Can You Negotiate Irs Payment Plan

The most widely used method for paying an old IRS debt is the monthly installment agreement or IA. OPA is quick and has a lower user fee compared to other application methods.

What If I Can T Pay My Taxes A Step By Step Guide The Question What If I Can T Pay My Taxes Is A Tough One To A Filing Taxes Tax Memes

What If I Can T Pay My Taxes A Step By Step Guide The Question What If I Can T Pay My Taxes Is A Tough One To A Filing Taxes Tax Memes

To calculate your minimum monthly payment the IRS divides your balance by the 72-month period.

Can you negotiate irs payment plan. This is done by filling out Form 9465 Installment Agreement Request. You may request a payment plan including an installment agreement using the OPA application. If you qualify for a short-term payment plan you will not be liable for a user fee.

You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame. A payment plan is an agreement with the IRS to pay the taxes you owe within an extended timeframe. You must also indicate a desired monthly payment amount.

The Partial Payment Installment Agreement PPIA lets you pay your IRS tax debt in monthly installments for a specified amount of time. Make sure you are eligible. A Partial Payment Installment Agreement PPIC is just an Installment Agreement where the IRS has agreed to accept less than the full amount owed.

You must pay at least the minimum monthly payment but you are welcome to pay more than that amount. If the terms of the negotiation arent in their favor you could very well be denied of a payment plan. If you owe a few tens of thousands that could end up being a burden to pay each month.

While this is a major drawback from a negotiating perspective we were able to use this to our advantage. One newer IRS program allows you to pay your tax debt in low monthly installments. The IRS will not agree to a PPIC unless it is clear the monthly payments you can make will not cover your total taxes due over a course of many years.

The taxpayer has to come up with a payment plan then the IRS can choose to accept it or not. A taxpayer must file all required tax returns first before the IRS can consider a settlement offer. In some cases you can negotiate with the IRS directly to formulate a payment plan.

You can apply for an installment agreement online over the phone or via various IRS forms. If you dont negotiate another payment plan this amount is the default minimum. The monthly payment you offer should be equal to or higher than what the IRS believes it can garner from you from a negotiated agreement that it initiates.

When negotiating with the IRS the end result is for the IRS to get their money. If you dont think you can meet these conditions bring in someone else to negotiate. The IRS has an Offer in Compromise Pre-Qualifier tool on IRSgov.

The longest repayment period it will negotiate is 24 months. The IRS will apply submitted payments to reduce taxes owed. You can choose to pay off your IRS installment agreement early or to pay more than the required monthly payment.

You can negotiate with the IRS yourself with a few conditions. The tool also provides an estimate of an acceptable offer amount. Once youve paid the installment payments as agreed your debt is forgiven even if you havent paid the entire balance owed.

The Offer in Compromise program is not for everyone. If you want to negotiate yourself learn IRS terminology about the repayment process. Taxpayers who owe more than 50000 can negotiate an installment plan but must submit Form 433-F.

You dont want to miss any important fees or filing deadlines during the process. To request a payment plan you must offer the IRS a minimum of 20 of what you owe and the balance within five months or five payments. The IRS usually wont require additional financial information to approve this plan.

A streamlined installment plan gives you 72 months about six years to pay. The financial information included in this document will be used to accept or reject your proposal. When applying for a settlement offer taxpayers may need to make an initial payment.

Meet your tax obligation in monthly installments by applying for a payment plan including installment agreement Find out if you qualify for an offer in compromise -- a way to settle your tax debt for less than the full amount Request that we temporarily delay collection until your financial situation improves. With this type of agreement you will receive a decision within several months. Even if the IRS hasnt yet issued you a bill you may establish a pre-assessed agreement by entering the balance youll owe from your tax return.

To some degree you get to choose how much you want to pay every month. If you owe more than 50000 you will have to negotiate with the IRS to get one and provide financial information. The regular usually monthly tax payment.

Ill outline this in more detail later. Taxpayers can find out if they meet the basic qualifying requirements. Usually in an IRS installment plan theres a deadline.

If you hire a tax professional to help you file an offer be sure to check his or her qualifications. If you owe 50000 or less you should be able to get an installment payment plan for 72 months just by asking for it. Its pretty straightforward if blunt.

The IRS will ask you what you can afford to pay per month encouraging you to pay as much as possible to reduce your interest and penalties. The IRS will return any newly filed Offer in Compromise OIC application if you have not filed all required tax returns and have not made any required estimated payments. There are several factors to consider when deciding whether to pay off your installment agreement early including.

Typically you need to owe less than 50000 and be able to pay back the full amount within 72 months or six years. If you owe only 1000 or so that might not be such a big deal.

Negotiating Payment Plans With The Irs Taxcontroversy Com

Negotiating Payment Plans With The Irs Taxcontroversy Com

Irs Taxes Payment Plan Darien Il Www Mmfinancial Org Irs Tax Payment Plan Irs Payment Plan

Irs Taxes Payment Plan Darien Il Www Mmfinancial Org Irs Tax Payment Plan Irs Payment Plan

What If I Can T Pay My Taxes A Step By Step Guide The Question What If I Can T Pay My Taxes Is A Tough One To Answer Filing Taxes Irs

What If I Can T Pay My Taxes A Step By Step Guide The Question What If I Can T Pay My Taxes Is A Tough One To Answer Filing Taxes Irs

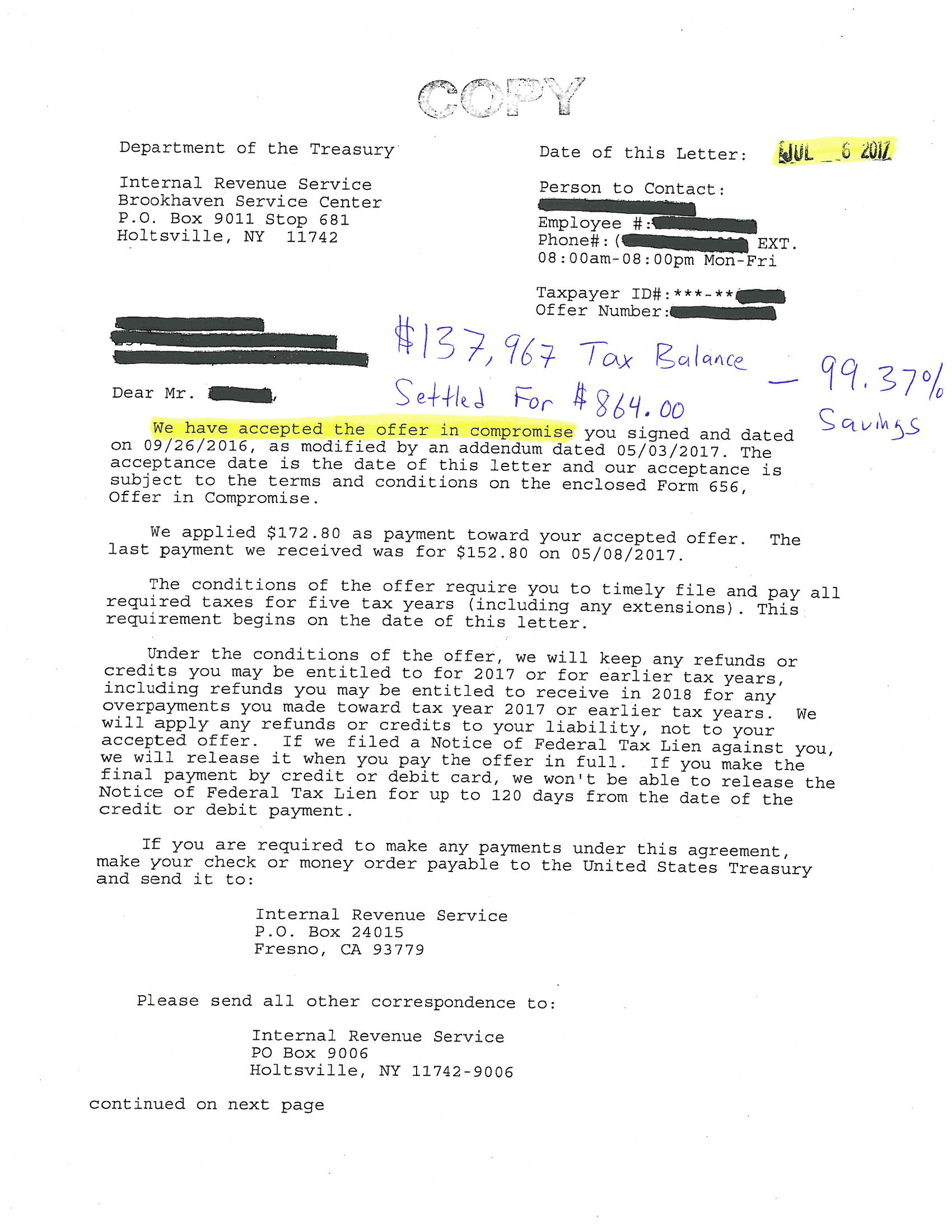

How A 137 967 Irs Tax Debt Was Settled For 864 Yes Really See Documents Landmark Tax Group

How A 137 967 Irs Tax Debt Was Settled For 864 Yes Really See Documents Landmark Tax Group

Installment Payment Plan Agreement Template Inspirational 7 Sample Installment Agreements Contract Template Invoice Template Word Freelance Invoice Template

Installment Payment Plan Agreement Template Inspirational 7 Sample Installment Agreements Contract Template Invoice Template Word Freelance Invoice Template

Irs Installment Agreement Georgetown Tn Mm Financial Consulting Inc Irs Taxes Payroll Taxes Irs

Irs Installment Agreement Georgetown Tn Mm Financial Consulting Inc Irs Taxes Payroll Taxes Irs

Get Irs Tax Relief Fast When Having Overwhelming Tax Problems A Majority Of Taxpayers Are Not Comfortable Call Irs Taxes Offer In Compromise Wage Garnishment

Get Irs Tax Relief Fast When Having Overwhelming Tax Problems A Majority Of Taxpayers Are Not Comfortable Call Irs Taxes Offer In Compromise Wage Garnishment

Notes On Tax Planning Services Tax Tax Preparation How To Plan

Notes On Tax Planning Services Tax Tax Preparation How To Plan

Payment Plan Letter Inspirational Can T Pay Irs Installment Agreement New Sample Letter To Letter Templates Lettering Quote Template

Payment Plan Letter Inspirational Can T Pay Irs Installment Agreement New Sample Letter To Letter Templates Lettering Quote Template

Irs Payment Plan Https Irspaymentplan Freetaxfree Com Tax Refund Freetax Irs Irstax Wheresmyrefund Irs Taxes Irs Payment Plan Tax Free

Irs Payment Plan Https Irspaymentplan Freetaxfree Com Tax Refund Freetax Irs Irstax Wheresmyrefund Irs Taxes Irs Payment Plan Tax Free

Taxes Payment Plans Irs Wesley Chapel Florida Mmfinancial Org Irs Taxes Payroll Taxes Irs

Taxes Payment Plans Irs Wesley Chapel Florida Mmfinancial Org Irs Taxes Payroll Taxes Irs

Tax Debt Help Napa Ca94559 Tax Debt Debt Help Payroll Taxes

Tax Debt Help Napa Ca94559 Tax Debt Debt Help Payroll Taxes

Nj Payment Plan Debt Help Tax Debt State Tax

Nj Payment Plan Debt Help Tax Debt State Tax

What If I Can T Pay My Taxes By April 15 Tax Relief Center Tax Prep Checklist Accounting Humor Tax Help

What If I Can T Pay My Taxes By April 15 Tax Relief Center Tax Prep Checklist Accounting Humor Tax Help

Missing Receipts And Irs Audits What Should I Do Irs Receipts Tax Prep Checklist

Missing Receipts And Irs Audits What Should I Do Irs Receipts Tax Prep Checklist

3 Important Questions Asked About Irs Payment Plan Irs Taxes Irs Payment Plan Tax Debt

3 Important Questions Asked About Irs Payment Plan Irs Taxes Irs Payment Plan Tax Debt

What If I Can T Pay My Taxes A Step By Step Guide The Question What If I Can T Pay My Taxes Is A Tough One Tax Extension Filing Taxes Irs

What If I Can T Pay My Taxes A Step By Step Guide The Question What If I Can T Pay My Taxes Is A Tough One Tax Extension Filing Taxes Irs

What If I Can T Pay My Taxes A Step By Step Guide The Question What If I Can T Pay My Taxes Is A Tough One To Answer In 2020 Irs

What If I Can T Pay My Taxes A Step By Step Guide The Question What If I Can T Pay My Taxes Is A Tough One To Answer In 2020 Irs

Rejected Offer In Compromise How To Negotiate With The Irs Offer In Compromise Negotiation Irs

Rejected Offer In Compromise How To Negotiate With The Irs Offer In Compromise Negotiation Irs

Post a Comment for "Can You Negotiate Irs Payment Plan"