Typical Payment Terms For Invoices

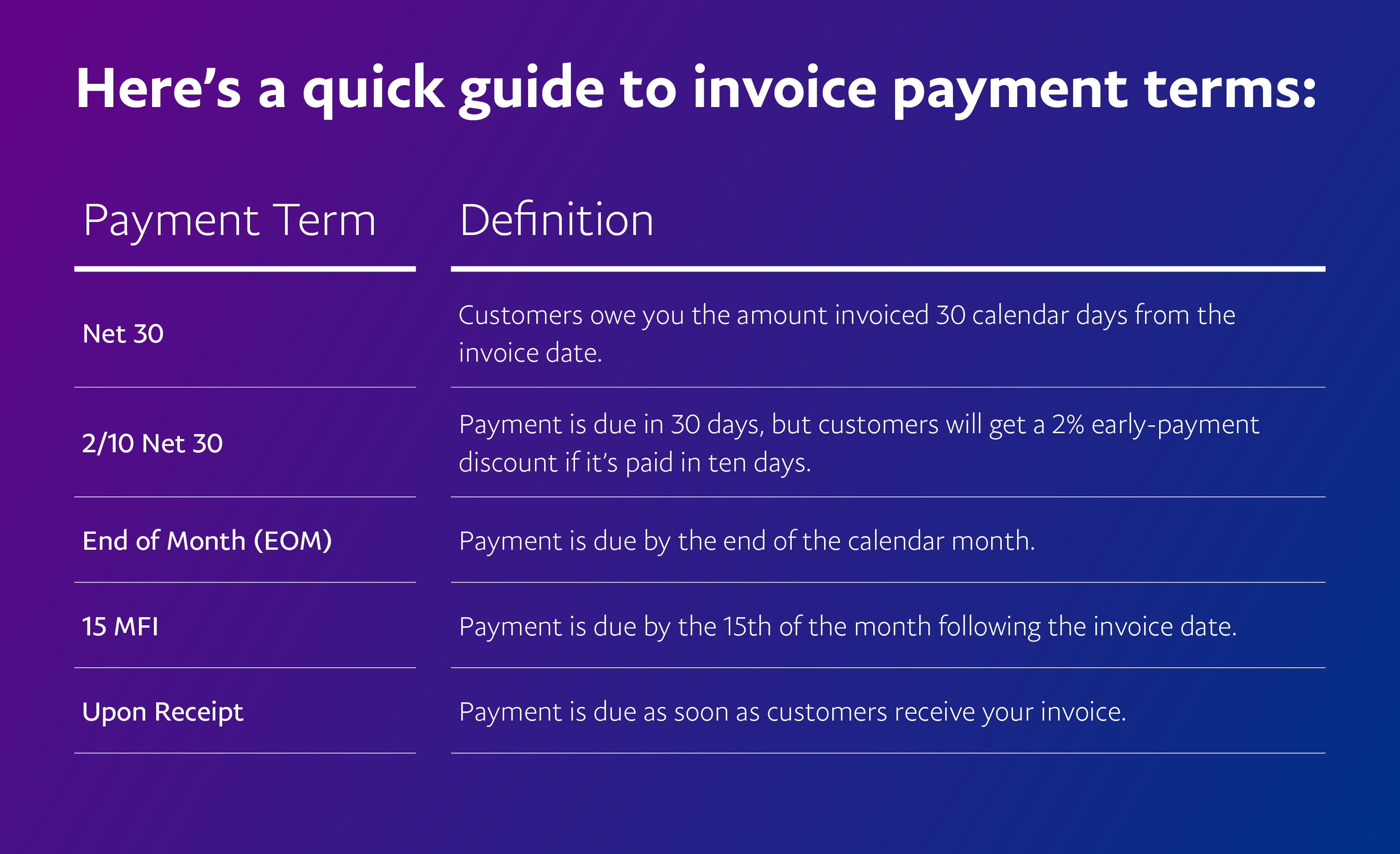

Net D is a common financial term indicating that the invoice is due within a certain number of days the D variable. Here are the ten most relevant invoicing and payment terms.

Net 30 And Other Invoice Payment Terms Invoiceberry Blog

Net 30 And Other Invoice Payment Terms Invoiceberry Blog

Here are common net payment terms examples.

Typical payment terms for invoices. Net 30 - Payment 30 days after invoice date. For example the contractor should specify any required forms of payment such as certified check. Lets also assume that the payment is 15 days late.

Common forms are net 10 net 15 net 30 net 60 and net 90 also written as net 10 days etc. While Net 30 is standard there are also other variations such as Net 10 Net 60 Net 90 etc. The only area of a company that can negotiate net 45 payment terms is the purchasing department.

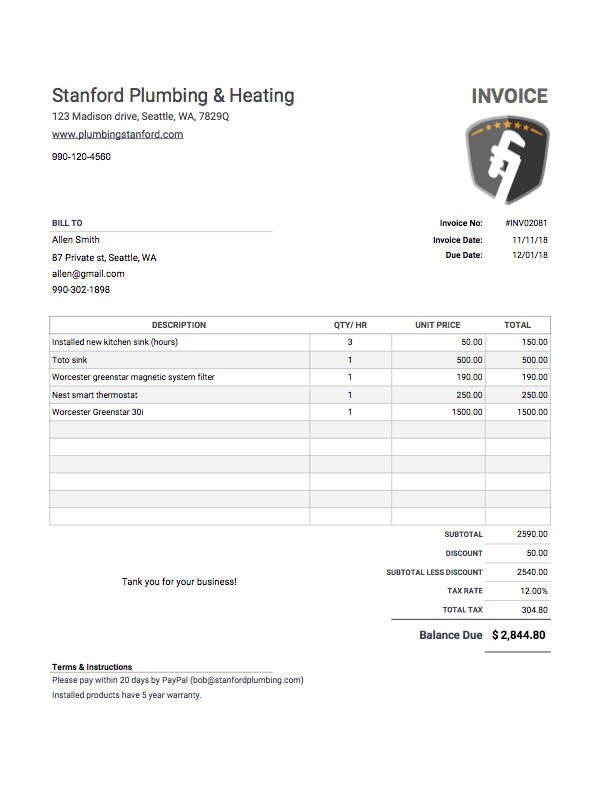

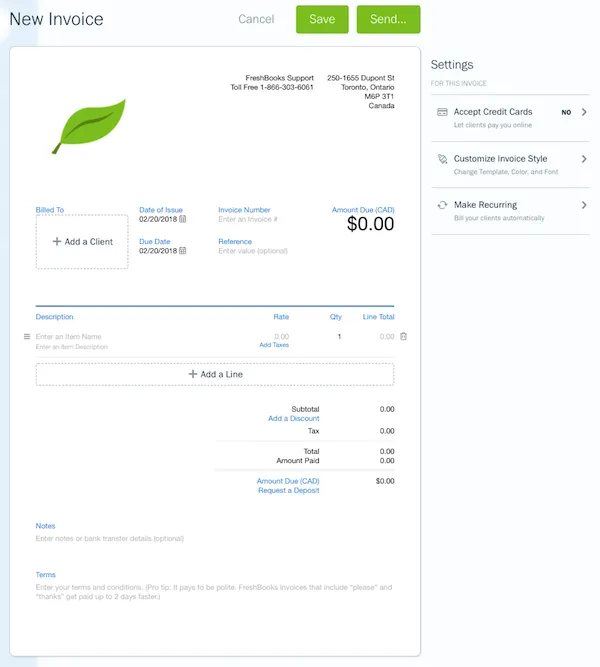

Terms such as cost amount delivery payment method and when the payment is expected or due. Net 30 is the most common invoice payment term but keep in mind that customers particularly the larger ones will likely negotiate Net 45 or Net 60 terms to offer them extended time to pay. Short but reasonable payment terms Typically invoices provide for 30 days of credit though some larger companies even go as high as 120 days.

Just divide the states max. PIA - Payment in advance. This list explains the payment terms most commonly used on invoices.

Most companies have a net 45 term. It all depends on the business. There are terms for advance payment when the client is offered credit.

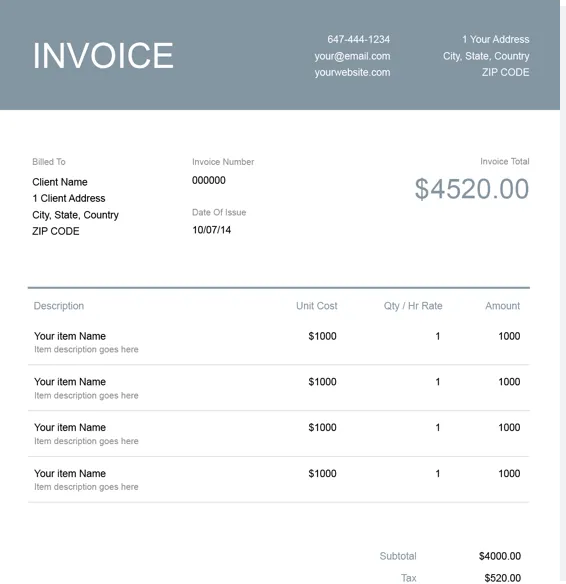

Net 7 invoice due 7 days after the date of invoice Net 15 invoice due 15 days after the date of invoice. When a supplier receives a purchase order there are terms and conditions that apply to all invoices received. The screenshot below shows how payment terms are generally shown on an invoice.

You can vary the number as much as you like. POLITELY WORD YOUR INVOICE PAYMENT TERMS. Net 10 - Payment ten days after invoice date.

It is mentioned as Net 7 or Net 30 which means pay the due after seven or thirty days of the date of the sales bill. Its important to remember that 30 days is not equivalent to one month. Net 7 - Payment seven days after invoice date.

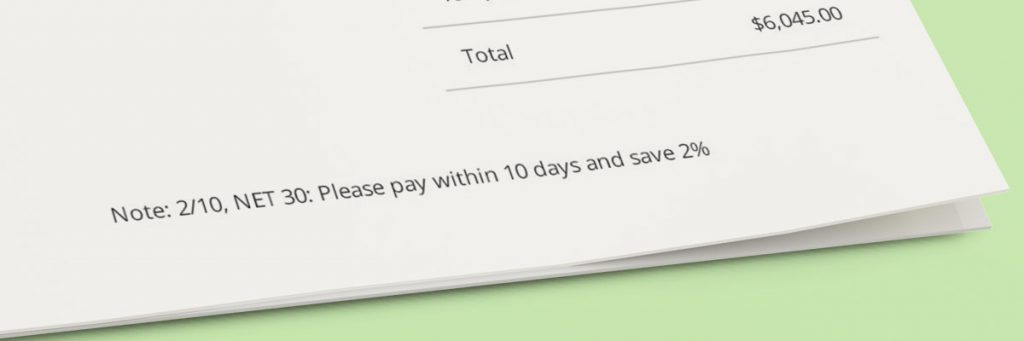

What Are the Best Invoice Payment Terms for Businesses. On a 5000 invoice that is 30 days late a penalty of 75 50000015 applies. For example if the rate is 18 the monthly finance charge is 15 1812.

In other words if you pay in 10 days or less the invoice can be settled for 980 instead of 1000. These are the payments terms that you and the buyer have agreed on. This means that buyers send payment 45 days after the date of invoice.

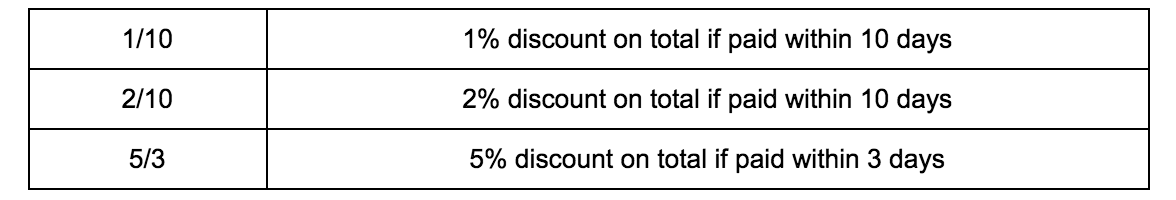

Net 7 for example means that payment is due seven days after the invoice and Net 15. An invoice with 2510 Net 30 offers 25 off the total if paid within 10 days. Net 30 is the most common invoice payment term but keep in mind that customers particularly the larger ones will likely negotiate Net 45 or Net 60 terms to offer them extended time to pay.

One of the most common payment terms Net 30 days or N30 means that a buyer must settle his or her account within 30 days of the date listed on the invoice. 21 MFI - 21st of the month following invoice date. These are also the essential components of any invoice.

Setting clear specific deadlines in your payment terms can help your business receive. If you pay after 10 days you must pay the full 1000. Net 60 - Payment 60 days after invoice date.

The term makes it clear to the client when the payment is due. Well you get the idea. 1 week payment terms get settled in about 2 weeks 2 week payment terms get settled in 2-3 weeks.

But sometimes it can create confusion if the term is not clear to him. Payment terms could also specify how the customer is to pay the amount and what penalties result for late payment. It refers to the amount of time30 daysthat the client has to submit payment for the invoice.

Net 90 - Payment 90 days after invoice date. On the invoice these terms would be noted as 210 net 30. Being polite when writing your invoice payment terms isnt just good.

EOM - End of month. Net 30 is a payment term used as a standard on most types of invoices. Invoices with short payment terms are more likely to go past due but you still get your money sooner than if you give three or four weeks to pay.

This is a common term which simply means that the client should pay 30 days from the invoice date. A study of millions of invoices sent through Xero showed that invoices with. For UK businesses as stated above standard payment terms are 30 days - this could be designated as net 30 or net 30 days indicating payment is due on the invoice amount 30 days after delivery of goods or services.

Common Invoice Payment Terms.

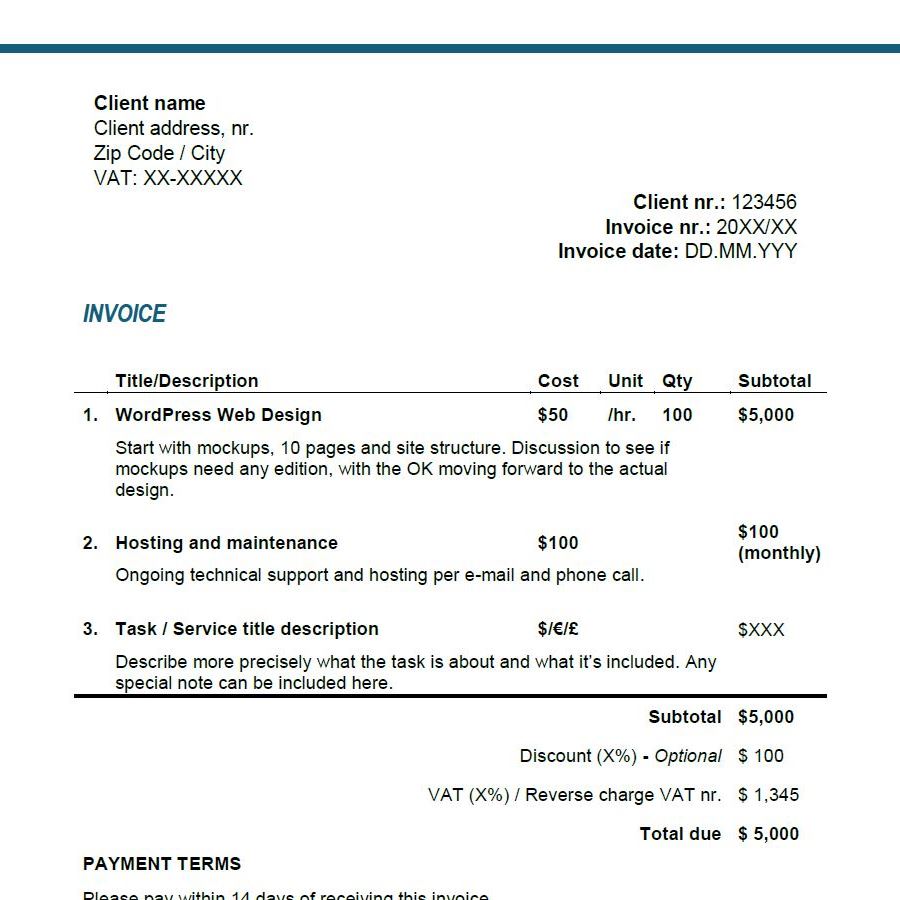

How To Invoice As A Sole Trader Invoicing Guide For Beginners

How To Invoice As A Sole Trader Invoicing Guide For Beginners

Everything You Need To Know About Invoice Payment Terms

Services Rendered Invoice Template Free Download Send In Minutes

Services Rendered Invoice Template Free Download Send In Minutes

Sample Invoice Template Invoice Simple

Sample Invoice Template Invoice Simple

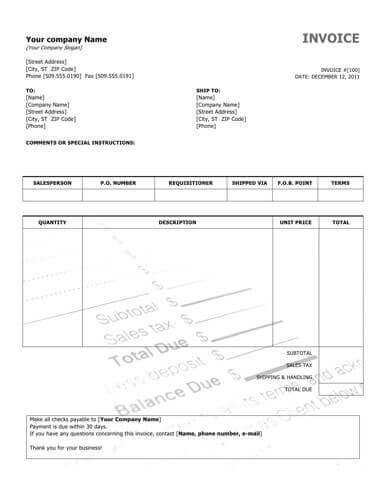

Invoice Template For Word Free Basic Invoice

Invoice Template For Word Free Basic Invoice

What To Include In Invoice Payment T C For Fast Payment

What To Include In Invoice Payment T C For Fast Payment

Invoice Payment Terms Explained Purchasecontrol Software

Invoice Payment Terms Explained Purchasecontrol Software

What Does Net 30 Mean On An Invoice A Simple Definition For Small Businesses

What Does Net 30 Mean On An Invoice A Simple Definition For Small Businesses

Choosing Payment Terms For Your Invoices And Co

Choosing Payment Terms For Your Invoices And Co

Sales Invoice Templates 27 Examples In Word And Excel Hloom

Sales Invoice Templates 27 Examples In Word And Excel Hloom

10 Invoicing Payment Terms You Need To Know Due

10 Invoicing Payment Terms You Need To Know Due

5 Popular Invoice Payment Terms Paypal

5 Popular Invoice Payment Terms Paypal

Standard Invoice Format Template Free Download Send In Minutes

Standard Invoice Format Template Free Download Send In Minutes

Invoice Payment Terms Wording Invoice Template Ideas Payment Terms On An Invoice Invoice Template Invoice Template Word Letter Format Sample

Invoice Payment Terms Wording Invoice Template Ideas Payment Terms On An Invoice Invoice Template Invoice Template Word Letter Format Sample

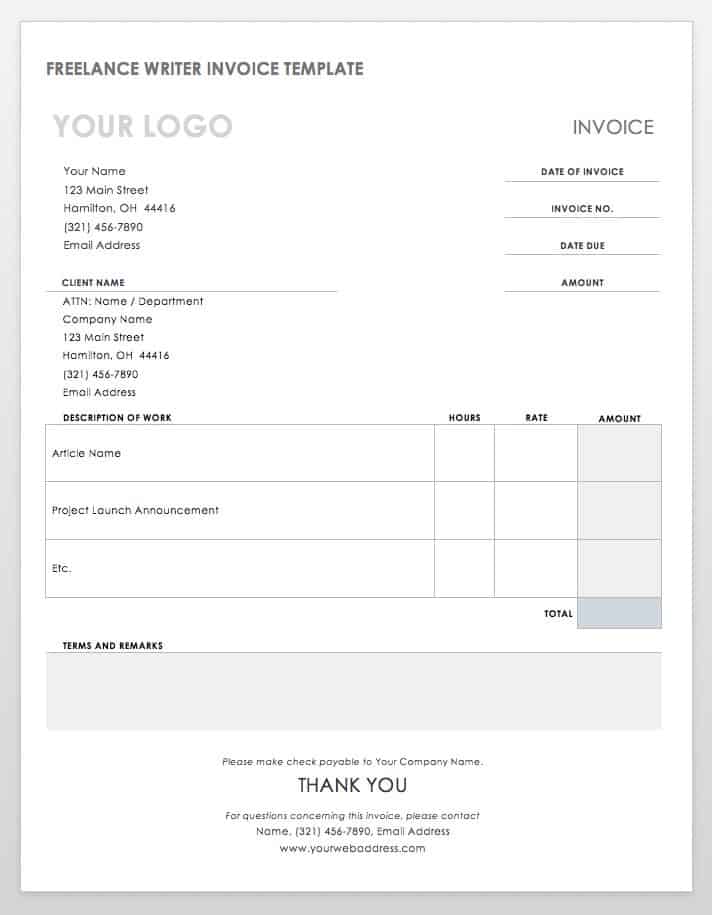

55 Free Invoice Templates Smartsheet

55 Free Invoice Templates Smartsheet

The Perfect Invoice Wording For Immediate Payment

The Perfect Invoice Wording For Immediate Payment

10 Best Images Of Sample Of Invoice For Payment Sample Invoice Payment Terms On An Invoice Invoice Template Invoice Template Word Invoice Example

10 Best Images Of Sample Of Invoice For Payment Sample Invoice Payment Terms On An Invoice Invoice Template Invoice Template Word Invoice Example

Post a Comment for "Typical Payment Terms For Invoices"