Maharashtra Online E Payment (stamp Duty & Registration Fees)

Name as Inspector General of Registration Select payment type as Non-Judicial Stamp Duty Customer Payment andor Registration Fees. E-SBTR is compulsory for Optionally-Registrable documents and optional for Compulsorily Registrable documents.

Stamp Duty Calculator Calculate Stamp Duty Online

Stamp Duty Calculator Calculate Stamp Duty Online

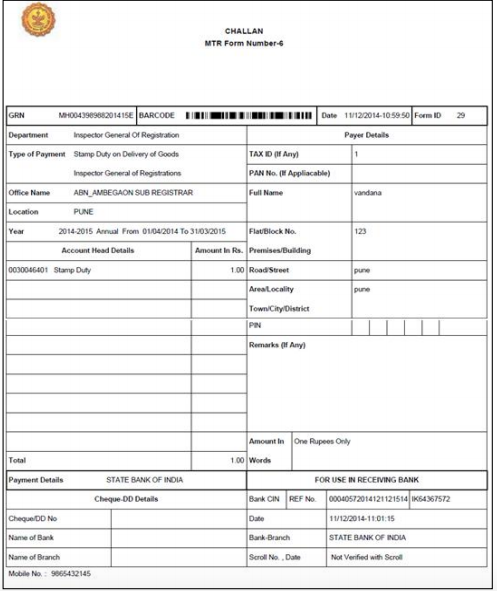

Pay stamp duty for delivery of goods in the form of e-Challan.

Maharashtra online e payment (stamp duty & registration fees). Form for Payment of Online Stamp Duty Registration Fees - Bank of Maharashtra. Click Pay Without Registration if you are not registered with the portal. 1 All parties to the document and their identifiers cum witnesses should have Aadhaar Number.

Maharashtra Online e Payments Stamp duty Registration Fees. Pay Without Registration If you are not a registered user then click here Search Challan If you want to search your challan then click here. For Online payment your Net banking transaction amount limit will be effective.

Inspector General of Registration and Controller of Stamps. Visit the Maharashtra Stamp Duty online payment portal. Inspector General of Registration and Controller of Stamps Pay stamp duty and registration fees in the form of e-Challan.

Simple Receipt Input Form. Pay search fee in the form of e-Challan. The applicant can pay the stamp duty charges and fees online by generating an online challan receipt.

If you are a registered user fill in the login details. Minimum value of transaction for e-SBTR should be Rs100-. A to the concerned Collector of Stamps for a refund of stamps within the time limit prescribed under the Maharashtra Stamp Act and b to the concerned Joint District Registrar for Refund of Registration Fee which is not utilized for registration of document within 6 months from date of e-Payment.

2 Stamp Duty and Registration Fee should be paid online through GRAS httpsgrasmahakoshgovin You are requested to deploy the updates on a high priority basis. Click Pay without Registration Register yourself if you are a regular user Visit GRAS website httpsgrasmahakoshgovin Select payment mode as e-payment Select Dept. How to obtain e-SBTR online.

Copy of the identity proof as mentioned during data input must be produced at the Branch for collecting e-SBTR. Pay judicial stamp fee in the form of e-Challan.

Pay stamp duty for delivery of goods in the form of e-Challan. E-stamp registration facility would help home buyers to pay the stamp duty registration fee or any other charges online with a few clicks. After payment Receipt of online payment to get e-SBTR to be presented at the selected branch for obtaining e-SBTR.

Stamp duty calculation is generally derived basis a few particulars that need to be mentioned while registering a property. For Online payment your Net banking transaction amount limit will be effective. Payment of Stamp Duty Registration Fees through GRAS - Online.

Pay stamp duty and registration fees in the form of e-Challan. Pay judicial stamp fee in the form of e-Challan. An e-SBTR obtained on payment of Stamp Duty Registration Fee and other charges online containing the Challan Identification Number CIN issued by the authorised participating bank the Government Reference Number GRN issued by the Virtual Treasury and the reconciled data regarding the amount paid relating to that Government Reference Number GRN kept by Virtual Treasury together shall be treated as sole proof of payment of Stamp Duty Registration Fee and other charges.

E-Payment is compulsory if Stamp Duty payable is more than Rs10000- or Registration Fee payable is more than Rs5000- or both Index of Legacy deed Non computerized deed is available online for a number of offices. Minimum value of transaction for e-SBTR should be Rs. Step 1 For Windows please download the update from.

E-sbtr simple receipt Payment. Pay stamp duty and registration fees in the form of e-Challan. All Registration offices are computerised.

Simple Receipt and Electronic - Secure Bank and Tresury Recipt e-SBTR Punjab National Bank renders its customers the facility to make Online E PYAMENTS of Stamp duty Registration Fees through Simple Receipt mode and e -SBTR Electronic Secure Bank and Treasury Receipt mode. E-SBTR print is free of cost. Copy of the identity proof as mentioned during data input must be produced at the Branch for collecting e-SBTR.

Pay search fee in the form of e-Challan. Now you can file your Notice of Intimation online without going to Sub Registrar office. What all Challan and Stamp Duty you can pay online for Maharashtra.

Payment of Stamp Duty Registration Fees and Other Fees to The Department of Registration and Stamps. For details see -View Legacy deed details- in this web page. To simplify the process of property registration several State governments have launched e-payment of stamp duty.

For Online payment your Net banking transaction amount limit will be effective. Finance Department State Government of Maharashtra. How to pay Stamp duty and Registration fees online How to pay via Cheque DD cash or NEFT via IDBI Bank.

Multiple payments for single duty payment is not allowed. Create User Account. Pay judicial stamp fee in the form of e-Challan.

What all Challan and Stamp Duty you can pay online for Maharashtra. The facility is available at igrmaharashtaraOnline ServiceseFiling For Citizens live for the across the Maharashtra. How to pay stamp duty online in Mumbai.

Multiple payments for single duty payment is not allowed.

Pin By Legaldocs On Rent Agreement Agreement Rent Vaud

Pin By Legaldocs On Rent Agreement Agreement Rent Vaud

Property Registration Stamp Duty Process In India Explained In Hindi How To Register A Property In India Consulting Business Buying Property Paid Stamp

Property Registration Stamp Duty Process In India Explained In Hindi How To Register A Property In India Consulting Business Buying Property Paid Stamp

Pin By Prem Gujeti On Wallpaper Power Of Attorney Marriage Registration Online Service

Pin By Prem Gujeti On Wallpaper Power Of Attorney Marriage Registration Online Service

Bhumi Jankari Minimum Value Of Land Property In Bihar For Stamp Duty Should You Register Agricultural Land Or Property In Bihar Stamp Duty Bihar Finance

Bhumi Jankari Minimum Value Of Land Property In Bihar For Stamp Duty Should You Register Agricultural Land Or Property In Bihar Stamp Duty Bihar Finance

All You Must Know About Step By Step Guide And Complete Process To Make Registered Rent Agreement Or E Registration Of Leave Licen Agreement Rent How To Make

All You Must Know About Step By Step Guide And Complete Process To Make Registered Rent Agreement Or E Registration Of Leave Licen Agreement Rent How To Make

Charges For Stamp Duty Registration Mumbai

Charges For Stamp Duty Registration Mumbai

The Revocation Of License Refers To The Cancellation Of License It Is Important To Know The Revocation Of License In Case Of Leave An Agreement Licensing Case

The Revocation Of License Refers To The Cancellation Of License It Is Important To Know The Revocation Of License In Case Of Leave An Agreement Licensing Case

Electronic Stamping Is A Convenient Way To Pay Stamp Duty

Electronic Stamping Is A Convenient Way To Pay Stamp Duty

Pin On Real Estate And Finance Video Tutorials

Pin On Real Estate And Finance Video Tutorials

Over Rs 1 095 Crore Spent On Incomplete Anicuts In Chhattisgarh Cag Report The Indian Express Medical College Tax App Ias Study Material

Over Rs 1 095 Crore Spent On Incomplete Anicuts In Chhattisgarh Cag Report The Indian Express Medical College Tax App Ias Study Material

Online Step Wise Process To Pay Stamp Duty And Government Fees Online Faceless Compliance

Online Step Wise Process To Pay Stamp Duty And Government Fees Online Faceless Compliance

How To Pay Stamp Duty In Mumbai Online

How To Pay Stamp Duty In Mumbai Online

Apnakhata Government Portal Rajasthan Districts

Apnakhata Government Portal Rajasthan Districts

What Is An E Rental Agreement What Is The Procedure For Doing It In 2021 Agreement Procedure Biometrics

What Is An E Rental Agreement What Is The Procedure For Doing It In 2021 Agreement Procedure Biometrics

Maharashtra Launches E Sbtr For Easy Stamp Duty And Registration Fee Payment

How To Pay Stamp Duty On Property In India

How To Pay Stamp Duty On Property In India

Fictitious Assets Know The Exact Meaning Of Fictitious Assets In The Balance Sheet And How To Identify Them In The Balance Sheet W Finance Meant To Be Asset

Fictitious Assets Know The Exact Meaning Of Fictitious Assets In The Balance Sheet And How To Identify Them In The Balance Sheet W Finance Meant To Be Asset

Top Eight Cities In India Which Are Offering Houses In The Budget Of Rs 30 To 50 Lakh Real Estate News City Estate Agent

Top Eight Cities In India Which Are Offering Houses In The Budget Of Rs 30 To 50 Lakh Real Estate News City Estate Agent

Post a Comment for "Maharashtra Online E Payment (stamp Duty & Registration Fees)"