Income Tax Payment Ledger In Tally

Income Tax Pay head type. You will be asked for an applicable date enter tax rate applicable date.

Tally Tdl For Voucher Enhancement With 19 Additional Buttons Including I Create A Company Pastel Accounting Enhancement

Tally Tdl For Voucher Enhancement With 19 Additional Buttons Including I Create A Company Pastel Accounting Enhancement

On this page Payment voucher Income Tax ITNS Challan 281 Challan Payment of Interest Penalty and Late Fee Challan for TDS with Penalty Charges.

Income tax payment ledger in tally. Press CtrlF Autofill for Payroll Auto Fill. Go to Gateway of Tally Accounting Vouchers F5. Select Employees Statutory Deductions from the list of pay head types Statutory pay type.

Yes Name to be displayed in payslip. Select Yes in Provide Details field if you wish to print the payment details in Income Tax Challan. Press Enter to show the income tax payment values for all employees.

Create a separate ledger for posting 4 sale as Sales 4 Set Alter Vat Details. Income Tax ITNS Challan 281 Challan. Select Earnings for Employees from the list of pay head types Income type.

Select the Income Tax Challan in Process for field. Gateway of Tally - Payroll Info - Pay Heads - Create Name. Based on the section selected in the Section field TallyERP 9 displays the section related nature of payments under which Tax deducted is pending for paymentSelect Payment to Sub-Contractors.

Income Tax Deduction Pay Head 1. Creating GST CGSTSGSTIGST Ledger in TallyERP9 Tax Ledgers should be created under Duties and Taxes group which contains all tax accounts like GST and other trade taxes and total liability. The name will be Input CGST as it is input tax which we pay when we purchase goods or services attracting GST.

Select Employees Statutory Deduction as the Pay Head Type from the List of Pay Head Types. Conveyance Allowance Pay head type. This is because if you happen to work with large companies or bigger clients they like you to include their terms of payment in your self-employment template.

Select the bank from which the payment will be made. In TallyERP 9 you can record income tax payments using the appropriate Payroll Ledger. Press F2 Date to change the voucher date.

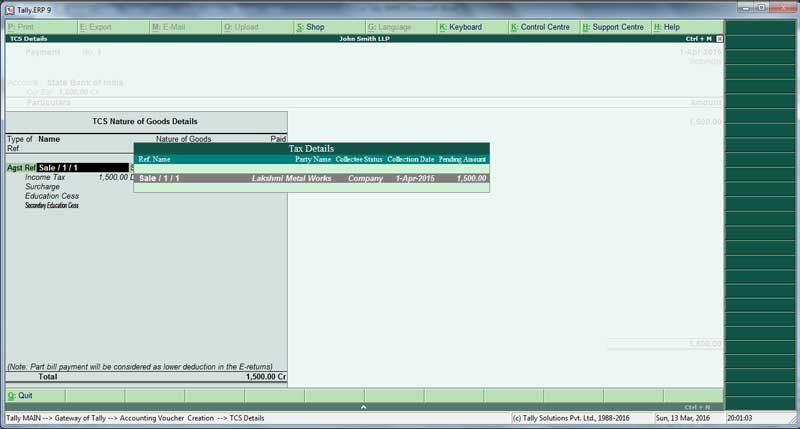

Payment of Interest Penalty and Late Fee. Payment Select bank then in particulars select TCS Ledger. In the Payment Details screen enter the ChequeDD No ChequeDD Date Challan Date Bank Branch Code.

Select Indirect Expenses from the list of groups Affect net salary. Challan for TDS with Penalty Charges. 3Printing TCS challan NOITNS 281.

Enter the From blank for beginningand To blank for end dates. Self-employment ledger template must include your tax avenues and should not differ with the templates date. Payment of Interest Penalty and Late Fee Without the TDS Ledger.

In TallyPrime you can record income tax payments using the appropriate Payroll Ledger. In this field TallyERP 9 displays all the Sections under which Tax deducted is pending for payment. Stat Payment and enter the required details.

As I said it will be under Duties and Taxes. Flat rate pay head means which does not depend on attendance example Conveyance. Gateway of Tally - Payroll Info - Pay Heads - Create Name.

Select Current Liabilities from the list of groups Affect net salary. Nature of Payments. Payment Voucher Gateway of Tally Vouchers press F5 Payment.

Enter the pay head name in the Name field. Any unknown payment received any difference in cash balance could not figured out. March 12 2019 at 10.

Select Statutory Pay Typ e as Income Tax. Go to Gateway of Tally Accounting Vouchers F5. Press Enter to save.

Go to Gateway of Tally Accounts Info. Select the central and state tax ledgers. Go to Gateway of Tally Payroll Info.

Record Income Tax Payments Payroll In TallyERP 9 you can record income tax payments using the appropriate Payroll Ledger. Income Tax ITNS Challan 281 Challan. Ledgers Create.

In this video you will learn how to make income tax provision entry in tally along with all adjustment entry. 15 September 2012 Sir our firm is partnership firm we have paid income tax on dt-05092012 Make entry in tally is Income Tax Return ac dr. Pay Heads Create.

Take a look at the picture above because that is exactly how you will need to create the Input CGST Ledger in Tally. You need to create pay head for Income Tax deduction to record tax deduction. Press enter You will have a screen where TCS Nature of Goods details can be selected.

Alternatively press AltG Go To Create Voucher press F5payment. With TallyERP 9 we can record advance payments made to registered or unregistered dealers in a payment voucher and now can raise liability in journal voucher GST Tax liability on purchases and can also record a refund in receipt voucher where such advance payment transaction is cancelled and cancel the liability GST Tax liability on purchases on advance payment in journal voucher. A comprehensive list of ledgers required for a company in tally erp 9the under which it is placed also given in tabular formats.

Yes Name to be displayed in payslip. Now in Type of Dutytax option select GST. Hi sir ple tell me advance tax and income tax which head come under the tally.

Set the type of payment as Regular. Challan for Penalty Charges without TDS Ledger. YesIn new window enter Tax rate 4Tax type automatically become Taxable.

Think critically on the payments of payments.

Tally Tdl For Ship To And Billed To Instead Of Consignee And Buyer T Student Council Campaign Microsoft Excel Formulas Excel Formula

Tally Tdl For Ship To And Billed To Instead Of Consignee And Buyer T Student Council Campaign Microsoft Excel Formulas Excel Formula

How To Create Supplier Ledgers In Tally Create Lesson Language

How To Create Supplier Ledgers In Tally Create Lesson Language

How To Create Drawings Account Ledger In Tally Erp 9 Accounting Capital Account Create Drawing

How To Create Drawings Account Ledger In Tally Erp 9 Accounting Capital Account Create Drawing

Narration For Each Payment Entry Accounting And Finance Payment Finance

Narration For Each Payment Entry Accounting And Finance Payment Finance

Creating Earnings Pay Head Payroll In Tally Erp 9 Data Migration Voucher Payroll

Creating Earnings Pay Head Payroll In Tally Erp 9 Data Migration Voucher Payroll

Tally Tdl For Default E Way Bill Distance Tally Add On For Default E Online Computer Courses Accounting Notes Business Education

Tally Tdl For Default E Way Bill Distance Tally Add On For Default E Online Computer Courses Accounting Notes Business Education

How To Record The Goods Used For Personal Use In Tally Erp 9 Debit Person Accounting

How To Record The Goods Used For Personal Use In Tally Erp 9 Debit Person Accounting

How To Create Sales Return Ledger Account In Tally Erp 9 We Can Record Goods Returned By The Customer In Tally Accounting Accounting Software Capital Account

How To Create Sales Return Ledger Account In Tally Erp 9 We Can Record Goods Returned By The Customer In Tally Accounting Accounting Software Capital Account

Tally Tdl For View Party Mobile Number And Gst Number In Ledger Account Free Download Full Movies Download Download Movies

Tally Tdl For View Party Mobile Number And Gst Number In Ledger Account Free Download Full Movies Download Download Movies

List Of Group In Tally Erp 9 Accounting Notes List Accounting And Finance

List Of Group In Tally Erp 9 Accounting Notes List Accounting And Finance

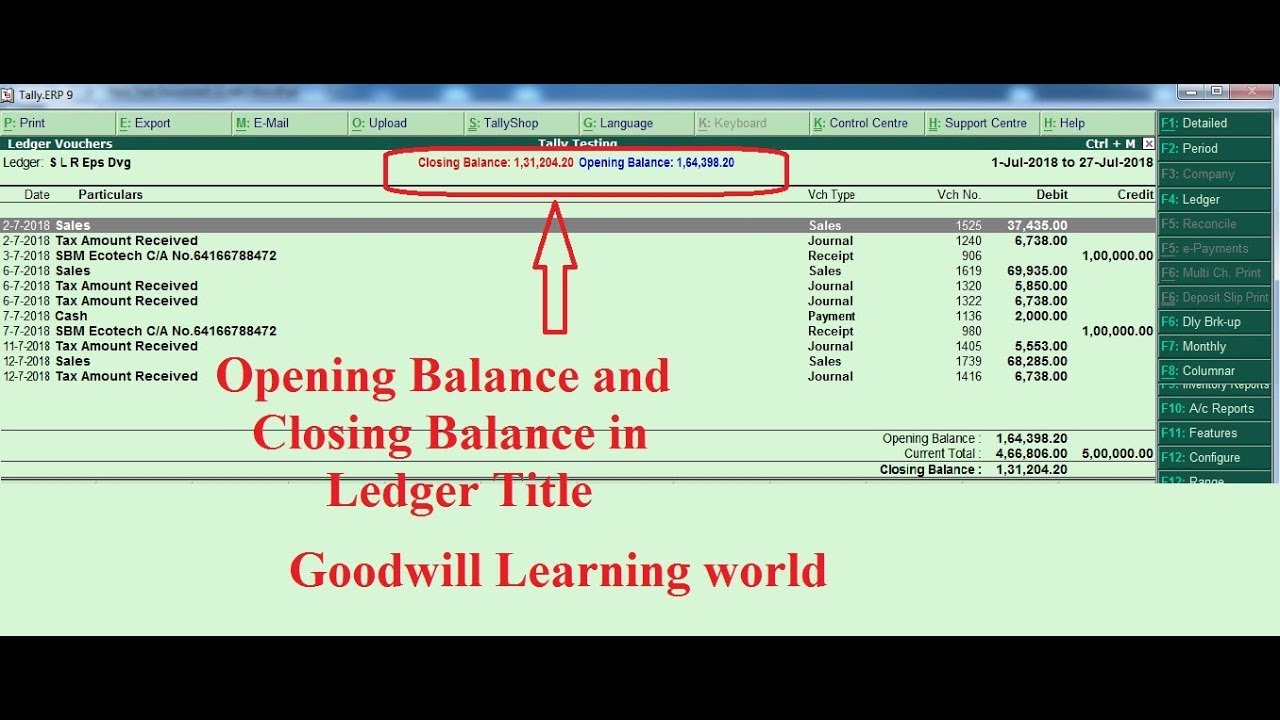

Tally Tdl For View Opening Balance In Ledger Account Free Tally Add O Free Excel Templates Ads

Tally Tdl For View Opening Balance In Ledger Account Free Tally Add O Free Excel Templates Ads

Integrated Accounting Software Tally Is One Of The Best Accounting Software Available That Can Easily Handle All Accounting Software Business Data Accounting

Integrated Accounting Software Tally Is One Of The Best Accounting Software Available That Can Easily Handle All Accounting Software Business Data Accounting

Creating Pay Head For Income Tax Deduction Payroll In Tally Erp 9 Income Tax Tax Deductions Voucher

Creating Pay Head For Income Tax Deduction Payroll In Tally Erp 9 Income Tax Tax Deductions Voucher

Tally Tdl For Ledger Opening Balance And Closing Balance In Ledger Title Shapes Worksheets Free Download Free

Tally Tdl For Ledger Opening Balance And Closing Balance In Ledger Title Shapes Worksheets Free Download Free

Tally Tdl For Import Ledger Group From Excel To Tally Tally Add On F Free Download Invoice Format In Excel Free

Tally Tdl For Import Ledger Group From Excel To Tally Tally Add On F Free Download Invoice Format In Excel Free

How To Create Fixed Asset Ledger Account In Tally Erp 9 In Tally Erp 9 We Can Create Fixed Asset Ledgers For A Company Fixed Asset Accounting Capital Account

How To Create Fixed Asset Ledger Account In Tally Erp 9 In Tally Erp 9 We Can Create Fixed Asset Ledgers For A Company Fixed Asset Accounting Capital Account

Maintain Bill Wise Details Agewise Analysis Outstanding Reports In Tally Erp9 Wise Bills Analysis

Maintain Bill Wise Details Agewise Analysis Outstanding Reports In Tally Erp9 Wise Bills Analysis

Post a Comment for "Income Tax Payment Ledger In Tally"