Payment Schedule For Home Equity Loan

Multiply the number of years in your loan term by 12 the number of months in a year to get the number of payments for your loan. Our rate table lists current home equity offers in your area which you can use to find a local lender or compare against other loan options.

How To Use A Heloc To Pay Off Your Mortgage Faster Heloc Mortgage Home Equity Line

How To Use A Heloc To Pay Off Your Mortgage Faster Heloc Mortgage Home Equity Line

Home Mortgage Calculators HELOC Home Equity Line of Credit Payment Calculator HELOC Payment Calculator This HELOC calculator is designed to help you quickly and easily calculate your monthly HELOC payment per your loan term current interest rate and remaining balance.

Payment schedule for home equity loan. Adjustable rates and entering the repayment phase of the loan. This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments. Simply input your loan amount interest rate loan term and repayment start date then click Calculate.

Leverage Your Home Equity Today. If you havent already paid off your first mortgage a home equity loan or second mortgage is paid every month on top of the mortgage you already pay hence the. Usually you will repay your loan on a monthly basis and your loan is paid in full when the term ends.

Repaying a Home Equity Line of Credit HELOC requires payment to the lender which typically includes both repayment of the loan principal plus monthly interest on the outstanding balance. The payment amount includes both principal and interest minimum of 100. From the loan type select box you can choose between HELOCs and home equity loans of a 5 10 15 20 or 30 year duration.

5yr60 10yr120 15yr180 20yr240 months. HELOC payments tend to get more expensive over time. Leverage Your Home Equity Today.

It also determines out how much of your repayments will go towards the principal and how much will go towards interest. An installment loan is a loan that a bank has amortized over regular equal payments. All fields are required.

Input how much you want to borrow how much your home is worth your current mortgage balance and your credit location and well do the rest. Home Equity Line of Credit. See rates below Your Monthly Payment.

Our rate table lists current home equity offers in your area which you can use to find a local lender or compare against other loan options. A home equity loan also known as a second mortgage term loan or equity loan is when a mortgage lender lets a homeowner borrow money against the equity in his or her home. The minimum amount you will need to pay each month does not include any payments for the Fixed-Rate Loan Payment Option.

Use our free HELOC payment calculator to easily find your monthly payments on any home equity line. There are two reasons for this. Enter your home equity loan amount.

One key difference between a home equity loan and a traditional mortgage is that the. Leverage Your Home Equity Today. Since these are usually fixed-rate loans repaid on a regular schedule all you have to do is enter your loan amount interest rate and length of the loan and the calculator will provide your monthly payments.

From the loan type select box you can choose between HELOCs and home equity loans of a 5 10 15 20 or 30 year duration. Some HELOCs allow you to make interest-only payments for a defined period of time after which a repayment period begins. Mortgages and home equity loans are both loans for which the borrower pledges the property as collateral.

Our rate table lists current home equity offers in your area which you can use to find a local lender or compare against other loan options. Most mortgages auto loans and personal loans are installment loans. You can also use the calculator to see payments for a fixed rate home equity loan.

For example a 30-year fixed mortgage would have 360 payments. More precisely its a loan with a fixed interest rate fixed monthly payment and a fixed duration. It shows payments for a HELOC with a principal and interest draw period or an interest only draw period.

The APR is variable and is based upon an index plus a marginThe APR will vary with Prime Rate the index as published in the Wall Street Journal. Rates may vary due to a change in the Prime Rate a credit limit below 100000 a loan-to-value LTV above. On the calculator click on the Payment button then choose fixed-rate loan under Payment option.

Refinancing your HELOC into a Home Equity Loan. The monthly required payment is based on your outstanding loan balance and current interest rate interest rates can increase or decrease and may vary each month. MONTHLY PAYMENT CALCULATOR Use our home equity loan calculator to find a rate and monthly payment that fits your budget.

Search For Home Equity Loan Payment Schedule Current 5 Year Arm Mortgage Rates Wife Not On Mortgage Zillow Home Loan Interest Rates Wings Mortgage Rates Will I Prequalify For A Mortgage What Is A Fha Mortgage Loan Zero Money Down Home Loan What Is Taking A Second Mortgage Will The Military Pay My Mortgage Yahoo Mortgage Rates. From the loan type select box you can choose between HELOCs and home equity loans of a 5 10 15 20 or 30 year duration. Enter the number of months to repay.

As of February 17 2021 the variable rate for Home Equity Lines of Credit ranged from 345 APR to 700 APR. Enter your estimated home equity rate APR. In some cases as with home equity lines of credit you might pay the interest only during the term of the loan and pay the full amount of borrowed funds when the loan term ends.

Home Equity Calculator For Excel Home Equity Loan Calculator Home Equity Amortization Schedule

Home Equity Calculator For Excel Home Equity Loan Calculator Home Equity Amortization Schedule

Second Mortgage Payment Calculator With Amortization Schedule Mortgage Payment Calculator Second Mortgage Mortgage Payment

Second Mortgage Payment Calculator With Amortization Schedule Mortgage Payment Calculator Second Mortgage Mortgage Payment

If You Want To Pay Off Your Mortgage Early In Five To Seven Years You Can Using A Simple Home Equity Line Of Cre Home Equity Line Line Of Credit Home Equity

If You Want To Pay Off Your Mortgage Early In Five To Seven Years You Can Using A Simple Home Equity Line Of Cre Home Equity Line Line Of Credit Home Equity

Financial Calculator Solves For Fv Pv Term Rate Payment Or Investment Amounts Create Amortization Schedule Mortgage Payment Calculator Interest Calculator

Financial Calculator Solves For Fv Pv Term Rate Payment Or Investment Amounts Create Amortization Schedule Mortgage Payment Calculator Interest Calculator

Want To Pay Off Your Home In Five To Seven Years You Have Come To The Right Place Replace Your Mortgage E Home Equity Line Home Equity Pay Off Mortgage Early

Want To Pay Off Your Home In Five To Seven Years You Have Come To The Right Place Replace Your Mortgage E Home Equity Line Home Equity Pay Off Mortgage Early

Home Equity Loan Process Underwriting Home Equity Loan Home Equity

Home Equity Loan Process Underwriting Home Equity Loan Home Equity

Home Refinance Mortgage Calculator Break Even Analysis And Amortization Schedule Mortgage Ref Refinance Mortgage Mortgage Refinance Calculator Home Refinance

Home Refinance Mortgage Calculator Break Even Analysis And Amortization Schedule Mortgage Ref Refinance Mortgage Mortgage Refinance Calculator Home Refinance

Should You Refinance Or Use A Home Equity Loan Freeandclear Refinance Mortgage Home Equity Loan Cash Out Refinance

Should You Refinance Or Use A Home Equity Loan Freeandclear Refinance Mortgage Home Equity Loan Cash Out Refinance

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Difference Between The Two Home Equity Loans Home Equity Loan Home Equity Home Equity Line

Difference Between The Two Home Equity Loans Home Equity Loan Home Equity Home Equity Line

Tumblr Home Equity Loan Calculator Mortgage Amortization Calculator Mortgage Payment Calculator

Tumblr Home Equity Loan Calculator Mortgage Amortization Calculator Mortgage Payment Calculator

Best Mortgage Payment Calculator Mortgage Payment Calculator Mortgage Payoff Refinance Mortgage

Best Mortgage Payment Calculator Mortgage Payment Calculator Mortgage Payoff Refinance Mortgage

Heloc Payment Calculator With Interest Only And Pi Calculations Home Improvement Loans Home Equity Loan Heloc

Heloc Payment Calculator With Interest Only And Pi Calculations Home Improvement Loans Home Equity Loan Heloc

Infographic How Can You Use Home Equity Reverse Mortgage Home Equity Mortgage Amortization Calculator

Infographic How Can You Use Home Equity Reverse Mortgage Home Equity Mortgage Amortization Calculator

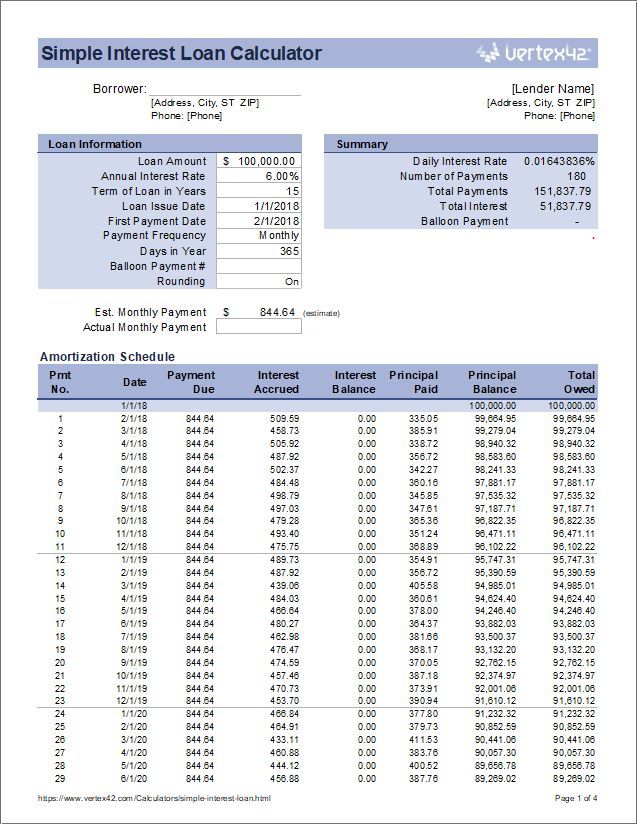

Download The Simple Interest Loan Calculator From Vertex42 Com Free Online Mortg Mortgage Amortization Mortgage Amortization Calculator Amortization Schedule

Download The Simple Interest Loan Calculator From Vertex42 Com Free Online Mortg Mortgage Amortization Mortgage Amortization Calculator Amortization Schedule

Home Equity Calculator For Excel Home Equity Loan Calculator Home Equity Loan Home Equity

Home Equity Calculator For Excel Home Equity Loan Calculator Home Equity Loan Home Equity

What Is The Difference Between A Home Equity Line Of Credit Heloc And A Second Mortgage Find Out The Key Differ Home Equity Line Second Mortgage Home Equity

What Is The Difference Between A Home Equity Line Of Credit Heloc And A Second Mortgage Find Out The Key Differ Home Equity Line Second Mortgage Home Equity

Park Bank Home Equity Ads On Behance Home Equity Home Equity Line Equity

Park Bank Home Equity Ads On Behance Home Equity Home Equity Line Equity

Download The Line Of Credit Calculator From Vertex42 Com Line Of Credit Home Equity Line Heloc

Download The Line Of Credit Calculator From Vertex42 Com Line Of Credit Home Equity Line Heloc

Post a Comment for "Payment Schedule For Home Equity Loan"