How To Fill Out A Payment To Avoid Garnishment Form

Depending on the garnishment there may be a form provided for this ie Form 668 for a federal levy. I certify that the statements contained above are true to the best of my knowledge and belief.

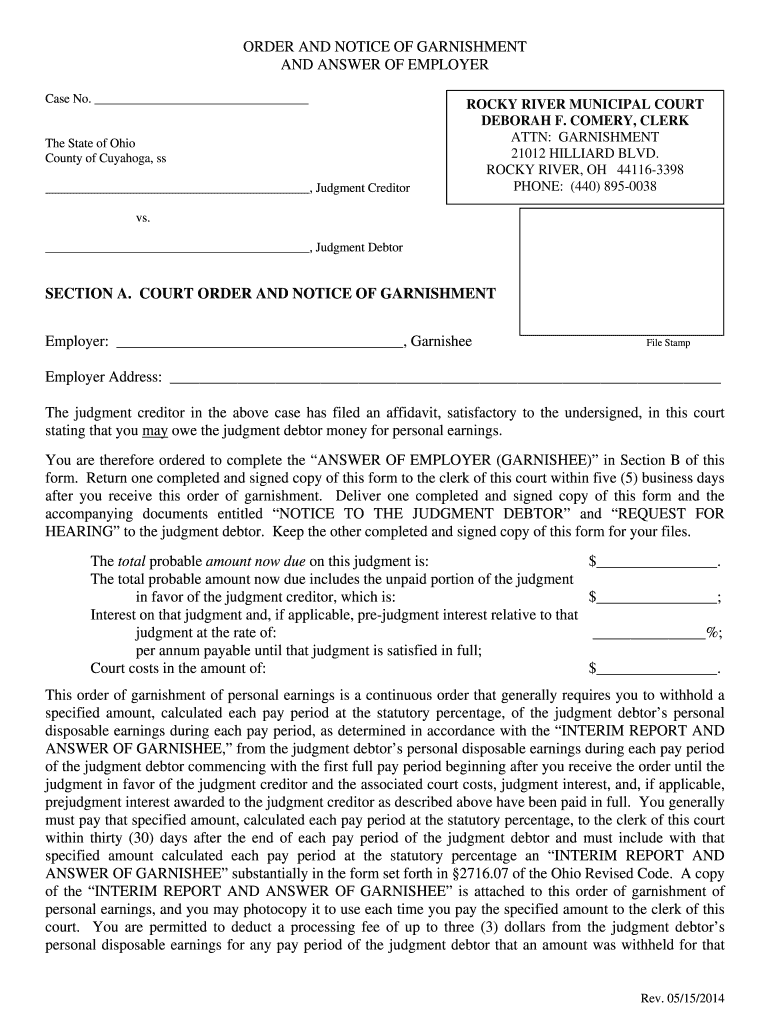

Wage Garnishment In Ohio Removal Of Wage Garnishment

Wage Garnishment In Ohio Removal Of Wage Garnishment

Filling out the IRS extension form will get you an extra two months with some further allowances if youre serving in the armed forces in a combat zone or living outside the United States.

How to fill out a payment to avoid garnishment form. It does not apply to any other form of garnishment or execution. Under federal law the garnishment amount cant be more than 25 of your net take home pay or the amount by which your take home exceeds 30 times the federal minimum wage currently set to 725hour whichever is less. These rules are set forth in 2716041 of the Ohio Revised Code.

If you get a demand letter from your creditor dont ignore it. Send this amount to the judgment creditor along with this form after you have signed it. Enter the smallest of the amounts on line 1 4 or 5 B.

Send this amount to the judgment creditor along with this form after you have signed it. Fill out both copies of the Employers Return form WG-005 and mail them to the sheriff within 15 days of the date you received the order. Use this opportunity to negotiate a payment plan with the creditor before it begins the garnishment process.

If you do the garnishment amount will be reduced or eliminated depending on what your state law says. 2 Fill out the payment form. An employer guide to processing continuous orders of garnishment is included with this order of garnishment.

Many creditors prefer to get voluntary payments from debtors rather than deal with the cost and time-consuming paperwork involved with garnishments. Requesting an extension if you cant pay whats owed when you file your return. You also may be able to find copies online that you can download and fill out on your computer.

The forms must be filed in the circuit court if the judgment is from the circuit court or district court if the judgment is from the district court. Should I fill out Form 12277 or Form 109169. This set of forms is for use in garnishment to collect a money judgment.

This is a Ohio form that can be used for Civil within City Municipal Court Cleveland. If section 2a of the Wage Garnishment Order specifies the dollar amount to be garnished the employer does not need to complete this Worksheet. Index of SCAO-Approved Forms for Use in Garnishment.

1 Creditors cant take money out of your bank account with a garnishment order. You can get the forms you need from the clerk of the court where your case was heard. An employer can also draft a letter detailing the specifics of the wage garnishment order the amount to be taken from each payment and the length of time the wages will be garnished.

You fill out a claim of exemption form stating why you believe that exemption applies to you and file it with the court issuing the order allowing the garnishment. Special stacking priority of payment and manner of payment rules apply when a garnishee receives multiple orders of garnishment with respect to the same judgment debtor. Pay court fees fines.

You can avoid wage garnishment by. 2 the garnishment amount set forth in 15 USC. Typically you must fill out an application to begin the wage garnishment process.

Garnishment Amount to be deducted from a debtors disposable pay. When to Start Withholding Earnings To figure out when to start withholding earnings garnishing wages count 10 calendar days from the date you received the order. Enter the smallest of the amounts on line 1 4 or 5 B.

I was sued by a collections agency for a debt I owe and they have obtained a judgement against me. 1 of the Employees disposal pay not to exceed 15. The judge will determine if you qualify for that particular exemption.

If consumer debt such as credit card or medical bills led to the garnishment or bank levy challenging the judgment will involve filling out paperwork and you may also have to attend a hearing. I do not trust the IRS on how will they know how to notify my employer to stop sending garnishment checks to the IRS. They sent me a form called Payment to avoid garnishment which I filled out and returned to them with the payment required.

The notice should include a form titled Payment to Avoid Garnishment If you intend to use this method to stop wage garnishment you must complete the form and return it to the creditor within 15 days of the date on the letter or notice to which the form was attached. Worksheet to figure out Garnishment exemption. Get an application and affidavit for a writ of garnishment.

I have not heard back from them since Im guessing they are deciding not to bother with it since I make so little. A The Wage Garnishment Amount is per pay period in accordance with an agreement between the Creditor Agency. -OR b The Wage Garnishment Amount for each pay period is the lesser of.

I was going to do a pay-off of my debt but decided against that thats how I know about those Forms Please help. I certify that the statements contained above are true to the best of my knowledge and belief. Payment To Avoid Garnishment.

Disposable pay includes but is not limited to salary overtime bonuses commissions sick leave and vacation pay. Continuing legal education reporting.

Things You Should Know About Student Loan Debt Infographic Student Loans Student Debt Infographic Student Loan Debt

Things You Should Know About Student Loan Debt Infographic Student Loans Student Debt Infographic Student Loan Debt

Martha Stewart S Cookies 0307394549 Martha Stewart Cookies Heart Shaped Candy Martha

Martha Stewart S Cookies 0307394549 Martha Stewart Cookies Heart Shaped Candy Martha

Garnishee Worksheet Fill Online Printable Fillable Blank Pdffiller

Garnishee Worksheet Fill Online Printable Fillable Blank Pdffiller

What To Do When You Receive Judgment Papers From A Creditor In 2020 Filing Bankruptcy Debt Management Creditors

What To Do When You Receive Judgment Papers From A Creditor In 2020 Filing Bankruptcy Debt Management Creditors

Ohio Garnishment Laws How To Stop Wage Garnishment In Ohio

Ohio Garnishment Laws How To Stop Wage Garnishment In Ohio

Generally Speaking The Automatic Stay Stops Foreclosures Repossessions Lawsuits Wage Garnishments And Tax Levi Wage Garnishment Medical Debt Consumer Debt

Generally Speaking The Automatic Stay Stops Foreclosures Repossessions Lawsuits Wage Garnishments And Tax Levi Wage Garnishment Medical Debt Consumer Debt

Understanding Wage Garnishment What To Do If The Irs Garnishes Your Wages If You Ever Get Involved In A Wage Garnishment I Wage Garnishment Wage Tax Help

Understanding Wage Garnishment What To Do If The Irs Garnishes Your Wages If You Ever Get Involved In A Wage Garnishment I Wage Garnishment Wage Tax Help

Wage Garnishment Forms Ohio Fill Out And Sign Printable Pdf Template Signnow

Wage Garnishment Forms Ohio Fill Out And Sign Printable Pdf Template Signnow

Https Www Fairfaxcounty Gov Circuit Sites Circuit Files Assets Documents Pdf Garnishment Summons Pdf

Quinoa Salad With Zucchini Poblano And Avocado In 2020 Quinoa Salad Green Olives Poblano

Quinoa Salad With Zucchini Poblano And Avocado In 2020 Quinoa Salad Green Olives Poblano

How Can I Stop A Wage Garnishment In 2021 Upsolve

How Can I Stop A Wage Garnishment In 2021 Upsolve

Https Www A2gov Org Departments 15d Documents 15dc Collectingmoneyfromasmallclaimsjudgment 2011 07 07 Pdf

Https Www Oregon Gov Dhs Seniors Disabilities Sua Documents Protect Your Assets Pdf

Https Www Courts Mo Gov Hosted Circuit13 Forms Acct Affidavitforheadoffamilyexemptionofwagesgarnishment Pdf

6 Tips To Avoid Wage Garnishment That Taxpayers May Want To Know Wage Garnishment Estimated Tax Payments Wage

6 Tips To Avoid Wage Garnishment That Taxpayers May Want To Know Wage Garnishment Estimated Tax Payments Wage

Collecting Money Judgments In Divorce Cases Enforcing Child Support Spousal Support And Property Division

Information For Debtors Ohio Judgment Collection Law Libguides At Franklin County Law Library

Information For Debtors Ohio Judgment Collection Law Libguides At Franklin County Law Library

This Is A California Form That Can Be Used For Enforcement Of Judgment Within Judicial Council Download This Fo Financial Statement Wage Garnishment Financial

This Is A California Form That Can Be Used For Enforcement Of Judgment Within Judicial Council Download This Fo Financial Statement Wage Garnishment Financial

Https Lawpoint Com Wp Content Uploads 2019 06 Packet Garnishment Exemption Pdf

Post a Comment for "How To Fill Out A Payment To Avoid Garnishment Form"