What Is The Deadline For Filing For Ppp Loan Forgiveness

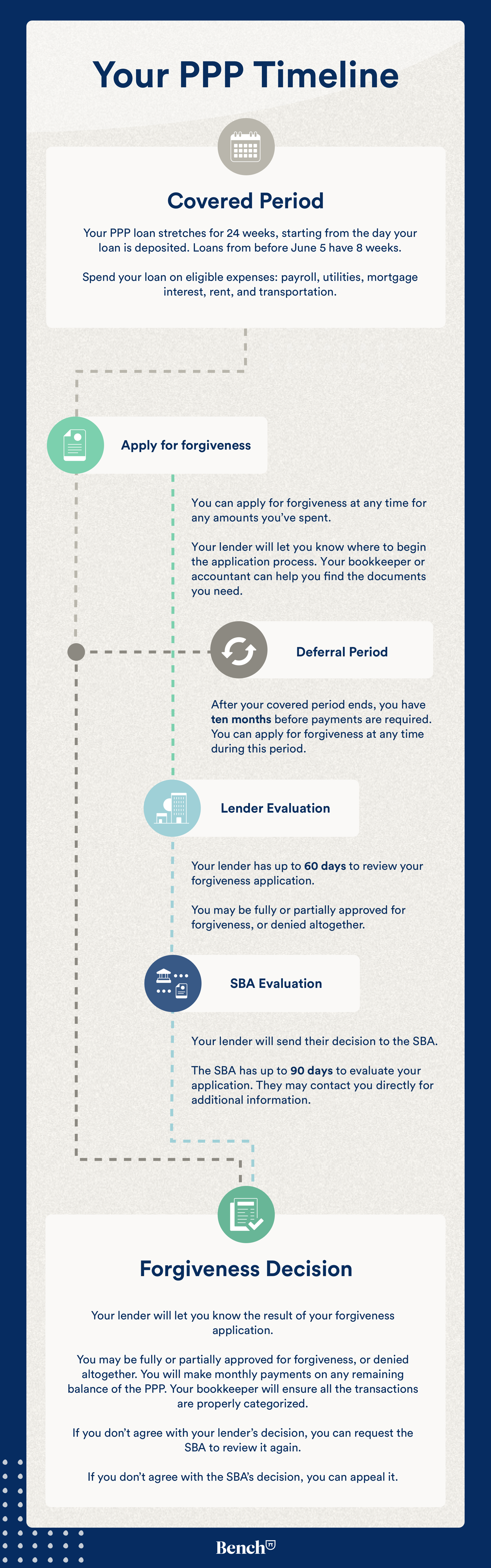

You must apply for forgiveness within 10 months after the end of the Covered Period which is the 24-week period that starts when you received your PPP loan. The PPP2 Act and the rules allow a borrower to select a covered loan period beginning on a date that is 8 weeks after the date of disbursement and ending on a date that the borrower selects that occurs before the end of the 24 weeks.

When Can I Submit My Ppp Loan Forgiveness Application Bench Accounting

When Can I Submit My Ppp Loan Forgiveness Application Bench Accounting

Time Is on Your Side Extended Coverage.

What is the deadline for filing for ppp loan forgiveness. There are two PPP safe-harbor provisions with a date of. Reduces the proportion of the loan that businesses must spend on payroll to be eligible for full forgiveness. If you apply for forgiveness after using all your PPP funds on September 15th 2020 whether your covered period is over or not for the purpose of Safe Harbor you will compare the number of FTEs you had on the most recent payroll to those you had on payroll on February 15 2020.

The IRS issued a notice on April 30 2020 that dramatically impacted the tax impact of the PPP. For example a borrower whose covered period ends on October 30 2020 has until August 30 2021 to apply for forgiveness before loan repayment begins. Specifically the IRS stated that no deduction of payroll mortgage interest rent or utilities is allowed if the payment of the expense results in forgiveness of a PPP loan.

The deadline to apply remains June 30 2020. The new PPP FAQs come as the August 8 2020 deadline to apply for a PPP loan fast approaches and as Congress and the White House negotiate a new Covid relief package expected to both simplify PPP. Is October 31 2020 the deadline for borrowers to apply for forgiveness.

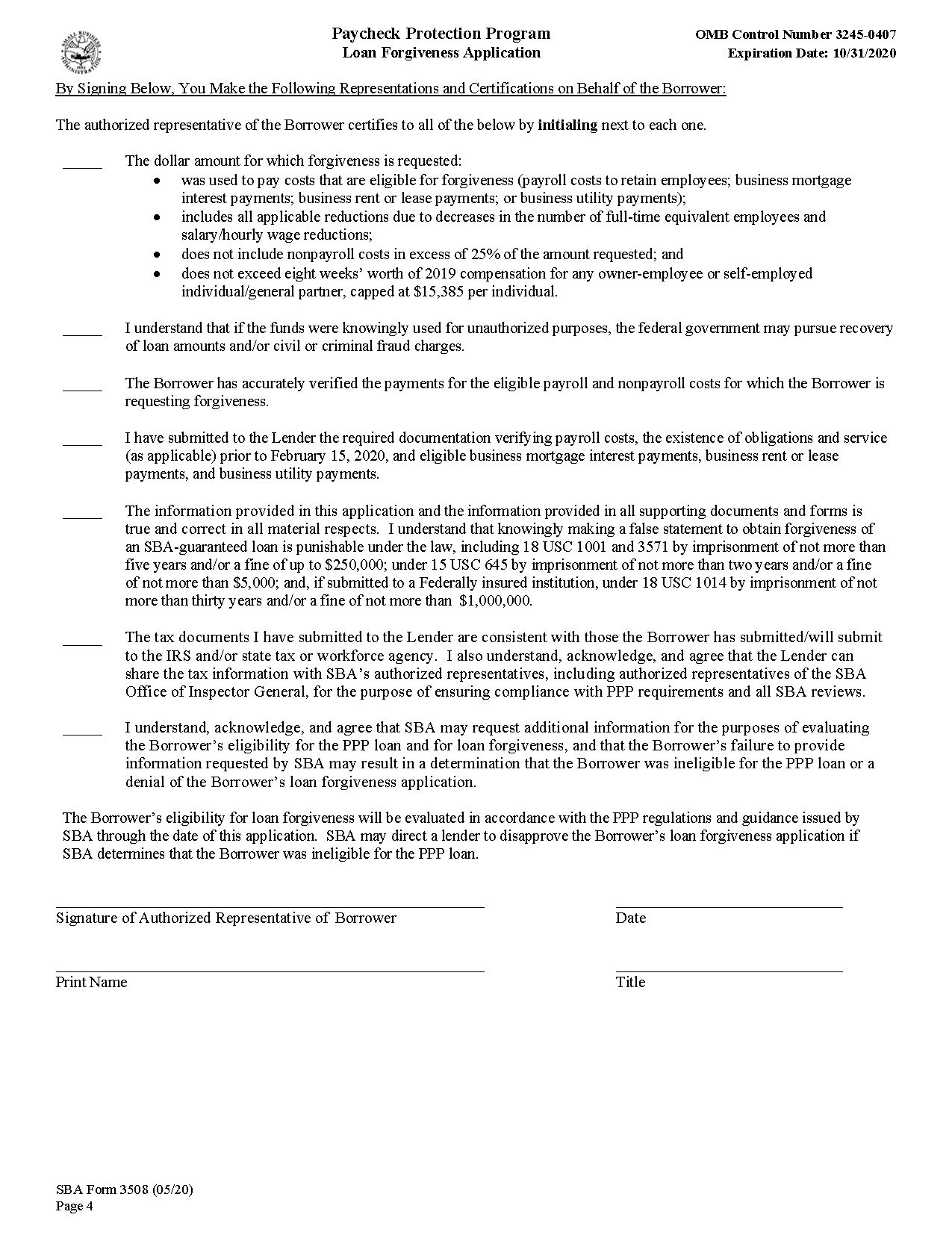

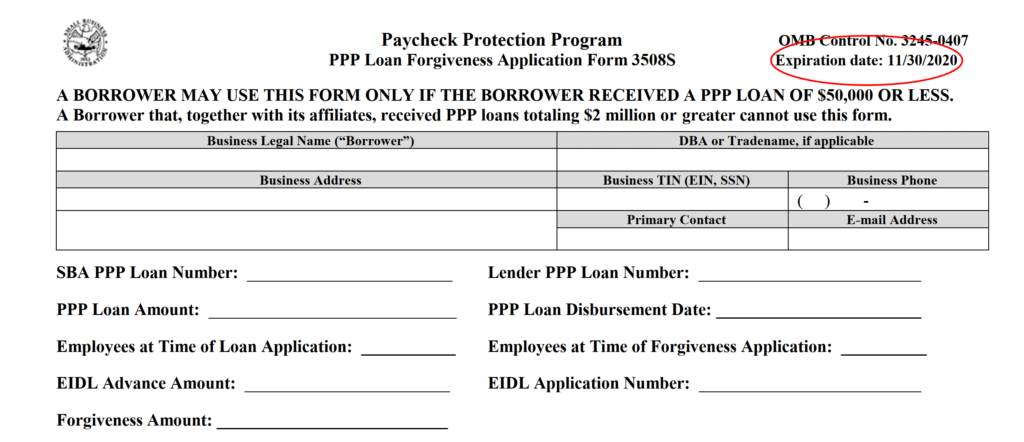

If you have the same number or more Safe Harbor will apply. The deadline is 10 months after the covered period of the PPP loan ends Coleman. Deadline to Apply for Forgiveness of PPP Loan is Loan Maturity Date Not October 31 2020 October 14 2020 by Ed Zollars CPA Some concerns had been raised regarding the expiration date found on the various Forms 3508 to be used to apply for forgiveness under the PPP loan program.

As long as the loan forgiveness application is submitted within 10 months of completing your covered period you are not required to make any payments until the forgiveness amount is remitted to. The PPP loan forgiveness application forms 3508 3508EZ and 3508S display an expiration date of 10312020 in the upper-right corner. Its recommended you apply for forgiveness before you need to make your first PPP loan payment.

At that point if forgiveness forms have not been submitted the funds officially become a loan that needs to be repaid. Deadline for Forgiveness Application. Fears of a late-October PPP surprise came to the SBAs attention because the programs loan forgiveness application forms 3508 3508EZ and 3508S display an expiration date of 10312020 in the upper-right corner.

The date on all three loan forgiveness forms has now been changed to November 30 2020. The issue came into sharper focus when the SBA released the streamlined PPP Loan Forgiveness Application Form 3508S in October with that very same expiration date see related post. Borrowers may submit a loan forgiveness application any time before the.

Under this bill 60 percent of PPP funds. There is no deadline to apply for PPP loan forgiveness. Lenders will continue accepting PPP forgiveness applications so long as borrowers have PPP loans.

The expiration date in the upper-right corner of the posted PPP loan forgiveness application forms is displayed for purposes of SBAs compliance with the Paperwork Reduction Act and reflects the temporary expiration date for approved use of the forms. 27 October 2020 Small Businesses Many businesses applying for loan forgiveness were shocked when they saw an October 31st deadline listed on the upper right corner of their application forms. Kari Hipsak CPA CGMA an Association senior manager said in an interview the important deadline in the PPP forgiveness process doesnt come until 10 months after the end of the loans covered period.

Your bank has 2. First pay period following its PPP loan disbursement is Sunday April 26 the first day of the Alternative Payroll Covered Period is April 26 Borrowers who elect to use the Alternative must apply the Alternative wherever there is a. For businesses with lower staffing levels than pre-Covid you are best waiting until January 2021 to apply for PPP loan forgiveness.

Small Business Administration SBA released guidance Tuesday confirming that Paycheck Protection Program PPP loan forgiveness applications are not due on Oct. The deadline for applying for forgiveness varies for each individual loan.

What S Next For Ppp Loan Forgiveness Kruggel Lawton Cpas

What S Next For Ppp Loan Forgiveness Kruggel Lawton Cpas

The New Ppp Loan Forgiveness Application Early Submission Greenbush Financial Planning

The New Ppp Loan Forgiveness Application Early Submission Greenbush Financial Planning

Federal And State Tax Consequences Of Ppp Loan Forgiveness Marks Paneth

Federal And State Tax Consequences Of Ppp Loan Forgiveness Marks Paneth

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

Ppp Loan Forgiveness Guidance For Employers

Ppp Loan Forgiveness Guidance For Employers

Top 10 Insights From The Sba S Ppp Loan Forgiveness Application Blogs Coronavirus Resource Center Back To Business Foley Lardner Llp

Top 10 Insights From The Sba S Ppp Loan Forgiveness Application Blogs Coronavirus Resource Center Back To Business Foley Lardner Llp

Sba Clarifies Filing Date S For Ppp Loan Forgiveness Gyf

Sba Clarifies Filing Date S For Ppp Loan Forgiveness Gyf

Ppp Loan Forgiveness When Should I Apply Ds B

Ppp Loan Forgiveness When Should I Apply Ds B

Paycheck Protection Program Ppp Loan Forgiveness H R Block

Paycheck Protection Program Ppp Loan Forgiveness H R Block

Ppp Loan Forgiveness How To Apply And Get Accepted Nav

Ppp Loan Forgiveness How To Apply And Get Accepted Nav

Ppp Loan Forgiveness Application Updated 6 16 2020 C Brian Streig Cpa

Ppp Loan Forgiveness Application Updated 6 16 2020 C Brian Streig Cpa

Pin On Paycheck Protection Program

Pin On Paycheck Protection Program

Ppp Loan Forgiveness Requirements How To Apply Divvy

Ppp Loan Forgiveness Requirements How To Apply Divvy

Ppp Loans How To Attain Total Forgiveness Accupay Payroll And Tax Services Indianapolis

Ppp Loans How To Attain Total Forgiveness Accupay Payroll And Tax Services Indianapolis

Guide To Getting Your Ppp Loan Forgiveness Application Accepted Smolin

Guide To Getting Your Ppp Loan Forgiveness Application Accepted Smolin

How Ppp Loan Forgiveness Works For The Self Employed Bench Accounting

How Ppp Loan Forgiveness Works For The Self Employed Bench Accounting

Updated Ppp Loan Forgiveness Guidance From Sba Stein Sperling

Updated Ppp Loan Forgiveness Guidance From Sba Stein Sperling

Post a Comment for "What Is The Deadline For Filing For Ppp Loan Forgiveness"