Irs Installment Payments Delayed

The IRS understands that many taxpayers face. The IRS has suspended the mailing of three notices the CP501 the CP503 and the CP504 that go to taxpayers who have a balance due on their taxes.

5 8 4 Investigation Internal Revenue Service

5 8 4 Investigation Internal Revenue Service

It states that the 1 million limit applies.

Irs installment payments delayed. Highlights of the key actions in the IRS People First Initiative include. You may even earn rewards points from your card. Your credit score could go down if you default on your installment agreement and the IRS reports a tax lien on your credit report.

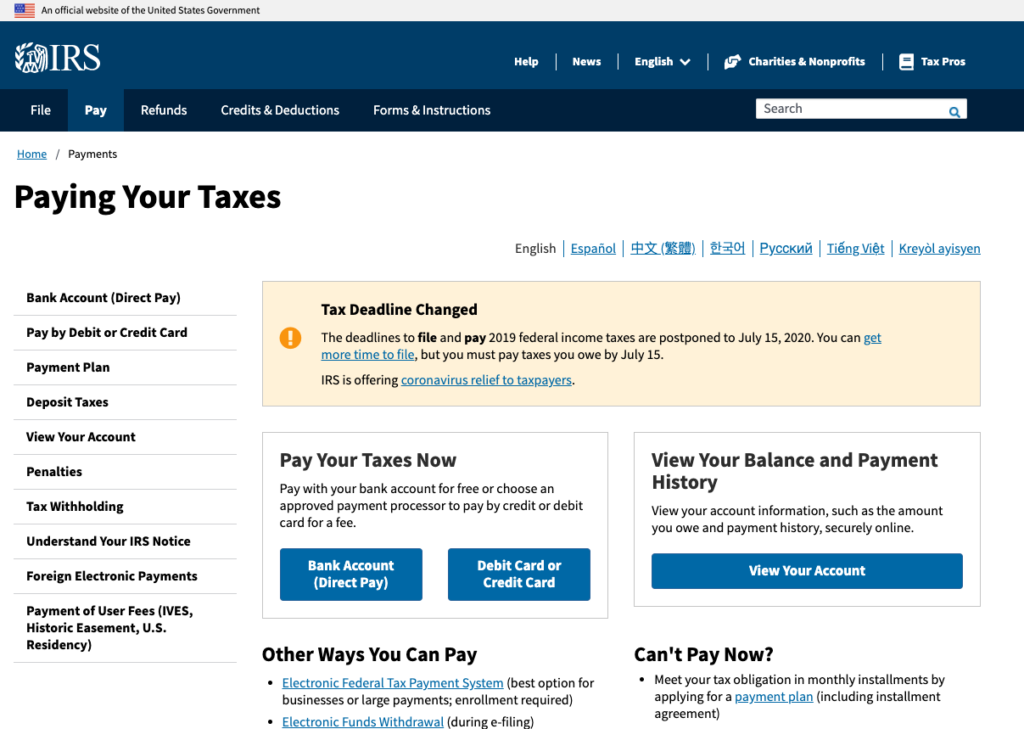

If youre not able to pay the tax you owe by your original filing due date the balance is subject to interest and a monthly late payment penalty. In updated guidance issued April 9 2020 the IRS said that anyone who still owed 2019 taxes or estimated Q1 or Q2 2020 taxes did not have to pay until July 15 2020. You have several options available if your ability to pay has changed and you are unable to make payments on your installment agreement or your offer in compromise agreement with the IRS.

965 h transition tax installment payments due April 15 are postponed until July 15 but June 15 estimated tax payments are not. By law the IRS may assess penalties to taxpayers for both failing to file a tax return and for failing to pay taxes they owe by the deadline. Its fast easy secure and your payment is processed immediately.

This option shouldnt be your first choice and. The new tax filing and payment. The failure-to-pay penalty is cut in half The interest rate on the IRS Installment Agreement drops to 025.

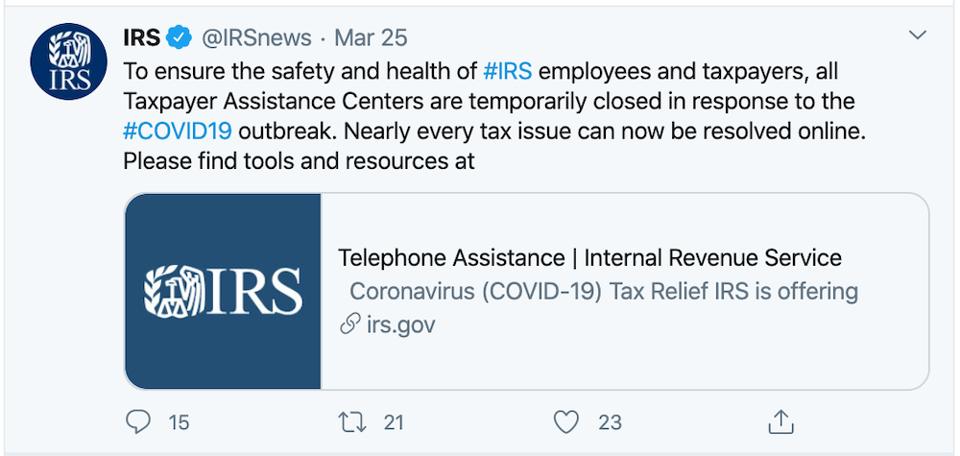

Taxpayers who are currently unable to comply with the terms of an Installment Payment Agreement including a Direct Debit Installment Agreement may suspend payments during this period if they prefer. This relief is effective through the filing and payment deadline Wednesday July 15 2020. Theres also a penalty for failure to file a tax return so you should file timely even if you cant pay your balance in full.

The guidance specifies that individuals and corporations can defer payments including for self-employment taxes that were due April 15 until July 15. Options could include reducing the monthly payment to reflect your current financial condition. The IRS is easing paperwork requirements to allow individuals more flexibility to get non-streamlined Installment Agreements up to 250000 without financial verification if their case is not yet assigned to a revenue officer.

Generally the IRS will only agree to an OIC if they determine they will not be able to collect the amount due within a reasonable period of time. Interest and failure-to-pay penalties continue to accrue until the total outstanding tax balance is paid in full. Hundreds of thousands of taxpayers have already entered into installment agreements with the IRS.

In these agreements people agree to pay unpaid and overdue taxes over a period of time. Due to COVID-19 the IRS People First Initiative provides relief to taxpayers on a variety of issues from easing payment guidelines to delaying compliance actions. Taxpayers who qualify for a short-term payment plan option may now receive up to 180 days to pay back the money instead of the usual 120 days.

Installment agreements are not reported on your credit report. Official Payments makes it easy to pay IRS 1040 taxes Installment Agreements Prior Year and other federal taxes using your favorite debit or credit card. The answers clarify that only payments that are actually due on April 15 are delayed.

For taxpayers under an existing Installment Agreement payments due between April 1 and July 15 2020 are suspended. Prior to approving your request to delay collection we may ask you to complete a Collection Information Statement Form 433-F PDF Form 433-A PDF or Form 433-B PDF. Existing Installment Agreements Under an existing Installment Agreement payments due between April 1 and July 15 2020 are delayed.

Existing Installment Agreements For taxpayers under an existing Installment Agreement payments due between April 1 and. The IRS is extending the short-term payment plan timeframe to 180 days normally 120 days. Call the IRS immediately at 1-800-829-1040.

If we determine that you cannot pay any of your tax debt we may report your account currently not collectible and temporarily delay collection until your financial condition improves. Being currently not collectible does not mean the debt goes away it means the IRS has determined you cannot afford to pay the debt at this time. Interest Rate with an Installment Agreement.

The IRS is suspending the requirement that taxpayers make their payments under these agreements during April 1 2020 through July 15 2020. Existing Installment Agreements For taxpayers under an existing Installment Agreement payments due between April 1 and July 15 2020 are suspended. Therefore first quarter 2020 estimated income tax payments and Sec.

Unlike a late credit card payment a late installment agreement payment will not count against your credit score as a late payment. Although the IRS continues to make significant reductions in the backlog of unopened mail that developed while most IRS operations were closed due to COVID-19 this temporary adjustment to processing is intended to lessen any possible confusion that might be associated with delays in processing correspondence received from taxpayers. The IRS will not default any Installment Agreements during this period.

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

Topic No 152 Refund Information Internal Revenue Service

Irs Will Expand Resolution Options To Help With Tax Bills During Covid

Irs Will Expand Resolution Options To Help With Tax Bills During Covid

Irs Allows Faxed Tax Refund Claims Here S How

Irs Allows Faxed Tax Refund Claims Here S How

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Instructions For Form 9465 10 2020 Internal Revenue Service

Instructions For Form 9465 10 2020 Internal Revenue Service

Owe The Irs But Can T Afford To Pay You Are Not Alone Here S What To Do About It

Owe The Irs But Can T Afford To Pay You Are Not Alone Here S What To Do About It

Https Www Irs Gov Pub Irs Prior F9325 1994 Pdf

3 13 2 Bmf Account Numbers Internal Revenue Service

3 13 2 Bmf Account Numbers Internal Revenue Service

Irs Payment Options How To Make Your Payments

Irs Payment Options How To Make Your Payments

Covid 19 The Irs Goes Easy On Taxpayers Who Owe Back Taxes

Covid 19 The Irs Goes Easy On Taxpayers Who Owe Back Taxes

Irs Tax Payment Plans Installments Or Offer In Compromise

Irs Tax Payment Plans Installments Or Offer In Compromise

Irs Continues To Limit Operations Due To Coronavirus Crisis But Will Still Issue Tax Refunds

Irs Continues To Limit Operations Due To Coronavirus Crisis But Will Still Issue Tax Refunds

Https Www Irs Gov Pub Notices Cp521 English Pdf

3 12 38 Bmf General Instructions Internal Revenue Service

3 12 38 Bmf General Instructions Internal Revenue Service

3 10 73 Batching And Numbering Internal Revenue Service

3 10 73 Batching And Numbering Internal Revenue Service

Internal Revenue Bulletin 2020 53 Internal Revenue Service

Internal Revenue Bulletin 2020 53 Internal Revenue Service

3 30 123 Processing Timeliness Cycles Criteria And Critical Dates Internal Revenue Service

3 30 123 Processing Timeliness Cycles Criteria And Critical Dates Internal Revenue Service

20 1 2 Failure To File Failure To Pay Penalties Internal Revenue Service

20 1 2 Failure To File Failure To Pay Penalties Internal Revenue Service

Post a Comment for "Irs Installment Payments Delayed"