Gst Payment Ledger In Tally

Go to Gateway of Tally Accounting Vouchers F5. All bank must have GSTIN it means they are not unregistered in this case this entry will show input credit in our books and effect our GSTR - 2.

Tally Tdl For View Party Mobile Number And Gst Number In Ledger Account Free Download Full Movies Download Download Movies

Tally Tdl For View Party Mobile Number And Gst Number In Ledger Account Free Download Full Movies Download Download Movies

How to enter Bill wise Receipt entry in tally.

Gst payment ledger in tally. Here you need to enter the GST amounts as they will not be auto-calculated. Decrease of Tax Liability. Press CtrlH Change Mode.

Enter the Name of the suppliers ledger. Set Off of Input Credit Against Out Tax Liability of GST. Gateway of Tally Vouchers press F9 Purchases.

This can be accounted under sale account. Now just press Enter till you save the ledger. Cancellation of Advance Payments under Reverse Charge.

Any unknown payment received any difference in cash balance could not figured out. Select the bank from which the payment will be made. Booking expenses with party details.

You can easily create all the GST Ledgers as in the list above by following this method. Debit the expenses and tax ledgers credit the party ledger and save. Similarly you can create ledgers CGST IGST by selecting the relevant Tax type under GST.

Ledgers to be Debited and Credited. Sale Transactions Outward Supplies of Goods and Services 3. Can put the balance under suspense until it is figured out.

Select the central and state. The Course Is Completed Guide For Tally Prime Learners And I Teach Step By Step From Basic to Advance and It Will Help to improve Your Career Path to Get The Accounting Job In Easy Manner Where Tally Prime Practicing Company And in this course I have Covered All Accounting Concept With Tally Prime in Practical Manner From Basic to Advanced Concept Including GST Goods and Services Tax. Repeat the same method and in no time you will have all the six ledgers required for passing the GST accounting entries in Tally.

- Create ledgers such as Purchase Sales State GST Central Integrated GST Stock item names etc. Select the Accounting Invoice mode from the List of ModesUsages. Select the party ledger and then the expense ledger along with the tax ledgers.

There should be different ledgers for tracking the liability recovery or interim recovery under GST else it will be a challenge. Select Bill No 1011 12 Use Space key to select bills Tally shows total amount for selected bills. Select Indirect Expenses from the List of Groups in the Under field.

Enter the name of the ledger in the Name field. Percentage of Calculation should be 0 Dont Change due to multiple Tax Rate. - Select the appropriate group to which such ledger belongs for example state tax under duties and taxes group.

Select GST as the Type of dutytax. Ledgers Create. Sale of Machinery or other Big assets attract GST.

Go to Gateway of Tally Accounts Info. Ledgers Create. For IGST Ledger.

Go to Gateway of Tally Accounts Info. To create an Expense Ledger. Go to Gateway of Tally Accounts Info.

You can select the income or expenses account group to create ledgers. In Under select Duties Taxes. From Gateway of Tally Select Display Account Books Ledger.

Open the ledger in alteration mode. As always you can press CtrlA to save. For CGST Ledger.

Stat Payment and enter the required details. For the purpose of GST tax payment every registered dealer will need to maintain 3 ledgers in the GST payment portal which is the starting step of the GST payment process. Go to Gateway of Tally Accounts Info Ledgers Create.

Credit Expenses or current assets ledger. Say for example if there is only one account of GST liability account then it will be a challenge to reconcile the same and state separately for the transactions related to. Record GST Payment Voucher 1.

Because tally have no option to show GST in a payment voucher. THIS VIDEO HELP YOU HOW MAINTAIN GST LEDGERS IN TALLY PAYMENT ADJUSTMENT JOURNAL ENTRIES MOST WATCH I If you want maintain GST and EWAY bill in Tally Softw. To create a supplier ledger 1.

All Purchase ledger created. Explained in Recording Journal Vouchers for Adjustments Against Tax Credit under GST. To Not Applicable to consider it as a party ledger.

Set the type of payment as Regular. If you pass bank charges in payment voucher then you will not able to calculate excluding amount in payment voucher. Configuring GST details for expenses ledgers are simple in Tally and once they are configured properly the GST paid on such inward supply will automatically reported as ITC claim in the relevant tables of the GST Returns.

Before we learn how to configure we need to understand the fundamental functionality built in Tally for GST compliance. GST Regime Types of Ledger Accounts to be Maintained Under GST. Purchase Transactions Input Supplies of Goods or Services 2.

Debit Central and state tax or integrated tax and cess ledgers. Record an expense in a payment voucher Expenses can also be recorded using payment vouchers. Set the option Is GST Applicable.

Select SUNIL COMPUTER SERVICES. From right side panel Select B. Select State Tax as the Tax type.

Electronic tax liability register - All liabilities of a person towards tax interest penalty late fee or any other amount will be debited here. The 3 ledgers are. Ledgers Create.

Alternatively AltG Go To Create Voucher pressF9 Purchases. You have created a GST ledger specifically an Input CGST ledger in Tally. Journal Entries Under GST.

Just change the name the Tax Type and you are done with creating all the ledgers.

Tally Tdl For Freight Charges In Purchase And Sales Invoice And Purchase Online Computer Courses Invoicing Sale

Tally Tdl For Freight Charges In Purchase And Sales Invoice And Purchase Online Computer Courses Invoicing Sale

How To Create Gst Purchase And Sales Ledger In Tally Erp 9 Part 98 Lear Learning Accounting Course Teaching

How To Create Gst Purchase And Sales Ledger In Tally Erp 9 Part 98 Lear Learning Accounting Course Teaching

Tally Tdl For Running Balance For All Ledger Account Free Tally Tdl D Accounting Free Running

Tally Tdl For Running Balance For All Ledger Account Free Tally Tdl D Accounting Free Running

How To Create Igst Ledgers In Tally Create Tutorial Lesson

How To Create Igst Ledgers In Tally Create Tutorial Lesson

Tally Tdl For Month Wise And Party Wise Gst Breakup Free Tally Add On Bio Data Free Breakup

Tally Tdl For Month Wise And Party Wise Gst Breakup Free Tally Add On Bio Data Free Breakup

How To Create Sales Return Ledger Account In Tally Erp 9 We Can Record Goods Returned By The Customer In Tally Accounting Accounting Software Capital Account

How To Create Sales Return Ledger Account In Tally Erp 9 We Can Record Goods Returned By The Customer In Tally Accounting Accounting Software Capital Account

How To Create Gst Multiple Ledger Creation In Tally Lesson Multiple Creation

How To Create Gst Multiple Ledger Creation In Tally Lesson Multiple Creation

Amazing Tally Tdl For Expand Information In Tally Erp 9 Updated Version Resume Format Expand Free Download

Amazing Tally Tdl For Expand Information In Tally Erp 9 Updated Version Resume Format Expand Free Download

Tally Advance Configuration Auto Round Off And Auto Gst Calculation I Round Off Configuration Advance

Tally Advance Configuration Auto Round Off And Auto Gst Calculation I Round Off Configuration Advance

Tally Tdl For Item Wise Columnar Report Tally Add On For Item Wise Co Wise Report Ads

Tally Tdl For Item Wise Columnar Report Tally Add On For Item Wise Co Wise Report Ads

Tally Tdl For Cheque Number In Ledger Account And Day Book View Updated Day Book Accounting Accounting Training

Tally Tdl For Cheque Number In Ledger Account And Day Book View Updated Day Book Accounting Accounting Training

How To Print Quotation From Tally Erp 9 Under Gst Learn Tally Accounting Accounting Classes Quotations Learning

How To Print Quotation From Tally Erp 9 Under Gst Learn Tally Accounting Accounting Classes Quotations Learning

How To Create Cgst Ledgers In Tally Create Lesson State Tax

How To Create Cgst Ledgers In Tally Create Lesson State Tax

Excel To Tally Import Ledger Master From Excel Tally Tdl For Excel Excel Master Pastel Accounting

Excel To Tally Import Ledger Master From Excel Tally Tdl For Excel Excel Master Pastel Accounting

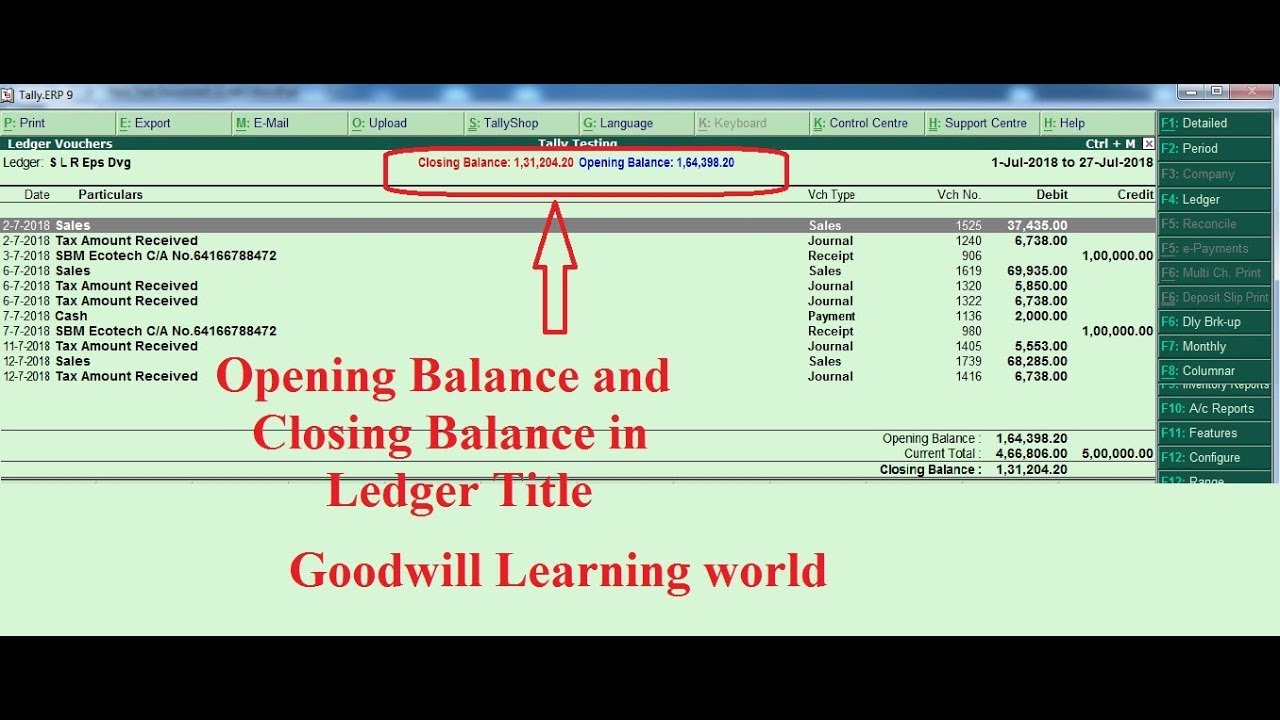

Tally Tdl For Ledger Opening Balance And Closing Balance In Ledger Title Shapes Worksheets Free Download Free

Tally Tdl For Ledger Opening Balance And Closing Balance In Ledger Title Shapes Worksheets Free Download Free

Tally Tdl For Ship To And Billed To Instead Of Consignee And Buyer T Student Council Campaign Microsoft Excel Formulas Excel Formula

Tally Tdl For Ship To And Billed To Instead Of Consignee And Buyer T Student Council Campaign Microsoft Excel Formulas Excel Formula

Narration For Each Payment Entry Accounting And Finance Payment Finance

Narration For Each Payment Entry Accounting And Finance Payment Finance

How To Create Supplier Ledgers In Tally Create Lesson Language

How To Create Supplier Ledgers In Tally Create Lesson Language

Tally Tdl For Import Ledger Group From Excel To Tally Tally Add On F Free Download Invoice Format In Excel Free

Tally Tdl For Import Ledger Group From Excel To Tally Tally Add On F Free Download Invoice Format In Excel Free

Post a Comment for "Gst Payment Ledger In Tally"