How To Treat Credit Card Payments In Quickbooks

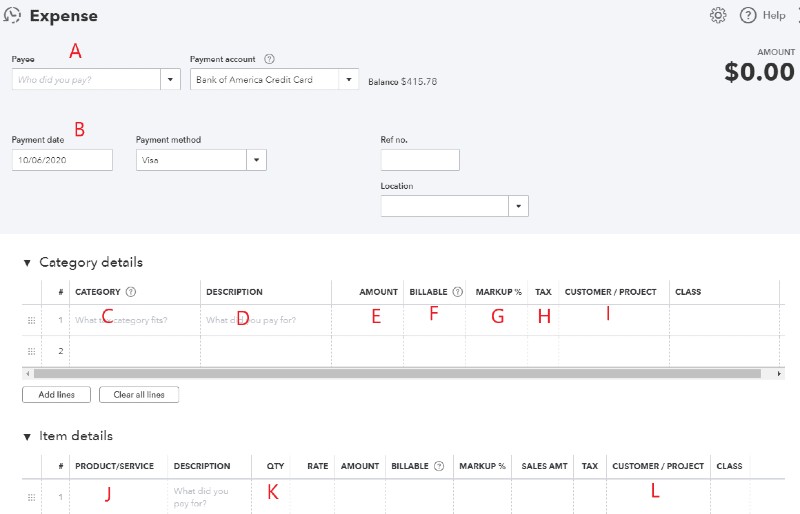

There are four basic steps to enter a credit card refund in QuickBooks Online. 3 Enter the details of your purchase.

Enter the amount of your payment.

How to treat credit card payments in quickbooks. On the Account dropdown select your credit card account. QuickBooks Online treats Credit Card Account transactions as cash transactions for cash-basis statements. Select the account you will be using to pay for your credit card charges not the credit card account you are paying.

Its simply a place to record credit card payments as you receive them. We are working in module nine and were talking about working with credit cardsWeve already talked about how to set up those credit card accounts in the Chart of AccountsWe learned how to enter the credit card transactions. Select Credit card credit in the Vendors column.

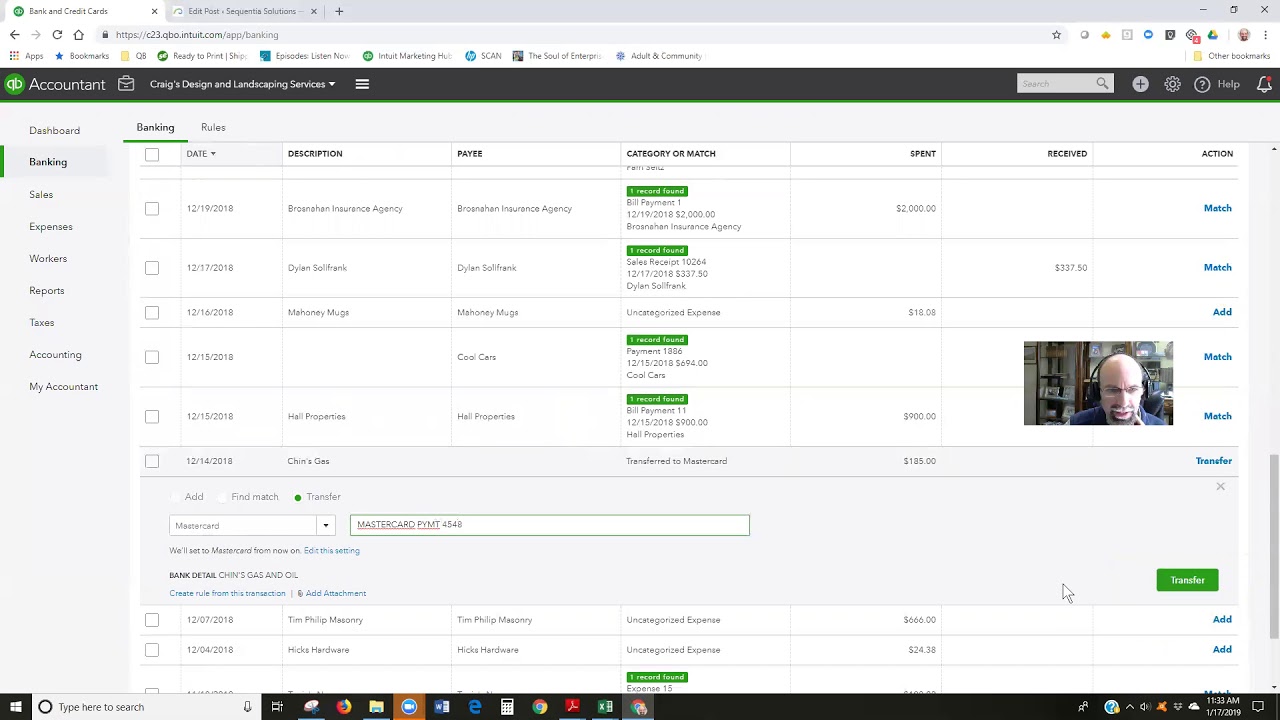

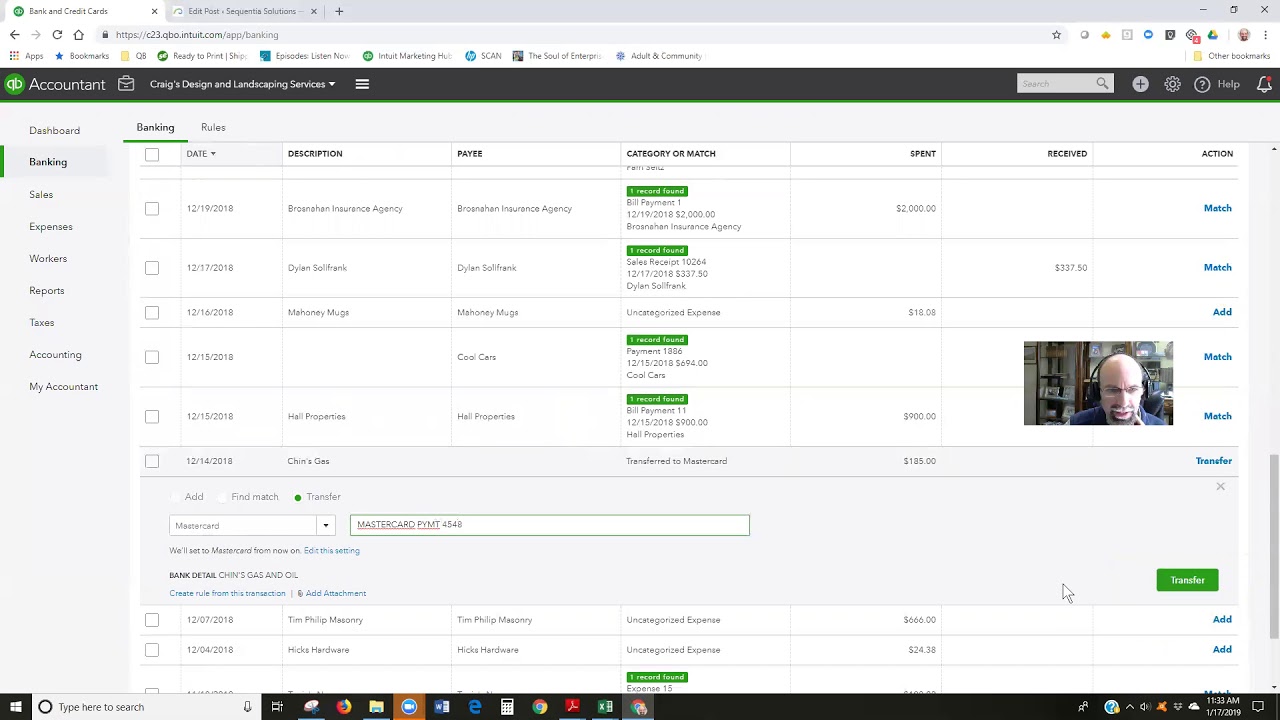

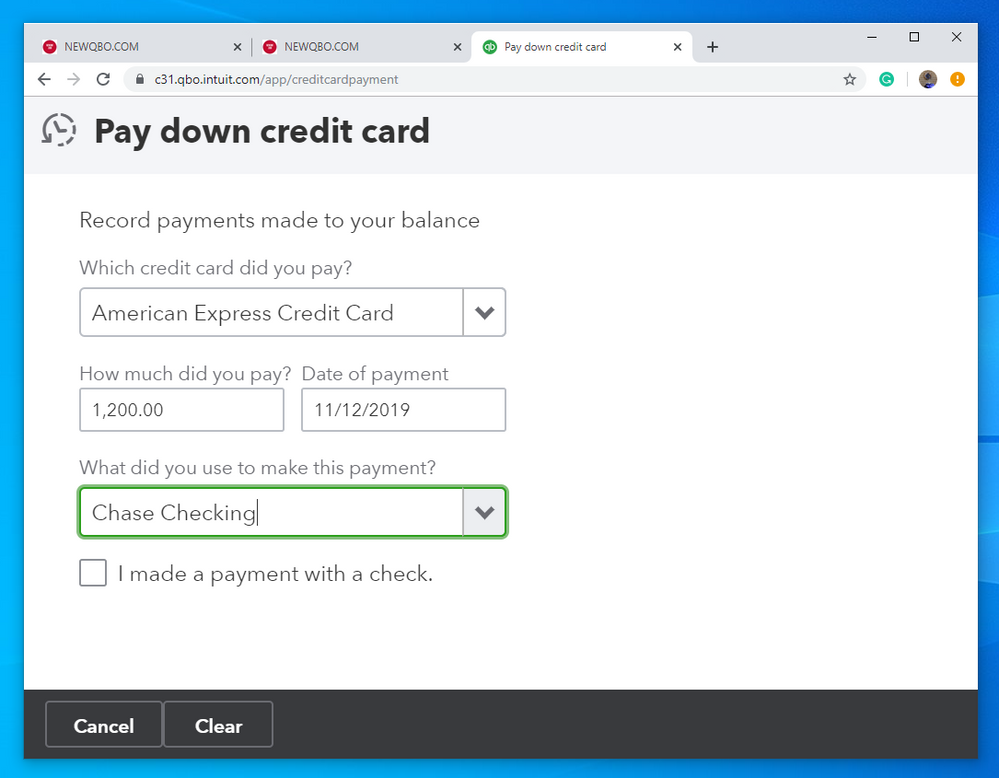

Under Money Out if youre in Business view or Other if youre in Accountant view select Pay down credit card. In the Banking transactions in QBO in his checking account window we see the downloaded transaction reflecting the payment he made to his Am Ex credit card account. Pay down a credit card.

The word cash is not meant literally. Input the credit transaction information. Select the bank account you want to use for paying the credit card from the Bank account dropdown.

You might be prompted to add a credit card account to QuickBooks. Enter your QuickBooks and choose banking from the menu bar on the left. 5 When you receive the credit card bill create a bill in QuickBooks Online.

First heres how to accept credit card payments in QuickBooks using the native QuickBooks software. Enter the date of the payment. Another treatment of credit card transactions is when you make payment or shop online from a merchant store and are being charged the transaction value upon successful order the accounting treatment is to CR your Credit Card account and DR your inventory account for online purchases or DR and expenses account.

You can just record sales receipt transactions when the credit card company deposits net charges amounts in your bank account. You put the charges on your card in each of the credit card accounts. As for Quickbooks credit card payment how to record please follow the steps below.

2 Choose the supplier and then select the credit card account. Use the QuickBooks Help command to search QuickBooks online help for the topic recording a credit card payment. Its not a real bank account.

Then from the bank account that you use to pay a particular card write the payment and in the category field you put the credit card account name. FREE QuickBooks 2019 Video Course. The offset transaction will thrn appear in that particular credit card account as a payment against the balance.

Select the date of your payment. About Alicia Katz Pollock. It also covers payments by check credit card barter etc.

4 Once done click Save and close. Treating credit card charges as cash-basis transactions is the conservative approach that fits the majority of our customers. Bctt tweetThe best method for entering credit card payments in QuickBooks Online is to use Transfers username5MinBookkeeping Recording payments to a credit card account as transfers.

Click on the New button at the top of the left menu bar. Select the Expenses tab. You might be prompted to add a credit card account to QuickBooks.

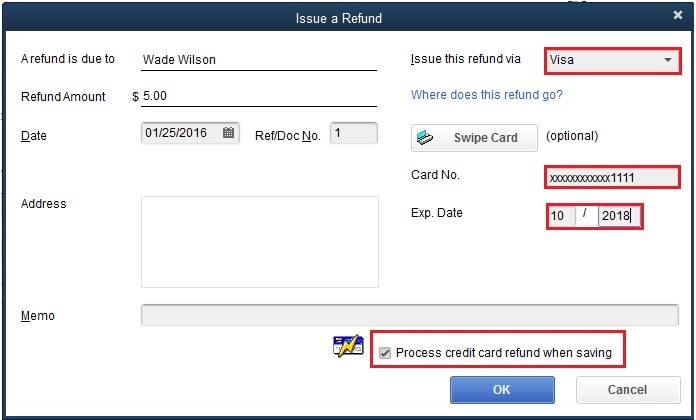

This is the main way to record your credit card payments in QuickBooks. To enter a credit card payment from the Sales Receipt or Receive Payment page. You can enter a credit card payment from the Sales Receipt Receive Payment or Invoice pages.

Select the name of your credit card company from the Pay to the order of dropdown. Chris paid his Am Ex credit card bill online through his credit card web portal using his banks checking account. If you have QuickBooks Payments you can do more than just track your accounting - you can process customer payments tooWith QuickBooks Payments you can accept credit card debit and ACH bank transfers for invoices you send and sales you make.

Learn how to accept and take customer payments from any QuickBooks products. You can either enter a credit card payment by following the reconciliation step above and clicking the Write a check for payment now option at the end or you can go straight to the Write Checks icon on the Home page. 7 Under the Account details select the credit card account.

Now every time you receive a credit card payment deposit it right away to the Credit Card Clearing account. From the top side of the screen click on banking and select the bank account you want to use. The Bad Accountants Way.

Select the credit card you made the payment to. If youve already entered the bill in QuickBooks before sending the payment always recommended then you should use the Pay Bills option. Several ways You can use the Vendors Pay Bills option and also the Banking Write Checks option depending on if youve entered the bill previously or not.

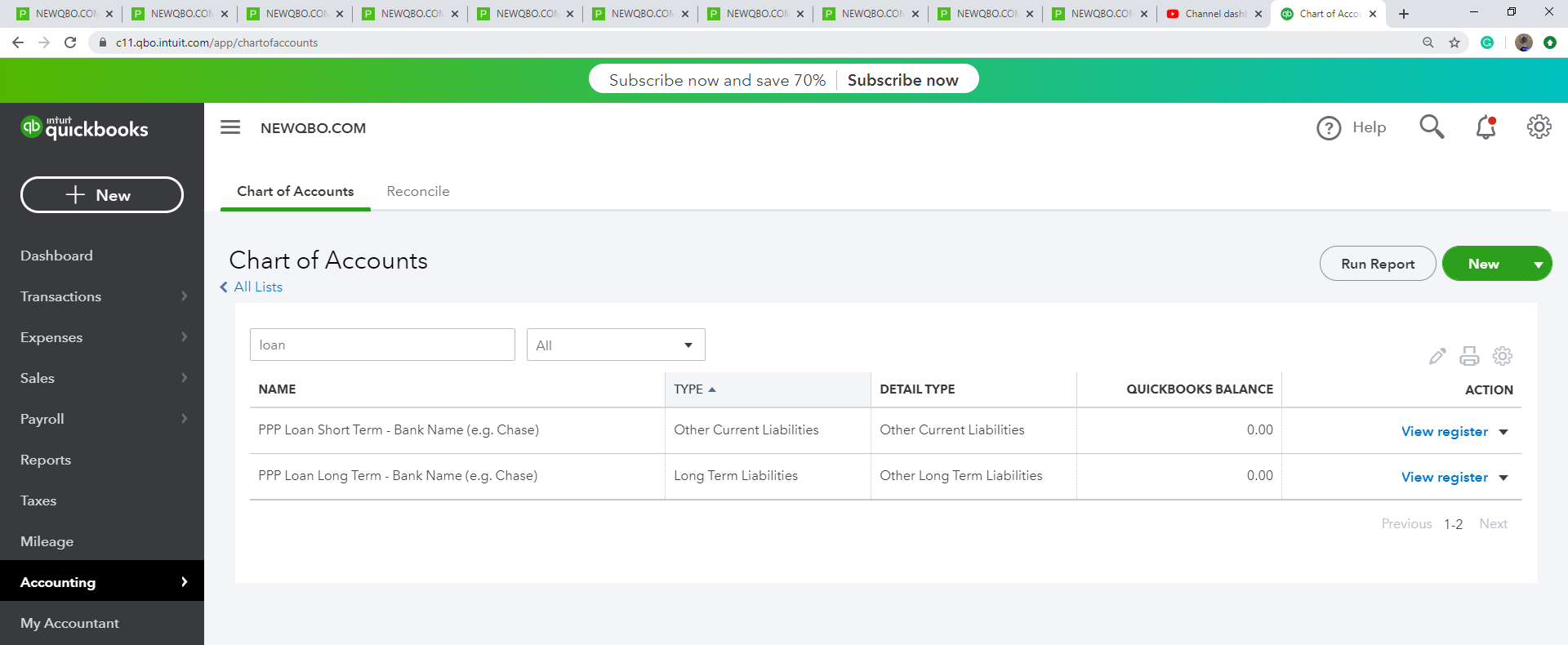

Use the QuickBooks Online Banking feature and automatically download your credit card charges and payments directly into your QuickBooks data file. Create a New Other Income Account Any cashback or statement credits you get on your credit cards go here. 6 In the supplier drop-down list select the bank institution.

From the menu bar select Banking Enter Credit Card Charges. Solution to Simplify Credit Card Deposits Create a bank account in QuickBooks called Credit Card Clearing. Select the desired credit card transaction from the options and click on the radio button to change it from add to transfer.

It classifies the refund as Income but it still stays outside your Gross Receipts so it doesnt impact your revenue analysis. Enter the payment amount.

How To Enter Credit Card Transactions In Quickbooks Online

How To Enter Credit Card Transactions In Quickbooks Online

Top Payment Processors That You Really Need For Your Online Business In 2020 Online Business Merchant Account Quickbooks Integration

Top Payment Processors That You Really Need For Your Online Business In 2020 Online Business Merchant Account Quickbooks Integration

Void Or Refund Customer Payments In Quickbooks Des

Void Or Refund Customer Payments In Quickbooks Des

Learn Quickbooks Pro 2014 Training Tutorial Course Quickbooks Quickbooks Pro Training Tutorial

Learn Quickbooks Pro 2014 Training Tutorial Course Quickbooks Quickbooks Pro Training Tutorial

How To Record Credit Card Payments In Quickbooks Online Youtube

How To Record Credit Card Payments In Quickbooks Online Youtube

How To Record Credit Card Payments In Quickbooks Online 5 Minute Bookkeeping

How To Record Credit Card Payments In Quickbooks Online 5 Minute Bookkeeping

Are You Facing 6190 And 816 Error In Quickbooks Don T Know How To Fix It Don T Worry We Are Providing The Easy Steps To Recover Quickbooks Coding Error Code

Are You Facing 6190 And 816 Error In Quickbooks Don T Know How To Fix It Don T Worry We Are Providing The Easy Steps To Recover Quickbooks Coding Error Code

Quickbooks Tutorial The Chart Of Accounts Intuit Training Lesson 1 9 Quickbooks Chart Of Accounts Quickbooks Tutorial

Quickbooks Tutorial The Chart Of Accounts Intuit Training Lesson 1 9 Quickbooks Chart Of Accounts Quickbooks Tutorial

Accounting For Credit Card Transactions In Quickbooks What May Seem Easier Is Harder Diving Into The Details

Find Out How To Record A Deposit In This Final Video On How To Do Accounts Receivable In Quickbooks Http Www Bookk Accounts Receivable Quickbooks Accounting

Find Out How To Record A Deposit In This Final Video On How To Do Accounts Receivable In Quickbooks Http Www Bookk Accounts Receivable Quickbooks Accounting

Quickbooks Quickbooks Quickbooks Help Quickbooks Payroll

Quickbooks Quickbooks Quickbooks Help Quickbooks Payroll

Realistic Credit Card Design Template With A Chip Frontside View Mock Up Illustrated Vector Geen Color Credit Card Design Card Design Design Template

Realistic Credit Card Design Template With A Chip Frontside View Mock Up Illustrated Vector Geen Color Credit Card Design Card Design Design Template

Post a Comment for "How To Treat Credit Card Payments In Quickbooks"