Payment Received From Debtors Journal Entry

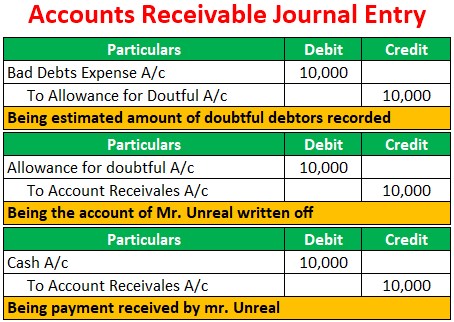

Examples of Account Receivable Journal Entry. We are receiving the amount from the debtor or party.

Barter Transaction Accounting Double Entry Bookkeeping

Barter Transaction Accounting Double Entry Bookkeeping

When a business allows a customer credit terms and invoices them for a product or service and receives payment at a later date 30 days 60 days etc then while the customer owes the business the amount outstanding they are classified as a debtor in the bookkeeping records.

Payment received from debtors journal entry. As a result journal entry for advance received from a customer is entered in the books. Leech owes Smith 50. Debtors or accounts receivable are also an asset.

Sale of Asset or Goods for Cash. He pays by cheque after deducting a 10 discount. Following are examples are.

Journal for Payment from Debtor with Discount Allowed. This is a typical accounting question to test your understanding of debtors or receivables people who owe you money and bad debts. In this case recording in Journal entry will be as follows.

Remember that any time you have a payment it means you are losing money which means less cash in the bank. Debtors in accounting are amounts which are owed to a business by customers they are sometimes referred to as accounts receivable. Most businesses borrow money for both long-term periods periods of more than one year and short-term periods periods of one year or less.

If we want to decrease this account we must credit it. Debtors as were debited before because they are asset for business as income receivable are now credited as payment is received and asset being cancelled. Withdrawal of funds from the Bank.

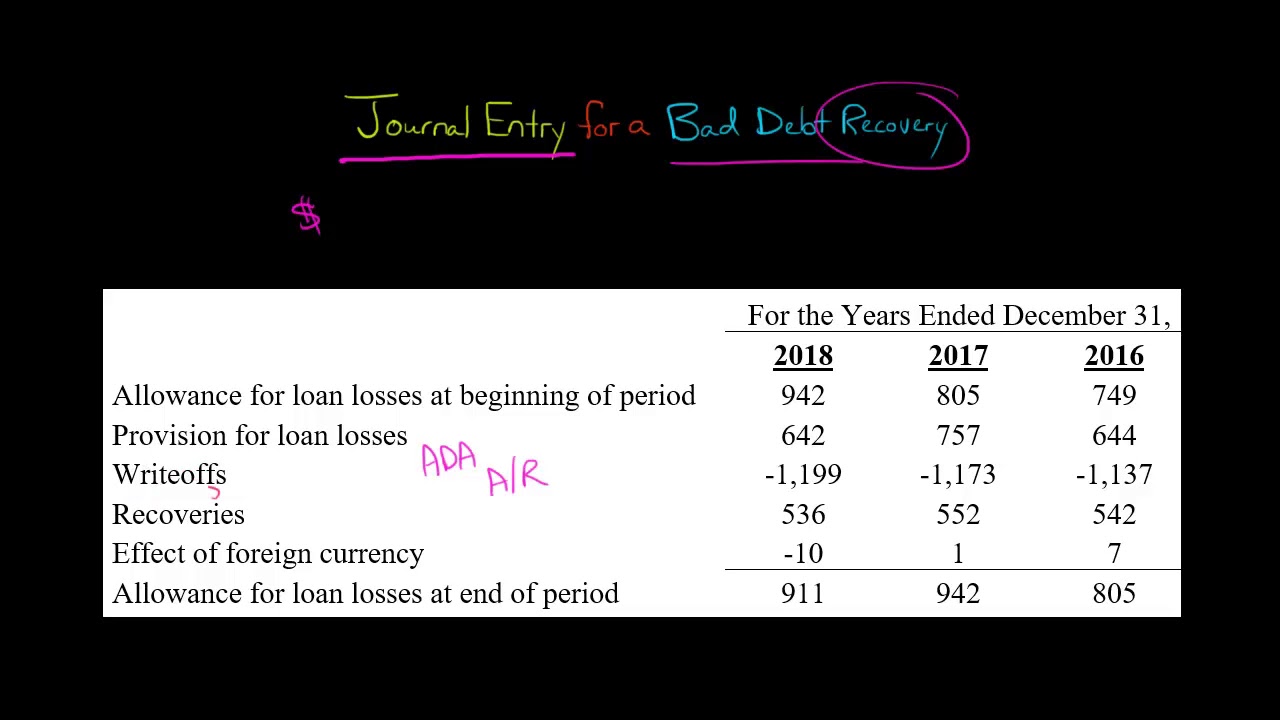

At times a debtor whose account had earlier been written off by a creditor as a bad debt may decide to make a payment this is called the recovery of bad debts. While journalizing for bad debts debtors personal account is credited and bad debts account is debited because bad debts written off are. A loan received becomes due to be paid as per the repayment schedule it may be paid in instalments or all at once.

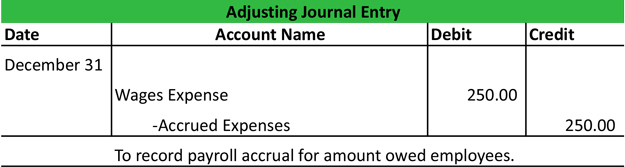

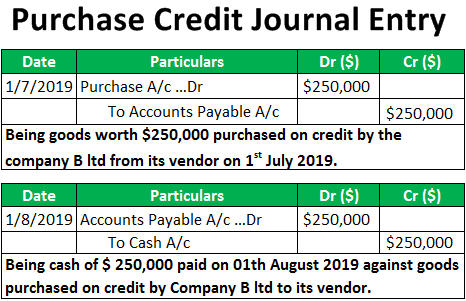

Accounts Payable Journal Entries refers to the amount payable accounting entries to the creditors of the company for the purchase of goods or services and are reported under the head current liabilities on the balance sheet and this account debited whenever any payment is been made. Journal Entry for Loan Payment Principal Interest Loans are a common means of seeking additional capital by the companies. Prepare the journal entry or entries for the following transaction.

The journal entry would be as follows. In each case the accounts receivable journal entries show the debit and credit account together with a brief narrative. Here is the journal entry for a payment on account.

Journal Entries for Accounts Payable. So the amount should be credited in the name of the party means party is depositing amount. Baloyi in settlement of his account of R126.

Bank is personal ac and receiver so debited. Once the interest income is accrued becomes receivable the journal entry should be passed to record it on the date when it became due and the date when the payment against the same is received then on that date receipt entry should be passed in the books of accounts. This is true at any time and applies to each transaction.

What is the entry in Smiths books. Issued a receipt for R105 to B. Accounting Equation for Received Cash on Account Journal Entry The Accounting Equation Assets Liabilities Owners Equity means that the total assets of the business are always equal to the total liabilities plus the equity of the business.

Long-term debt can include a 5-year car loan 20-year mortgage or any other type of debt that is paid over more than one year. Cash or bank is an asset. Cash is real ac and comes in business so debited.

ABC Inc sold some electronic items to Mr. While posting the journal entry for recovery of bad debts it is important to note that it is treated as a gain to the business that the debtor should not be credited as in case of sales. Here is the journal entry to record the above payment from the debtor.

Accounts receivables are the money owed to the company by the customers and accrual accounting system allows such type of credit sales transactions by opening a new account called accounts receivable journal entry Accounts receivables can be considered as an investment made by the business that includes both risks and returns. Side and will be like this to the debtor party name ch. So this entry should be in cr.

Dr Bank 45 Dr Discount Allowed expense 5 Cr Leech debtors account 50. Cash received Journal Entry. Journal Entry for Advance Received from a Customer.

Most companies take on some form of long-term. In certain types of business transactions it is a requirement for the customer to pay a part of the total amount or the entire sum in advance for example security deposit to rent a property customized items bulk orders insurance premium etc. Arun kausik let me teach you in simple language.

The accounts receivable journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of accounts receivable. Enter the amount by which you wish to debit the account. And when assets increase we debit them.

Cash received Journal Entry is passed when a business or person receives cash from the following. They can be obtained from banks NBFCs private lenders etc. So we debit the business bank account or cash.

For CreditorsDebtors Journal transactions a useful narrative to have available in Abbreviations would be Balance written off. The total amount of invoice including expenses and Taxes was 25000 which has to be paid on or before Apr01 2019. If entering a Creditors Journal debiting the account will reduce the amount you owe the Supplier.

John Stewart on Mar012019. R Rands South African currency A. The journal entry for this transaction is as follows.

Reimbursed Employee Expenses Journal Double Entry Bookkeeping

Reimbursed Employee Expenses Journal Double Entry Bookkeeping

What Is A Journal Entry Journal Format Journal Journal Entries

What Is A Journal Entry Journal Format Journal Journal Entries

Accounts Payable Explanation Journal Entries Examples Accounting For Management

Accounts Payable Explanation Journal Entries Examples Accounting For Management

Journal Entry For A Bad Debt Recovery Youtube

Journal Entry For A Bad Debt Recovery Youtube

Use Journal Entries To Record Transactions And Post To T Accounts

Use Journal Entries To Record Transactions And Post To T Accounts

How To Create An Ledger Paper Template Excel Free An Easy Way To Start Is To Download This Ledger Paper General Ledger Bookkeeping Templates Excel Templates

How To Create An Ledger Paper Template Excel Free An Easy Way To Start Is To Download This Ledger Paper General Ledger Bookkeeping Templates Excel Templates

T Chart Accounting Example Printables And Charts Within T Chart Accounting Example22396 Accounting And Finance Accounting Online Accounting

T Chart Accounting Example Printables And Charts Within T Chart Accounting Example22396 Accounting And Finance Accounting Online Accounting

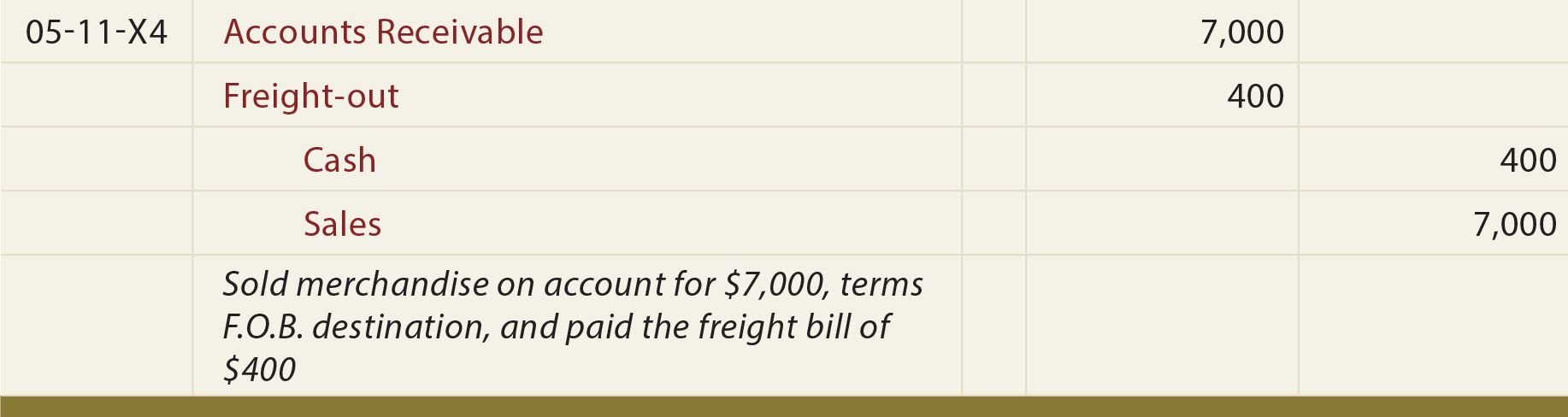

What Is The Journal Entry For A Sales Invoice Quora

Reversing Entries Principlesofaccounting Com

Reversing Entries Principlesofaccounting Com

Narration For Each Payment Entry Accounting And Finance Payment Finance

Narration For Each Payment Entry Accounting And Finance Payment Finance

Single Entry Vs Double Entry Accounting Systems Examples Compared Accounting Single Double Entry

Single Entry Vs Double Entry Accounting Systems Examples Compared Accounting Single Double Entry

Accounts Receivable Journal Entries Examples Bad Debt Allowance

Accounts Receivable Journal Entries Examples Bad Debt Allowance

Reversing Entries Accounting Example Requirements Explained

Reversing Entries Accounting Example Requirements Explained

Freight Principlesofaccounting Com

Freight Principlesofaccounting Com

Payment Of A Liability Using Cash Double Entry Bookkeeping

Payment Of A Liability Using Cash Double Entry Bookkeeping

Journal Entry Template Double Entry Journal Journal Template Journal Entries

Journal Entry Template Double Entry Journal Journal Template Journal Entries

Currency Exchange Gain Losses Principlesofaccounting Com

Currency Exchange Gain Losses Principlesofaccounting Com

Purchase Credit Journal Entry Definition Step By Step Examples

Purchase Credit Journal Entry Definition Step By Step Examples

Account Receivable Collection Journal Entry Double Entry Bookkeeping

Account Receivable Collection Journal Entry Double Entry Bookkeeping

Post a Comment for "Payment Received From Debtors Journal Entry"