seller pays accrued of riskless coupon days 61360 36mm notional 100bp rate 61k Net buyer pays 659k. T-4 On receipt of upfront fee on purchase of interest rate swap trade.

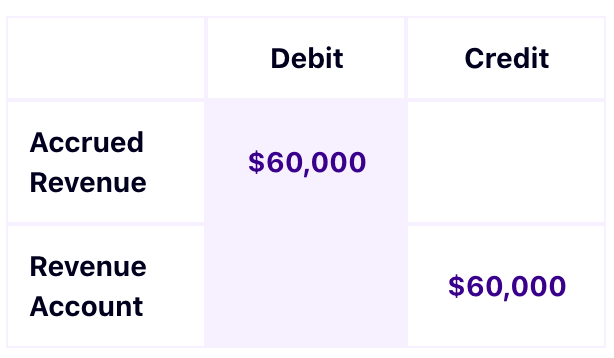

The amount of accrued interest for the party who is receiving payment is a credit to the interest revenue account and a debit to the interest receivable account. In many cases advance payments protect the seller against nonpayment in case the buyer doesnt come and pay at the time of delivery. Consider it a big financial win.

When converting between clean points and dirty fee the converter follows CDSW in making the simplifying. Paying a little more toward your loan may reduce your total loan cost. Reset the interest rate for the floating leg.

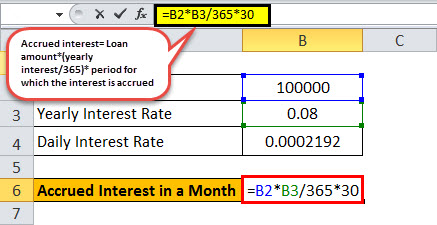

For example 7 would become 007. T-9 On reversal of accrued. Advance payments are made before receiving a good or service.

Effective date maturity date principal coupon rate. Interest payable accounts also play a role in note payable situations. Say you want to borrow 100 at 10 per annum.

On January 1 2016. T-7 Accrued interest on valuation datepay leg. The lender gives you only 90 100 minus the 10 for the interest.

The current interest rate is 10. By paying for the accrued interest in your purchase you provide the money to pay off the sellers accrued interest. T-7 Accrued interest on valuation datepay leg.

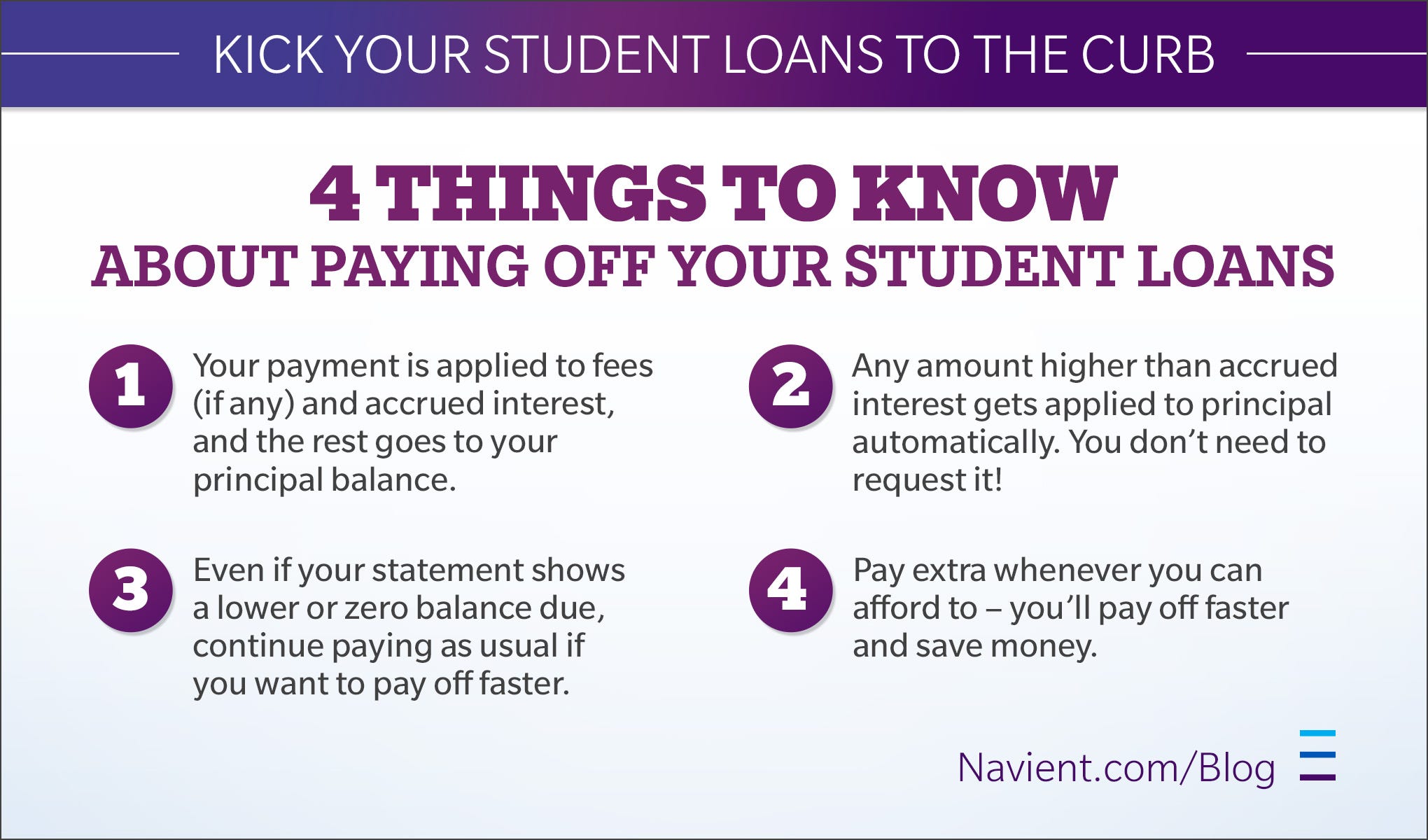

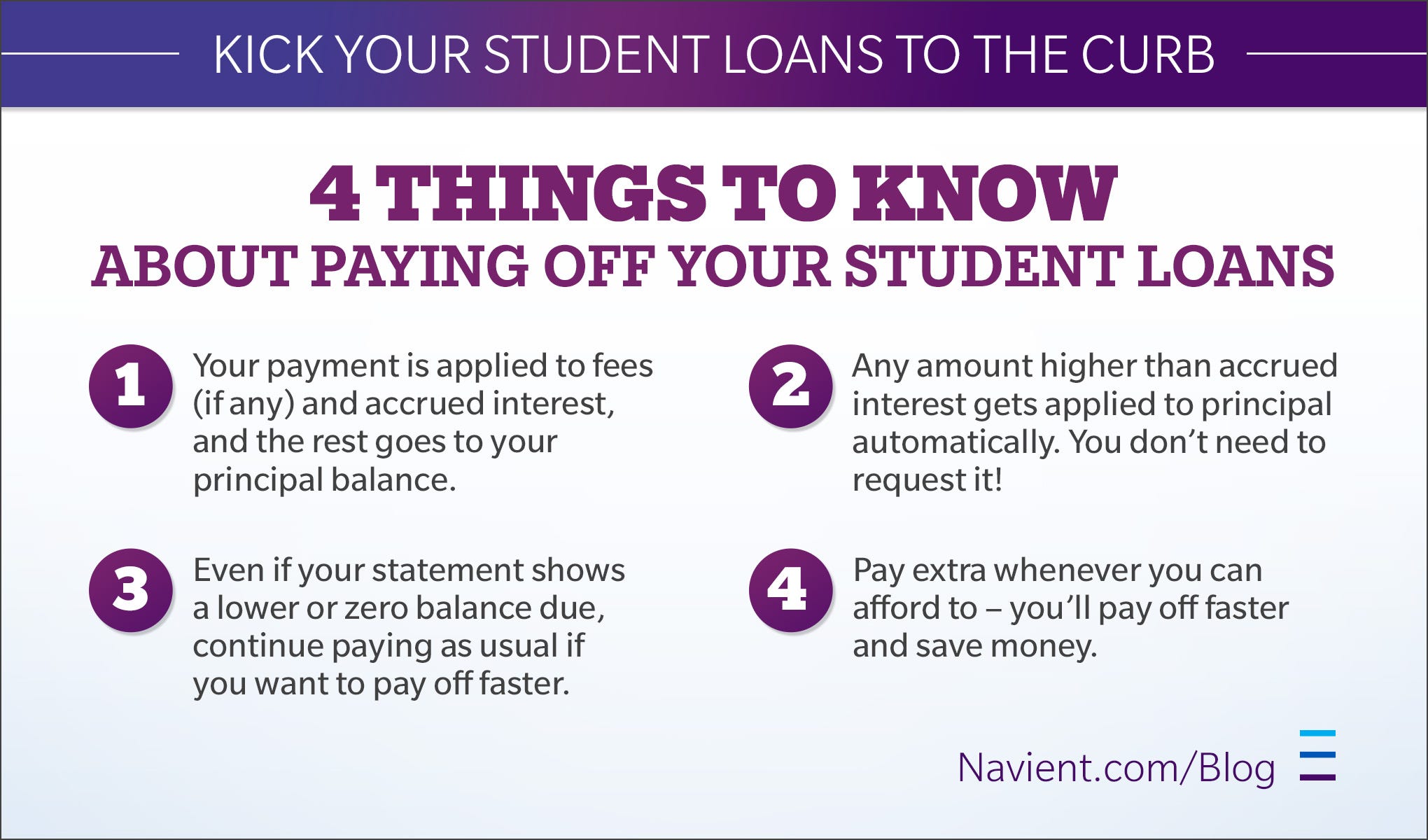

This payment represents the coupon payment that is part of the bond. Account for the upfront fee premium on the trade Pay or receive the upfront fee for the trade. That is your payment is first applied to interest you accrued since your last payment and then your principal.

Double-check your lenders payment policies to make sure any extra payments are really going to pay down your principal. Then you pay 100 back in equal monthly installments over the course of the year. Throw in the 10 down payment and the car costs 38497.

It has four columns. The type of accrued interest payment takes two values. T-4 On payment of upfront fee on purchase of interest rate swap trade.

For example XYZ Company purchased a computer on January 1 2016 paying 30000 upfront in cash and with a 75000 note due on January 1 2019. T-5 On reversal of existing net present value of interest rate swap on valuation date. Suppose the CDS from Table 1 is quoted at 2 points upfront.

Reverse the accrued interest on pay leg on. Account for accrued interest on receive leg on valuation date. Since the payment of accrued interest is generally made within one year it is classified as a current asset or current liability.

Every dollar you pay right now will pay off any interest accrued prior to March 13 2020 and then go directly to reduce your principal student loan balance. See how accrued interest could affect your loan balance. It might mean a type of loan where you pay the interest in advance upfront and then pay the balance over time.

Even if youre not currently making loan payments interest continues to accrue grow. The accrued interest adjustment on a bond is the amount paid which is equal to the balance of interest that has accrued since the last payment date of the bond. Any other extra payments made throughout the month are treated as normal payments.

T-9 On reversal of accrued. If you have a CD with a term of 12 months of less you do not report the earnings until you receive the interest. The accrued interest on a CD represents the amount of interest that you have earned to date although you do not typically receive the interest until the CD term ends.

Account for accrued interest on pay leg on valuation date. So you pay taxes in the year you receive the money even if you actually accrued most of the interest during the prior year. The borrowers entry includes a debit in the interest expense account and a credit in the accrued interest payable account.

T-5 On reversal of existing net present value of interest rate swap on valuation date. 1 pay accrued interest of premium upon default 2 pay no accrued interest of premium up on default. T-8 Accrued interest on valuation datereceive leg.

On the next payment date youll receive the full interest amount which makes. Next figure out your daily interest rate also known as the periodic rate by dividing this by 365. T-6 On valuation of interest rate swap on valuation date.

The monthly payment on a five-year loan for 30287 at 6 interest would be 58553.

Accrual Vs Deferral Top 6 Best Differences With Infographics

Accrual Vs Deferral Top 6 Best Differences With Infographics

Accrued Interest Vs Regular Interest Overview Differences Examples

Accrued Interest Vs Regular Interest Overview Differences Examples

Accrued Revenue Definition Examples Chargebee Glossaries

Accrued Revenue Definition Examples Chargebee Glossaries

How To Record Accrued Interest Calculations Examples

How To Record Accrued Interest Calculations Examples

What Is This Option Offering Me On My Loan Repayment Personal Finance Money Stack Exchange

What Is This Option Offering Me On My Loan Repayment Personal Finance Money Stack Exchange

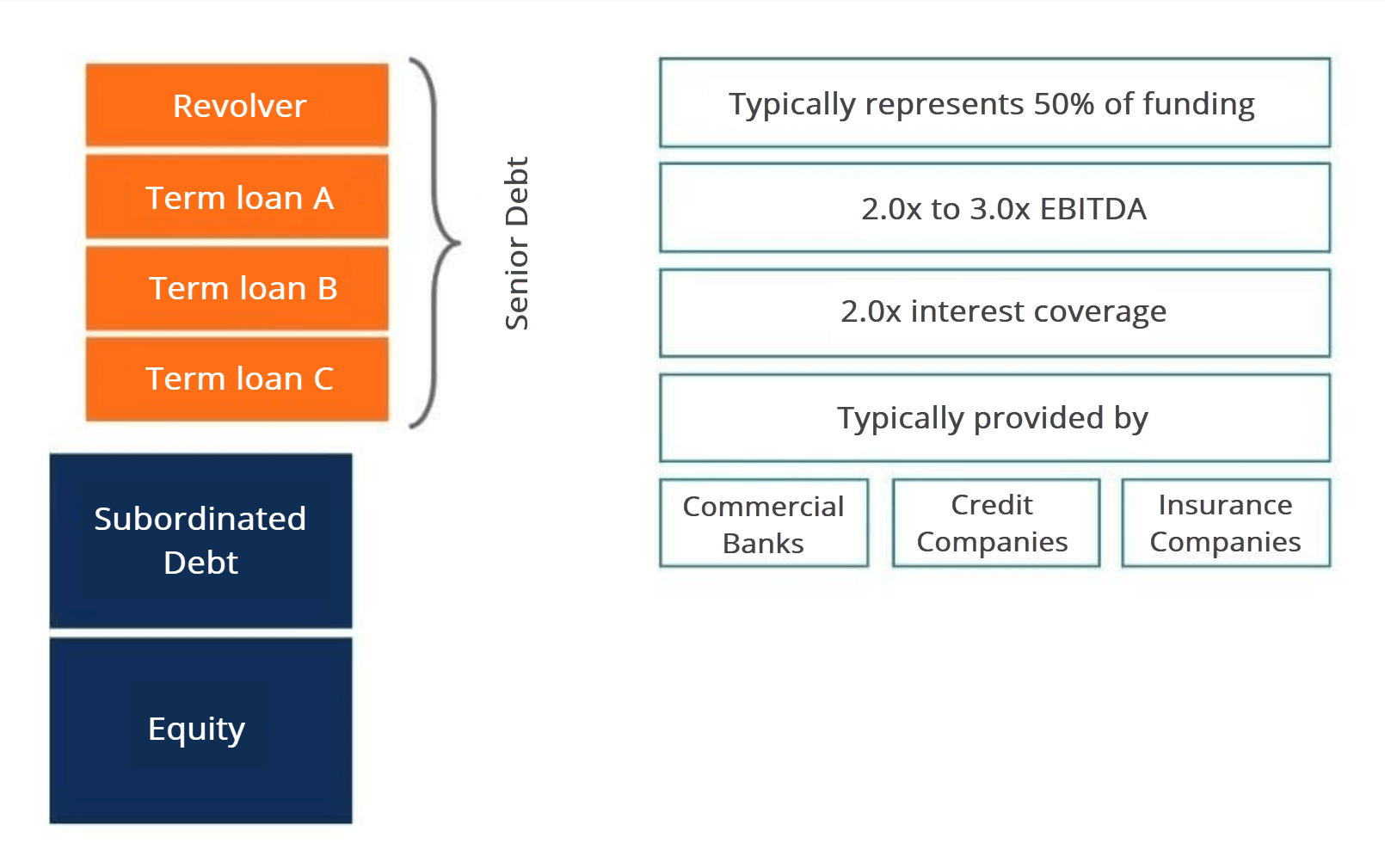

Senior And Subordinated Debt Learn More About The Capital Stack

Senior And Subordinated Debt Learn More About The Capital Stack

Florida Prompt Payment Act What Contractors Need To Know

Florida Prompt Payment Act What Contractors Need To Know

Utah Prompt Payment In Construction Faqs Guide Forms Resources

Utah Prompt Payment In Construction Faqs Guide Forms Resources

Borrower Question How Do I Pay Toward The Principal Of My Student Loan By Navient Medium

Borrower Question How Do I Pay Toward The Principal Of My Student Loan By Navient Medium

Tennessee Prompt Payment Act Faqs Guide Forms Resources

Tennessee Prompt Payment Act Faqs Guide Forms Resources

Notes Payable Principlesofaccounting Com

Notes Payable Principlesofaccounting Com

Texas Prompt Payment Act What Contractors Need To Know

Texas Prompt Payment Act What Contractors Need To Know

Accrued Interest Formula Calculate Monthly Yearly Accrued Interest

Accrued Interest Formula Calculate Monthly Yearly Accrued Interest

The Us Prompt Payment Act A Guide For Construction

The Us Prompt Payment Act A Guide For Construction

Is Mortgage Interest Paid In Advance

Is Mortgage Interest Paid In Advance

Loan Note Payable Borrow Accrued Interest And Repay Principlesofaccounting Com

Loan Note Payable Borrow Accrued Interest And Repay Principlesofaccounting Com

5 Types Of Private Mortgage Insurance Pmi

Post a Comment for "Upfront Payment Of Accrued Interest"